At the current time of economic difficulties, the levels of capital, prudent risk management and productivity of Spain's insurance industry have helped to make the financial system more stable and have significantly aided the Spanish economy. By way of example, in 2011 the insurance industry demonstrated its strength by means of an estimated volume of direct insurance premiums issued totalling 60,592 million euros, with a growth of 4.13% compared with 2010 despite the shrinking economy. However, notwithstanding its commercial strength, the industry is also going through a decisive and redefining period and it will face significant challenges in the coming years.

Solvency II regulations, equivalent to those of Basel II for the financial system, together with the necessary review of bank insurance agreements as a consequence of the numerous mergers between savings banks, represent two critical points in defining Spain's insurance industry of the future. Moreover, the slowdown in economic activity and the credit squeeze, with a deterioration in the sovereign debt of almost all European countries, represent a challenge to managing investment in the sector.

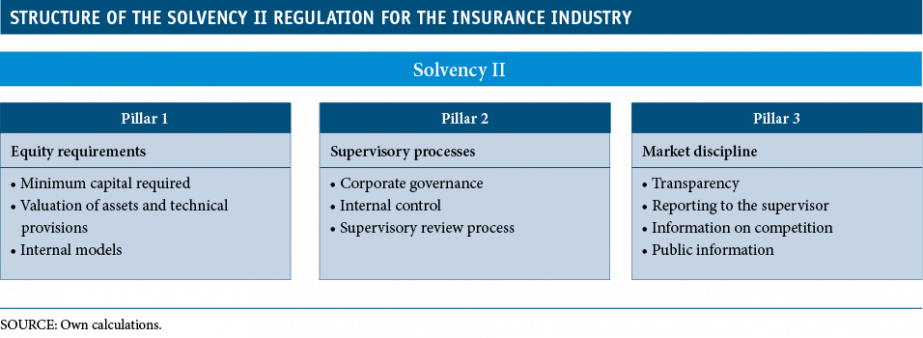

At a European level, a new regulatory framework is being proposed for the industry, known as Solvency II, which raises capital requirements and is provoking debate regarding some of the criteria adopted. Solvency II is a regulatory proposal that will probably come into force in 2014 and that, emulating the regulation of the financial sector, is divided into three fundamental pillars. The first pillar is quantitative in nature and establishes the minimum capital requirements for insurance companies. The other two pillars are qualitative in nature and affect governance (industry supervision) and market discipline (information transparency).

In general terms, Solvency II is a positive development in regulation for the sector as it modifies the powers of the supervisory regime, giving it a dynamic, prospective view that allows it to anticipate potential crisis situations. It also encourages a more transparent organisational structure among insurance companies, separating functions more appropriately and with improved communication channels. With regard to the quantitative part of capital requirements, this model is based on establishing criteria to value assets and liabilities and thereby determine the risks managed by each entity and the minimum capital it requires. According to the latest calculations carried out with individual figures for entities by the Basel Committee (QIS5), the impact for the sector is significant in this respect as, for Spanish insurance companies, this raises their capital requirements by 10,277 million euros to 17,205 million euros. An amount that does not entail global bankruptcy for the industry, as it has an excess of solvency, but which, on the other hand, should make the system more secure.

However, as a result of the QIS5, points of disagreement have arisen related to long-term products. The debate revolves around the method chosen to value assets and liabilities on the companies' balance sheets. Solvency II proposes that this should be mark-to-market. But in a sector such as the insurance industry, where portfolios are held long term, this methodology increases the procyclicality of the requirements and could put the wrong incentives in place.

Insurance risk is long term due to its very nature. More than 20 years might pass from when a client takes out, for example, a life-savings policy to when this is cashed in. Consequently, the insurer must invest in long-term secure assets to be able to ensure that the client will receive what has been guaranteed in the future. The assets and liabilities of an insurance company should therefore not be valued as if they were going to be sold tomorrow, which is what happens with the mark-to-market model, as this might result in a short-term management focus that would not be suitable for insurance business.

This debate becomes highly significant at times such as the present, so that work is being carried out on measures to resolve this problem. In this respect, there is the option of a countercyclical premium or matching adjustment, which means that adjustments can be made to the valuation of assets and liabilities at times of stress and thereby avoids the procyclicality caused by stressful discounting. However, its design needs to be studied in depth to make sure it does not encourage companies to invest in riskier assets. Moreover, the conditions under which this premium could be applied must be made very clear, without this limiting its applicability to any great extent.

Anyway, in today's complex and changing economic and financial environment, the risks for the insurance industry are not limited to regulatory aspects but are also related to business. Up to 12 insurance companies have alliances with banks, a sector that distributes 73% of life assurance premiums and is also gaining presence in non-life insurance branches, where it accounts for 10% of the premiums. But the strong process of concentration in the financial system, with numerous mergers between savings banks, means that these bank insurance agreements need to be reviewed. It therefore becomes necessary to establish a single bank insurance operator (to broker the sale), although the same financial institution can sell insurance from several different companies through its network, if so agreed. This process won't be simple as the current bank insurance agreements are private insurance policies between entities with large amounts of compensation should they be broken, established during an economic boom but difficult to afford in the current environment.

And we also need to add into the mix the slowdown in economic activity in Spain, which is clearly having a detrimental effect on business volumes and new operations in the risk business, as well as the fall in the savings rate, which harms savings products. In addition, the high volatility of the markets and the uncertainty regarding sovereign debt of most European countries make it difficult to manage the risk of entities.

In short, over the last few years Spain's insurance industry has shown itself to be strong at a commercial level and also solvent but it's not free from regulatory or business pressures. The coming months will be important in terms of defining the regulatory model to ensure the right incentives are established and to make progress in drawing up a new competitive map in bank insurance.

This box was prepared by Anna Mialet Rigau

Economic Analysis Unit, Research Department, "la Caixa"