In the same way that, during a football match, many fans feel capable of designing the best strategy to beat their rival team from the stands, the same thing happens with the monetary policy that needs to be implemented by the ECB: there are as many opinions as articles written about it. The intensity acquired by this debate reflects the importance of monetary policy when taking investment and consumption-related decisions. Moreover, in the last few years the disparity of criteria also reflects the perplexity caused by the exceptional nature of the economic situation.

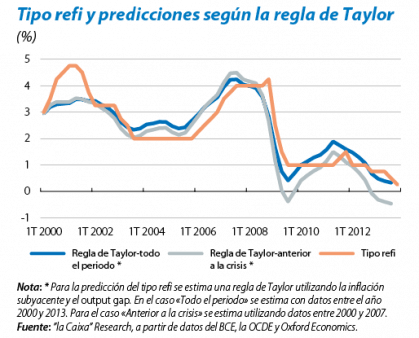

The range of instruments available to the ECB to establish the direction of monetary policy has recently widened but the official interest rate for the main refinancing operations (also known as the refi rate) is still the most important. One relatively simple way to determine whether the current refi rate is at an appropriate level consists of analysing whether inflation and the output gap are good references to predict it. As argued by J. Taylor at the beginning of the 1980s, the direction of monetary policy must be set, above all, based on the following two variables: generally speaking, the interest rate should go up when inflation rises and when production is above the economy's potential production capacity. As can be seen in the first of the graphs contained in this article, the predictive capacity of these two variables has been high over the last few years. More interesting is the fact that the current refi rate can be explained by the ECB's behaviour to date. In other words, the only time when the interest rate deviated from this general pattern was in 2001, when it was higher than the economic conditions would suggest.

Another way of analysing whether the ECB has modified the criteria used to set the refi rate consists of estimating how it has responded to changes in inflation and in the output gap up to 2007 and extrapolating this behaviour to the current situation. As can be seen in the first graph, if the ECB had responded to inflation and to the output gap in the same way as before the crisis, the refi rate would be at a slightly lower level than at present, between –0.25% and –0.50%.1 Although technically possible, for the time being the ECB has avoided setting negative interest rates. To offset what, a priori, appears to be a more restrictive monetary policy than the one required by the economic conditions, the ECB has set up other instruments, such as forward guidance, that have helped to lower long-term interest rates.

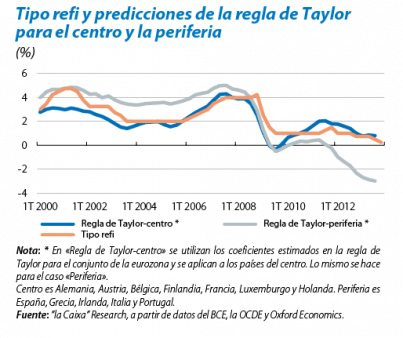

Therefore, although it could be argued that the ECB could implement a monetary policy that is a little more relaxed, the refi rate does not appear to be very much above the level demanded by the economic conditions of the euro area as a whole. Discrepancies emerge due to the divergence of economic conditions among the different countries. If the peripheral countries as a whole had a central bank that responded to inflation and the output gap as the ECB does for the euro area as a whole, then the refi rate would be clearly below its current level. However, the official interest rate required by the core countries is more similar to the current level, although this is fairly normal as these countries have a greater relative weight than those on the periphery.

1. This result is obtained from estimating the same Taylor rule as in the previous case but with data up to 2007 Q4 and using the coefficients estimated to determine the interest rate that would be predicted with data up to 2013 Q4.