Although the growth and the labour market figures have come as a pleasant surprise over the last few months, we cannot become complacent. The adjustment of the external imbalance, which has served to convince those both within and outside Spain of the economy's medium-term growth capacity, is showing clear signs of losing steam.

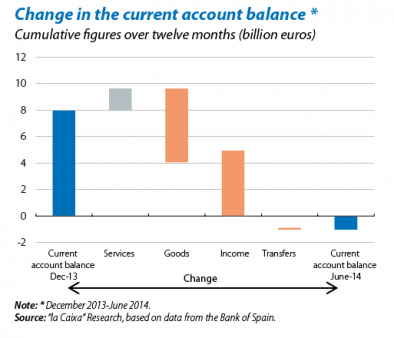

The current account balance went from a deficit of 114.3 billion euros in June 2008 to a surplus of almost 8 billion euros in December 2013, boosted by gains in competitiveness that have helped exports to grow substantially while a weak domestic demand has kept imports at a standstill. However, over the last few months the improvement in the current account balance has come to a halt, a worrying sign given the country's high gross external debt (163% of GDP in 2014 Q1). The latest figures published for June were particularly negative: over the last 12 months the cumulative current account balance has returned to negative terrain, reaching just over 1 billion euros.

One of the main reasons for this change in trend is the development in the income balance: its deficit has increased by almost 5 billion euros over the last six months. However, to a large extent this is due to the recovery in foreign investor appetite for Spanish assets, which is gradually getting back to normal. It is therefore unlikely to increase much further.

Attention is now focused on the balance of goods, whose deficit has risen by nearly 5.6 billion euros this year so far, up to 15.8 billion euros. Of particular note is the upswing in imports (5.3% year-on-year in the first half of the year compared with –1.3% for 2013 as a whole), especially automobiles, consumer durables and capital goods. Exports of goods have suffered from the slowdown experienced by important emerging economies (Brazil, South Africa and Russia) and the weakness of France and Italy. This means they only grew by 0.5% year-on-year in the first half of 2014, a much lower figure than the 5.2% of 2013.

Part of this upswing in imports is likely to be temporary. Greater confidence in the ability of Spain's economy has boosted consumption and investment decisions that had been postponed during the crisis years and which, given their nature, are highly import-intensive. We also expect imports to be boosted by the recovery in world demand over the coming months.

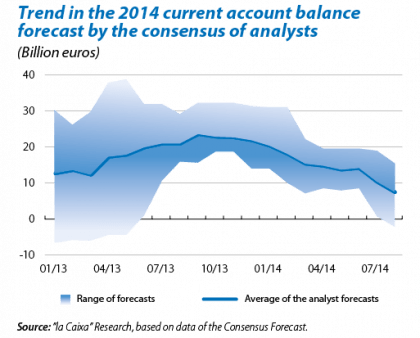

In any case, the Spanish economy is unlikely to end the year with a current account balance larger than the one in 2013 (0.8% of GDP). By way of example, should the trade in goods perform the same in the second half of this year as it did in the second half of 2013, which would constitute a more than remarkable change in trend, the current account balance would reach around +0.5% of GDP. If such a change in trend does not occur and the dynamic of the first six months continues, 2014 could end with a current account balance of around –0.5% of GDP.

This reminds us of how important it is for the Spanish economy to continue making gains in competitiveness. For several months now the consensus of analysts has been lowering its current account balance forecasts. This is a trend that will very probably continue over the coming months and that, if not corrected, could erode the highly prized confidence of the international community in the Spanish economy.