The improvement in Spain's household consumption is in full swing

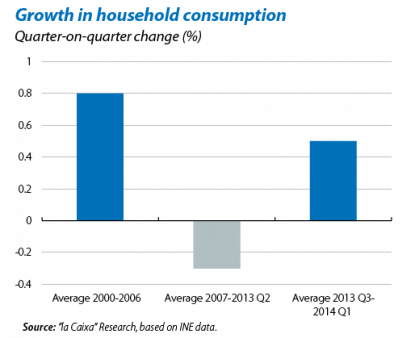

The long expected recovery in the Spanish economy that started last year and has gradually built up steam has been accompanied by a considerable and somewhat surprising improvement in household consumption. Between 2013 Q3 and 2014 Q1, household consumption grew at a rate of 0.5% quarter-on-quarter on average, clearly more than the figure of –0.3% recorded between 2007 and 2012 and approaching the figure of 0.8% from 2000-2006.

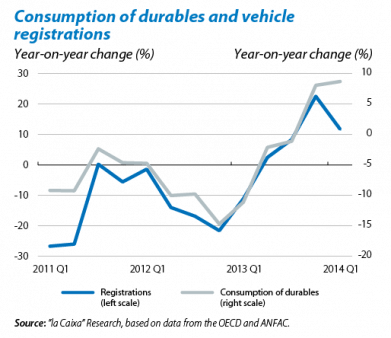

This recovery in household consumption is closely related to a substantial rise in the consumption of durables. Consumption of this kind of product decreased the most during the recession, by almost 25% in real terms but now that confidence in the economy's ability to recover has once again taken root among the population, it is starting to make up the ground it lost. However, according to OECD estimates, between 2000 and 2006 an average of 10% of household consumption was on durables, similar to this type of consumption in the euro area or US. The share reached is just 6% at present, so there is still some way to go before it returns to its pre-crisis level.

Automobile purchases are one of the main factors supporting the recovery in the consumption of durables. During the first six months of the year, 225,000 cars were sold to individuals, up by 23% compared with 2013. The government's approval of the PIVE 6 plan, with a budget of 175 million euros, and the continuing improvement in consumer confidence suggest this good rate of growth in sales will carry on over the coming months. The automotive industry, including all activities related to automobiles such as insurance and dealerships, represents 6% of GDP and employs almost 7% of Spain's labour force, so these recent consumption figures are particularly encouraging.

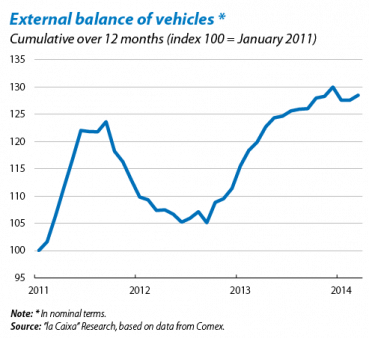

However, this sharp increase in the consumption of durables, and vehicles in particular, is resulting in a notable upswing in imports. As the proportion of goods imported in durables is higher than that for non-durables, it comes as no surprise that this recovery is being accompanied by higher growth in imports. For example, between January and March this year the increase in vehicle imports accounted for 22.8% of the total increase in goods imports.

The current account balance ended 2013 with a historical surplus of 0.7% of GDP but part of the improvement posted over the last few years was due to the fall in domestic demand and, in particular, to the slump in the consumption of durables. All this reminds us of just how important it is for the Spanish economy that its agents continue their efforts to improve competitiveness.