Improvement in the euro area's current account: cyclical or structural?

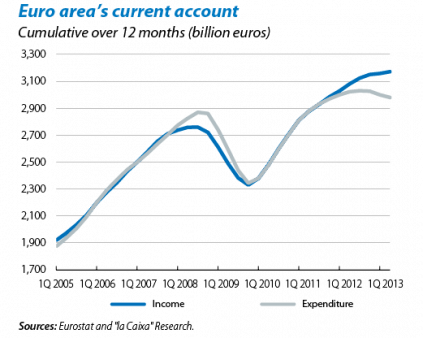

The euro area's current account experienced a sharp change in trend in 1Q 2011: the surplus, which had remained almost at equilibrium since 2005, started a marked upward trend; by 1Q 2013 it was already slightly above 2% of GDP. This change in trend coincides with the slowdown in European economic activity and is therefore very likely to be due to cyclical factors. This is largely the case but a more detailed analysis reveals some interesting dynamics in European trade.

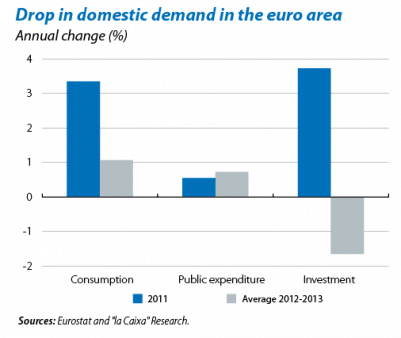

The main reason for the higher surplus is the balance of goods. This had remained close to equilibrium during the last decade but, since 1Q 2011, has increased to 1.6% of GDP. Such a change in trend is not due either to a change in the relative prices of imports and exports or to a greater share of exports with a lower import content. The surplus of the balance of goods has also increased in real terms while the relative weight of the different goods exported has remained almost constant over the last few years. The higher surplus for the balance of goods must therefore be due to the effect of the recession on domestic demand. Private consumption slowed up considerably between 2011 and 2013. For its part, investment went from growth of 3.7% in 2011 to an average fall of 1.6% in 2012 and 2013. The resulting drop in imports is what lies behind the rise in the balance of goods surplus.

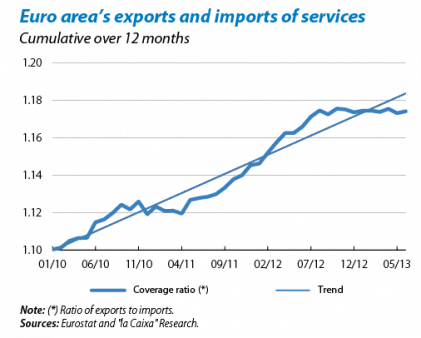

The trend in the trade balance for services is very different: this has increased almost continually since 2000. Exports of services have a much lower import content that those of goods (0.06 and 0.17 per unit exported, respectively, according to OECD estimates for the European Union). This, together with relatively weak demand for service imports at a European level, has allowed the balance of services surplus to expand. The trend in the coverage ratio (the ratio between exports of services and imports) is a clear sign of this, with growth remaining stable over the last three years.

The volume of services exported is much lower than that of goods, 145 million and 471 million respectively in 1Q 2013. Consequently, services have contributed less to the increase in the current account surplus, specifically 20% compared with the remaining 80% contributed by the balance of goods.(1) But this trend must be monitored carefully because, if it continues, exports of services may turn out to be quite significant.

(1) The balance of income and transfers has remained practically constant.