May 1984, Columbia Business School, New York. Huge crowds have come to hear a talk by Warren Buffett defending an investment approach known as «value investing». He explains the experience of a group of portfolio managers who, following this strategy, have achieved much higher long-term returns than the market average. But does this investment style really work? And, if so, why is it not applied by the majority of investors?

Although Buffett is considered to be the greatest exponent of value investing, the origins of this school date back to the theory presented by Ben Graham and Dave Dodd in their influential book Security Analysis in the 1930s. The core idea of value investing is simple: buying assets whose prices are far below their intrinsic value. This gap in the share price provides the so-called «margin of safety» which means the share price has a lot of room to move upwards, at the same time as limiting potential losses should the price fall. This concept contrasts with the usual relationship between risk and return which postulates that a higher expected return must necessarily be associated with greater risk.

The key to this strategy is knowing how to arrive at a relatively accurate estimate of a share's intrinsic value. In principle this would involve precise estimates of the future flow of a company's profits and calculating its present value. However, empirical evidence points to a series of criteria that help to identify «value» firms: for example, their shares are quoted at relatively low price-to-book or price-to-earnings ratios, they have little debt (for example, below 50% of their total assets) and they have a good business model (not excessively complex) and good quality management. Such data can also be complemented by an analysis of the sector to spot factors (regulations, new rivals, future prospects for demand, etc.) that might affect the trend in the shares and explain values that, at first sight, could seem to be unjustifiably low. Without forgetting there may also be shares in the so-called «value trap» whose supposed gains in price never materialise.

In addition to accurate analysis, this investment strategy also requires another ingredient: patience. The underlying bet is that the assets acquired will eventually achieve their potential gains with their share price approaching the intrinsic value. Experience indicates, however, that in many cases the minimum amount of time required for value investing to start generating higher returns than the market or other investment methods is 10-15 years. A considerable period of time in a world where managers' results are evaluated over a much shorter timescale, forcing them to follow strategies that are not too far away from the market's performance.

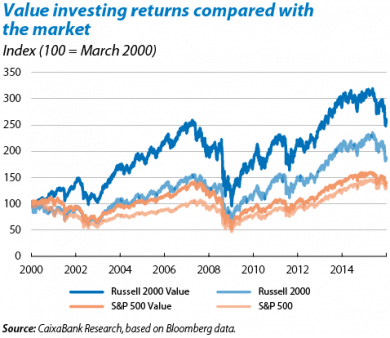

The superiority of value investing in the long term contradicts the so-called «efficient markets hypothesis». According to this hypothesis, in a sufficiently liquid market a share's price reflects the best possible estimate of its intrinsic value at all times. So an asset can only offer a higher expected return if there is also a greater risk (greater volatility associated with this return). In practice, however, companies identified as value in accordance with a series of relatively simple criteria from the Russell 2000 (a benchmark for small and medium-sized enterprises) have provided notably better risk-adjusted returns than those of the index as a whole, and also the S&P 500. The most plausible explanation for this market inefficiency is that there is less information on this kind of company so that more work is required to gather and analyse data. As these companies are therefore less scrutinised by analysts, their share prices are more likely to be inaccurate, producing a large margin for gain.

As Buffet said himself, «When the price of a stock can be influenced by a "herd" on Wall Street with prices set at the margin by the most emotional person, or the greediest person, or the most depressed person, it is hard to argue that the market always prices rationally. In fact, market prices are frequently nonsensical». It is more than likely that the panic affecting the world's stock markets over the last few weeks can provide many examples supporting this view.