The Spanish economy fulfilled projections and got back on the road to growth in 2013 Q3. Less expected was that domestic demand would become the driving force behind activity in this period: the rise in consumption and investment in capital goods contributed 0.3 percentage points to quarter-on-quarter growth in GDP. Judging by the trend in key activity indicators, this positive contribution by domestic demand will gradually consolidate over the coming quarters.

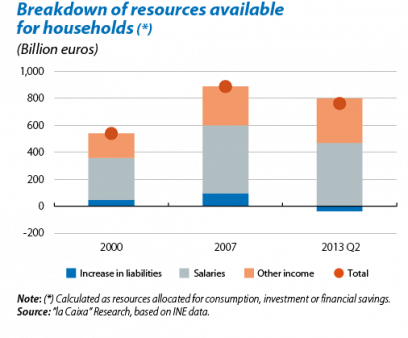

The capacity of domestic demand to recover depends partly on household deleveraging and an analysis of their accounts illustrates this fact. Between 2000 and 2007, the indebtedness of households helped cover those needs in consumption and investment (generally residential) which could not be met either by the resources generated via wages or other income (such as interest) or via savings accumulated in previous years. By way of example, the increase in household debt in 2007 (+97 billion euros) helped to finance a significant proportion of its demand. In the last few years this situation has been the opposite. The deleveraging process, together with the squeeze on wages, has reduced the resources available to households for consumption and investment.

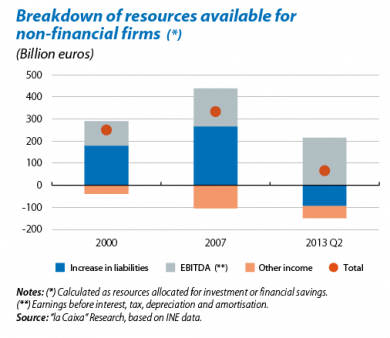

The impact of deleveraging can also be seen on non-financial firms, which started to significantly reduce their liabilities after a period of dramatic increases in debt. Improved earnings and a reduction in financial assets have partly helped to offset of this effect though not entirely, so corporate investment fell substantially, also weakening economic growth.

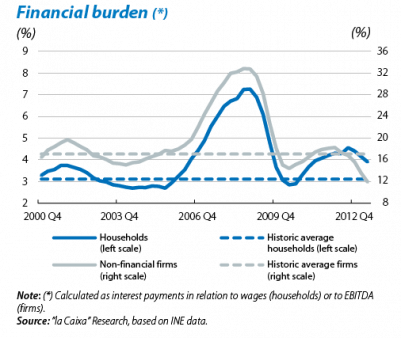

At present, although the private sector is still immersed in a significant deleveraging process, some signs can be seen that suggest pressures on economic growth are starting to abate. One factor exemplifying this is the contraction in the financial burden of Spanish firms which, in 2013, fell below the levels recorded before the recession. This is helping investment in capital goods to pick up, already accumulating three consecutive quarters of growth.(1) In the case of households, although the interest burden is still above its historical average, this has also shown a downward trend over the last few months: considerable points of support for a domestic demand that will gradually help Spain's economy to consolidate its revival.

(1) Financial burden is measured as interest payments in relation to EBITDA in the case of non-financial firms and in relation to wages in the case of households.