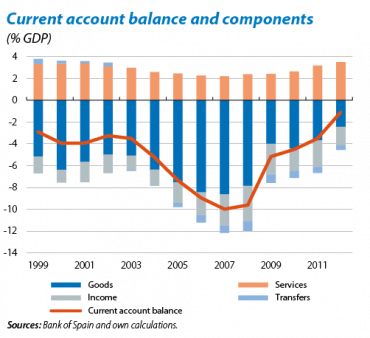

In 2007, Spain's current account deficit reached 10% of GDP. The crisis arrived and, with it, an extraordinary correction that returned this deficit to 1.1% by 2012. How was this achieved? Without forgetting the favourable trend in the income and transfer balances, the lion's share of this correction was due to the incredible improvement in the balance of goods and services. An improvement that, in turn, was boosted by exports of a strength that has surprised both Spaniards and others but also by imports remaining subdued, in line with the weakness of domestic demand. This contribution by imports, however, calls into question the sustainability of the adjustment once the domestic economy picks up. To what extent are these fears justified?

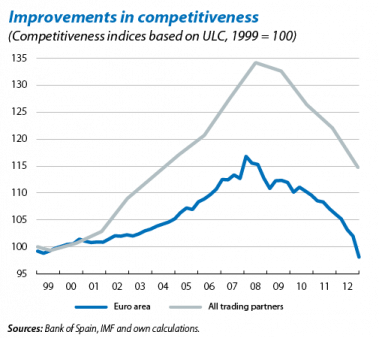

Let's start with the obvious: when the economic cycle improves and domestic spending picks up, imports shall normally rise; at a faster or slower pace depending on the rate of economic growth and the competitiveness regained over these years. If the rest of the items remained unaltered, this greater drive on the part of imports would undoubtedly damage the external balance. However: there are reasons to believe that any recovery in imports could be offset by exports, spurred on by the euro area's improved economy but especially by structural improvements. Of particular note among these improvements are: (1) substantial gains in external competitiveness (see the second graph); (2) a notable increase in the number of firms exporting, which are unlikely to go back to restricting themselves to the domestic market even when the situation improves; and (3) a growing diversification in terms of target markets and the type of product exported.

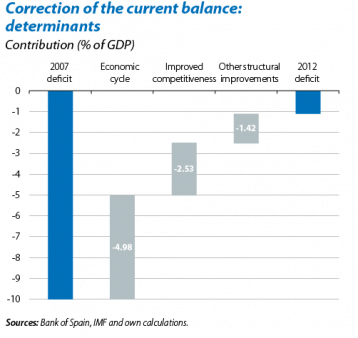

But how important is the cyclical effect likely to be compared with the structural? To give an idea, based on a simple econometric analysis that relates the current account balance with the economic cycle and competitiveness, we estimate that 55% of the correction in the current account deficit between 2007-2012 could be put down to the cycle. The remaining 45% could be attributed to improvements in competitiveness and other advances of a structural nature. If we project this analysis into the future, based on a deficit of 1.1% of GDP; assuming (1) the recessionary phase of the cycle is corrected in five years (which we calculate would lead to a decline in the current balance of 2.7 GDP points); and (2) that the recovery of structural advantages continues at a similar rate to the past five years, we estimate a deficit by the end of the period of 1.3% of GDP. This figure is consistent with a scenario of external sustainability for the Spanish economy. The key therefore lies in persevering with competitiveness and encouraging the largest possible number of firms in the largest possible number of sectors to start exporting to the largest possible number of countries.