The resilience of Spanish exports has truly come to the fore over the last few years. After world trade plummeted in 2009 Spain was, together with Germany, among the first economies in the euro area able to make up the ground lost.

In particular, exports of goods rose on average by 4.8% year-on-year in nominal terms between 2007 and 2013 while in real terms this rise was 3.4% year-on-year. This good trend in Spanish exports also occurred in spite of the demand by our main trading partner, the euro area, being in decline. Undoubtedly the diversification of exports both in geographical and product terms was crucial to reviving Spain's export sector.

One clear indication of the Spanish economy's greater internationalisation is that variations in global foreign demand are leading to a larger increase in Spanish exports. This can be seen by means of a simple exercise that relates the increase in global demand with growth in Spanish exports before and after the recession (see the graph). According to this, with the rise in global demand over the last three years, the annual increase in Spanish exports of goods has been 0.8 pps higher than what would have been with the pre-crisis export model. The same logic can be applied to the period before the recession: between 2000 and 2008 the rise in foreign demand for goods resulted, on average, in an annual increase in exports of goods of 10.1%.1 However, with the pattern of exports observed between the years 2011-2013, exports would have increased by 11.5%, 1.4 pps more than with the pattern from the previous period.

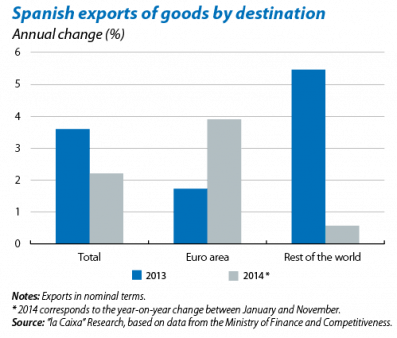

Nevertheless, the 2014 trend in the export sector has raised some questions. In real terms exports of goods during the first three quarters of the year grew by 4.1% year-on-year on average, 0.2 pps below their growth in 2013. However, in nominal terms the rate of growth was considerably more modest: between January and November 2014, nominal exports of goods grew by 2.2% year-on-year, a figure far below the annual average prior to the crisis, namely 5.4%, and even lower than the already moderate figure of 3.6% from 2013. This slowdown in nominal exports is particularly due to the weakness of some regions such as Latin America, Africa and non-EU Europe, the destination for 20% of Spain's exports, although exports towards the euro area accelerated substantially: growing by close to 4%, 2.3 pps more than in 2013.

The disparity between real and nominal growth in exports is a consequence of the fall in the price of exports, particularly significant in capital and intermediary goods, and this phenomenon can be seen in most developed countries. In the US, for example, the fall in the price of exports stood at 3.2% in 2014.

In Spain, this fall in the price of exports represents a considerable setback, undermining the good performance by exports in real terms and making it especially difficult to consolidate current account surpluses, a goal the Spanish economy cannot abandon given its still high external debt. The growth capacity of Spain's export sector has surprised everyone over the last few years but the country cannot rest on its laurels. The slow and erratic recovery in the euro area means that it is wise not to count on its support and the price factor is proving to be very damaging. It is still of the utmost importance to continue working to improve the competitiveness of the Spanish economy.

1. Spanish exports in nominal terms to the seven major destinations.