The "la Caixa" Research real estate thermometer: the vital signs of a sector starting to revive

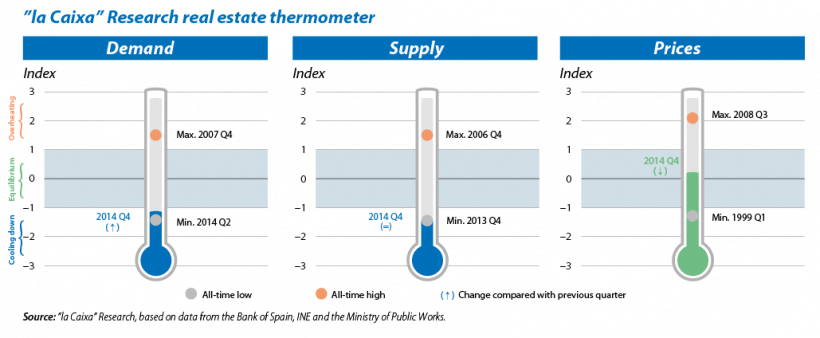

2014 marked a turning point in the real estate sector. Signs of stabilisation appeared during the first half of the year followed by an improvement in some indicators in the second. With a view to 2015, these advances are expected to gain steam, resulting in the long-awaited consolidation of the sector's recovery. To illustrate the situation of Spain's real estate market and monitor its vital signs, we have developed the "la Caixa" real estate thermometer.1 This is made up of three sub-indicators (supply, demand and prices), designed to measure the current temperature of each of these three dimensions. If the temperature is below the equilibrium zone, the sector is cooling down; on the other hand, if it is above this zone, it is overheating.

In the case of demand, the thermometer takes into account both domestic demand for first and second homes foreign demand. At present, the overall picture is that, although demand has increased slightly over the last few months, it is still below what is considered to be its equilibrium level. For the moment house purchases by foreigners, which grew by 23.5% in 2014, are driving growth but, in spite of this growth, there is still a long way to go before reaching equilibrium level.

With regard to the trend in supply, the indicator takes both residential investment and completed residences into account, as well as the stock of unsold residential properties. Although this indicator was at rock bottom at the end of 2014, some signs of improvement seen in the last few months augur a good 2015. Worthy of note is the increase in residential investment, in applications for new building permits and employment in the sector. These trends should consolidate in 2015 although the stock of unsold residential properties is still very high in some regions, making the overall recovery quite gradual.

The current situation is also encouraging with regard to prices. In this case the indicator takes the purchase capacity of households into account and therefore combines house prices with data on household income and financing conditions, as well as returns from rental income. As shown by the thermometer, on the whole prices have now returned to their equilibrium level, demonstrating the recent trend in prices which, after falling by 30% in nominal terms since 2008 Q1 (37% in real terms), stabilised in 2014 Q4. Improvements in financial conditions and the labour market are also helping the effort required by households to purchase housing to reach a sustainable level.

In short, the thermometer shows that the real estate sector's pulse is getting stronger and that there is still a lot of potential for growth, both in terms of demand and supply, although the recovery is expected to be gradual for both. In the case of demand, it is vital for the recovery in the labour market to consolidate, now that the measures adopted by the ECB suggest financing conditions will be favourable for quite some time. However, the recovery in supply is still strongly affected by the stock of unsold residential properties. Nevertheless, there are marked differences from region to region; in fact, in some the excess supply is almost non-existent and a recovery can already be seen

in activity. The vital signs of this incipient cycle are healthy but the sector's temperature will have to be monitored constantly to make sure the errors of the past are not repeated.

1. For more information on the methodology behind the "la Caixa" Research real estate thermometer, see the methodological note Termómetro inmobiliario de "la Caixa" Research.