From the spring of 2009 up to last August, the S&P 500 saw incredible gains resulting in the index tripling its value, reaching a level 30% above the one achieved during the peaks of 2000 and 2007, both being preludes to sharp, prolonged losses. With this track record, the weak performance of shares since the middle of the summer is making both analysts and investors uneasy. Some fear we are about to witness another prolonged downward turn while others believe this is merely a lull in the upward trend, although opinions differ among the latter regarding the duration of this correction, its intensity and especially the rate of possible subsequent gains.

One very useful exercise to clarify the uncertain future for stocks and shares is to examine whether there were any signs of a bubble in the middle of the year. Logically the resulting scenarios would differ greatly depending on our diagnosis. Unfortunately there are no precise instruments to measure the phenomenon of overheating or bubbles in financial markets but a combined analysis of various relevant indicators can provide a reasonable guide. There tend to be three factors present in bubbles, albeit to varying degrees. First, one fundamental factor: when the market price deviates notably from the price indicated by the asset's intrinsic fundamentals. Second, a speculative factor: investor mood is typically euphoric, stimulating speculative, less rational purchases. Third, a risk factor: high leverage which can lead to instability.

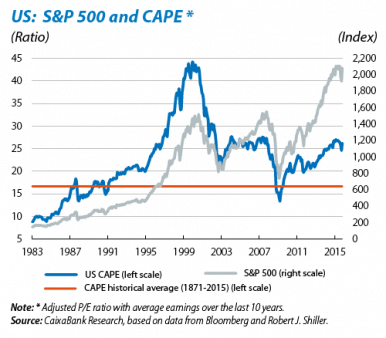

One of the most reliable tools to evaluate the fundamental factor is the CAPE or cyclically adjusted price-to-earnings ratio, which measures the relationship between share prices at a specific point and average corporate earnings over the last ten years. By the middle of the year, this indicator was above its historical average but far from the level recorded before the big stock market crises of 1929, 2000 or 2007. Moreover two other elements may have pushed up the CAPE ratio: the low level of interest rates (which is not taken into account by this indicator) and regulatory changes that penalise earnings by counting provisions for losses in assets. These two elements may have distorted any possible historical comparison. For their part, the various indices used to measure the speculative factor do not seem to suggest the stock market is particularly overheated. For example, the share turnover, which measures the volume of shares traded and tends to increase when speculative activity grows, was far below the level it reached in 2000. The so-called «dividend premium» also points in the same direction, namely the difference of the average market-to-book ratios between companies that pay out dividends and those that do not. Given that the former are safer, under normal conditions this premium tends to be positive but can become negative at times of speculative fever, as happened at the peak of the dot.com bubble in 2000. This premium was positive mid-summer, suggesting there was much less speculative activity than on that previous occasion. Lastly, if we look at the margin debt to measure the level of risk in the stock market we can see this is at a higher level than before the crisis in 2000 and similar to the level in 2007, certainly encouraged by low interest rates. One attenuating circumstance is the fact that this indicator has been high for some time now and, over the last few months, has not shown any sign of increasing sharply, unlike the bursting of bubbles in the past.

Consequently, a combined interpretation of these indicators and other, similar signals,1 moreover within a context of moderate growth (both in GDP and corporate earnings) and the gradual monetary normalisation planned for the next two or three years in the US, provides several valuable elements for the debate we mentioned at the beginning. On the one hand, the absence of sufficiently clear signs of a bubble should allay fears that we are witnessing a potentially sharp downward turn in the market due to a hypothetical bursting of the bubble. But, on the other hand, share prices are at relatively generous levels and we can therefore expect much more modest returns in the medium term than over the last five years. In summary, the most plausible scenario points to a moderation in the upward trend of the last few years.

1. See the Focus «The implied equity risk premium: a clearly imperfect indicator that needs to be taken into account» in MR11/2015.