Corporate mergers and acquisitions: the wave is growing again

Corporate mergers and acquisitions are growing at a global level. This fact is in addition to the equally strong recovery being enjoyed by international financial markets after the crisis of 2008-2012. Several conditions have encouraged this situation: the improved macroeconomic environment, the good performance by the stock markets, the fall in financing costs and also the surplus liquidity maintained by numerous companies during the years of crisis (given the limited investment). Ultimately, the reasons behind these mergers and acquisitions (M&A) are related to the motivations of the parties involved: for the acquiring company, setting targets for growth in size or market repositioning (often internationally); and for the firm being acquired, the shareholders' desire to realise the value of their shares or to diversify risks (a clear circumstance in the case of family businesses).

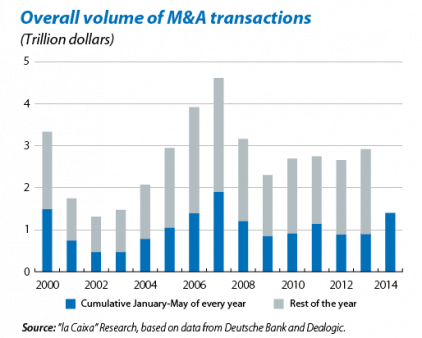

The figures recorded between January and May this year speak for themselves: the total value of global M&A (announced, under negotiation and completed) has exceeded a billion dollars according to calculations by Thomson Reuters Datastream. This is only the third time the billion dollar threshold has been crossed during similar periods of the year since this agency started gathering data back in 1980. This represents more than 50% growth on the rate in 2013 and its projection for the year as a whole would bring us close to the record figures of 2006-2007. By geographical area, the US leads M&A with 51% of the total volume, followed by Europe with 24% and Asia-Pacific with 16%. These last two regions are gradually gaining share and, in the case of Asia, its volumes are almost 70% higher than those of 2013. This is related to the rise in cross-border transactions, where the companies involved come from different countries. This kind of M&A has grown significantly in 2014 (in the order of 80% year-on-year) thanks to a phenomenon that needs to be taken into account: firms from emerging countries looking for targets in other emerging countries. This can clearly be seen in markets with high growth potential such as Turkey and Vietnam. At a sector level, although there have been significant transactions in all industries, most have been concentrated in media, communication and entertainment firms, as well as in the real estate, energy and technology sectors. Another distinctive trait this year is the predominance of mega-transactions including some that are of truly incredible proportions. This has been key to achieving the aforementioned volumes as the actual number of agreements is similar to the figure for 2013.

The financial crisis seems to have introduced some new parameters when carrying out M&A. The main change can be seen in the area of financing. Whereas, in the first four months of 2007, more than 70% of M&A were financed exclusively through corporate loans, in 2014 this figure is below 50%. On the other hand, the number of transactions financed by shares from the acquiring company currently stands at 20%. Another approach that is gaining in importance is mixed financing, combining credit with issues of high-yield bonds (with a junk bond rating). According to Barclays, for the year to date an extensive group of European companies has placed 15 billion euros in this kind of debt to finance M&A, compared with 9.6 billion euros issued in the whole of 2013.

This last figure gives pause for thought. It is a well-known fact that, throughout history, M&A activity has come in waves and not gradually. But the exact reasons for any particular behaviour at any given time are less well-known. Undoubtedly factors such as the economic climate, technological innovations and regulatory changes all play a fundamental role. But there are also more elusive aspects such as liquidity conditions and risk appetite. In this respect, the current conditions created by the incredibly accommodative monetary policies employed by the main central banks play a role: they make it easier to issue high-yield bonds or shares to finance acquisitions. In the long term, the effects, both individual and collective, will depend on the efficiency of these new corporate combinations. We therefore trust that the exuberant climate that is starting to be seen is nonetheless rational in terms of the analyses carried out by corporate managers regarding such transactions.