At a time when all eyes are on oil due to the dramatic fall in its price since the middle of the summer, the price of gas (especially in the US) has remained stable. Historically prices for both these fuels used to move in a very similar way. However, in the last few years this relationship has broken down (once again, mainly in the US). While the price of crude has fallen by 50% in the last six months, the price of US gas has dropped by about 15%. What are the reasons for this divorce between prices?

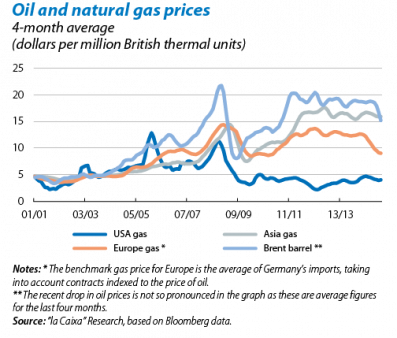

The boom in unconventional energy (shale) led by United States, both in gas and oil, and its uneven impact on both markets is the main reason for prices decoupling. At present, US natural gas is still three times cheaper than oil on an energy equivalent basis (see the graph).1 This is due to the fact that the gas market, far from being global like the oil market, is split into three large regions (United States, Europe and Asia) that are mutually isolated due to high transport costs, especially overseas. In the US case the gas shale revolution has led to a substantial increase in supply for the region and has therefore considerably lowered its price, but this has not been passed on to the rest of the world.

By way of example, between 2007 and 2013 US gas production increased by 26% with shale eventually accounting for 40% of all production (compared with less than 5% at the beginning of 2000). The fall in gas prices that occurred during this period in the US reached 45%. However, the sale of oil at a global level meant that the prices for this resource followed a very different path, even though US production also increased. Although crude oil production in the United States rose by 45% in the same period, the country only produces around 10% of the world's total. Nevertheless, we should make one very important proviso at this point. In spite of the relatively global nature of the oil market, the US shale revolution did have some effect on the price of oil extracted in the country (namely West Texas Intermediate): this fell significantly compared with the price for crude oil sold in Europe (Brent), a difference that had reached 20% by the end of 2011 and 2012. The reason for this was the bottleneck occurring in the oil storage hub located at Cushing (Oklahoma), resulting in a large stockpile of oil and pushing down prices. This situation has gradually been corrected as Cushing's transport infrastructure has been improved but it has lasted several years.

Similarly, and in spite of the aforementioned fragmentation in the world gas market, there has also been some decoupling in Europe between the price of these two fuels (gas and oil). Nonetheless, such decoupling has been to a lesser extent and the price of gas in Europe is still twice as much as that of the United States while, in Asia, it is four times higher (see the graph). In the European case, in order to make gas investment and exploitation more attractive, in the early years (in the 1950s and 1960s) the decision was taken to set up long-term contracts indexed to the price of oil (a clear energy substitute). This practice has continued up to the present day; in 2011 around 70% of the contracts were still long-term and indexed. However, since then the spot market, in which the price is fixed more in line with local supply and demand factors, has gradually come to the fore. This development has been encouraged by three factors: falling transport costs (due to advances made in the field of liquefied natural gas), regulatory changes in the European Union to further liberalise the energy market and extensive fluctuations in oil prices.

In the long run, this greater price disparity in both dimensions (between gas and oil and between regions) is likely to diminish. At an international level the United States might become interested in exporting gas, an option that is currently subject to extensive legal restrictions. The significant price differences, especially compared with Asia, together with the aforementioned advances made in liquefied natural gas (reducing shipping costs) may make it profitable for American gas to be sold beyond the country's borders. Such a development would help bring prices closer together in the three markets. With regard to the difference between gas and oil prices, should the gap observed continue for any length of time, especially in the US market, this might encourage the more expensive fuel (in this case oil) to be replaced by the cheaper one (gas), which should also limit this disparity in the long term.2

1. The value of the same amount of energy for both fuels.

2. For example, with the price gap in 2013, the EIA estimates that, up to 2040, the use of natural gas in the transport sector could grow at an annual rate of 12%.