The recovery in the real estate market is getting stronger month by month. One sign of this is that, in 2015, house sales increased by 11.1% compared with 2014. Moreover, all the evidence suggests that the different factors supporting the sector's recovery will consolidate over the next few quarters.

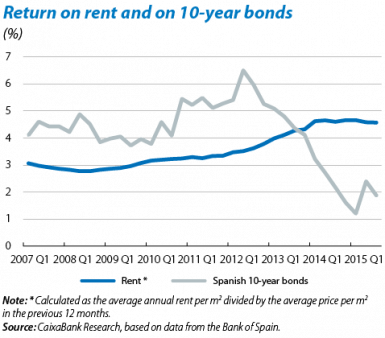

Broadly speaking the factors boosting house sales can be divided into two groups: demographic factors, which affect the formation of new households, and factors of an economic nature such as house purchases as a form of investment, to change the usual residence or to buy a second home. Economic factors are currently the main support for this recovery in housing demand. The good performance of the economy, reflected in an increase of disposable income and wealth in households as a whole, in lower unemployment and greater consumer confidence, is providing the main boost for domestic demand. Improved financial conditions are also contributing to the recovery: the number of new mortgages granted grew by 33.4% in 2015 and interest rates to acquire housing fell to 1.98%. On the other hand, in a highly liquid environment, the return on investment in housing,1 which was close to 4.6% in 2015 Q3, much higher than other investments such as sovereign bonds, is boosting investor appetite in the sector. Foreign demand is looking particularly strong: sales made to foreigners accounted for 19.4% of the total in 2015 Q3 (8.7% in 2008 Q3)2 and inflows of foreign capital for real estate activities are increasingly significant. Specifically, in 2015 Q3 EUR 2.67 billion entered in net terms, a figure clearly above the EUR 1.45 billion posted in 2013.3

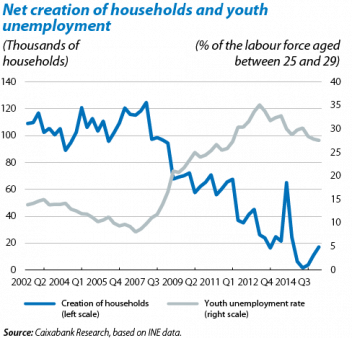

The formation of new households, however, is still sluggish. In the last two years the migratory balance has been negative, leading to a net reduction in the population. This, together with the impact of the economic recession, means that household creation rates are still at a very low level. For example, in the last two years 75,000 households a year were created on average, only 19% of the net formation of households achieved in 2008.

In the short term the creation of households will gain traction as economic growth is passed on to the population at the age of leaving the parental home via improvements in youth employment and disposable income. In addition to this will be the latent demand for housing composed of all those households that would normally have been formed since the start of the crisis but were not as a consequence of worsening economic conditions (see the first graph).

However, beyond the impact that economic factors may have on the creation of households, over the medium to long term all the evidence suggests that demographic factors will keep this rate at a lower level compared with the last expansionary cycle. For example, according to estimates by the Bank of Spain, in the medium term the annual net creation of households would be 238,000 in the most favourable scenario.4

In summary, the improvement in the economic cycle is stimulating demand for housing and reviving the real estate sector. Now that the upward cycle has started to consolidate, we need to monitor the situation closely to ensure the errors of the past are not repeated.

1. Return on rent is calculated as the average annual rent per m2 divided by the average price per m2 in the previous 12 months.

2. Cumulative figures over four quarters.

3. Cumulative figures over four quarters, based on «Datos de inversión extranjera en España», Datainvex, Ministry of Economy and Competitiveness.

4. See «Creación de hogares y necesidades de vivienda nueva principal a medio plazo», Boletín Económico, October 2015.