Bank globalisation and the international transmission of monetary policy

The 1990s saw the start of intensive bank internationalisation: in 1995 the percentage of foreign banks out of the total number of banks worldwide was 20%, whereas by 2009 this figure had doubled.1 Global banks emerged as a result of this process and the international interbank market developed, creating a more globalised and interconnected banking architecture with significant implications for the transmission of monetary policy: the monetary stimuli issued by a central bank no longer affect solely the financial conditions of the country itself but also have an impact far beyond its national borders via global banks. This article examines the workings of the global banking system and its role in the international transmission of monetary policy.

Before we analyse the international aspect in more detail we should remember that banks play a fundamental role in transmitting monetary policy at a domestic level: when the central bank adopts an accommodative monetary policy by lowering the official interest rate, its aim is to encourage real economic activity (consumption and investment) by increasing the supply of bank loans granted to households and companies. This transmission mechanism is called the bank lending channel. The bank risk-taking channel also plays its part as more accommodative monetary policy reduces returns from safe assets, encouraging banks to relax their credit standards and invest in assets with a higher return but also higher risk (known as a search for yield).

As we have already mentioned, these transmission channels for monetary policy operate at a domestic level. However, in the case of the central banks of the main advanced economies, and as a result of bank globalisation, these channels also operate at a global level. This international transmission of monetary policy through the banking system occurs in the following way. Firstly, the relaxation of monetary policy in an advanced economy such as the US allows global banks to obtain funding under more favourable terms, either directly from the central bank or by issuing financial instruments to private investors at a lower cost, generally short-term loans in dollars.2 Global banks then use this liquidity to lend directly to the real economy, through their subsidiaries or branches in different countries (and here the internal capital market of each bank also comes into play),3 or they offer liquidity to other banks through the international interbank market. Lastly, the banks receiving these interbank loans can, in turn, pass on more favourable borrowing conditions to their local customers.

The main consequence of this transmission of monetary policy at an international level is that the supply of credit and bank risk-taking in a particular economy no longer depend solely on the specific factors of the country in question, such as domestic macroeconomic conditions or institutional quality, known as pull factors, but also on global or push factors.4 The importance of push factors in a particular country will depend on several conditioning factors although the structure of bank financing is fundamental. When global financial conditions change, those banking systems that depend more on wholesale or interbank funding and less on customer deposits tend to change their loan supply more compared with systems that are less dependent on wholesale funding. Foreign banks, which usually find it more difficult to attract retail deposits in the local market, will tend to reduce the loan supply even further in response to negative external shocks and, consequently, push factors become more relevant in those countries with a larger share of foreign banks.5 However, it should be noted that this behaviour changes depending on whether global banks operate through subsidiaries or branches. On the one hand subsidiaries enjoy a large degree of autonomy in the management of capital and liquidity, are subject to the banking regulations of the domestic country and usually obtain more funding by attracting local deposits, factors which make it easier for subsidiaries to mitigate international shocks (or shocks affecting their parent bank). On the other hand international branches form part of a more centralised model that depends on the parent bank and are therefore more susceptible to global fluctuations. Consequently, international monetary policy is less likely to be transmitted through the banking channel in those countries where foreign bank subsidiaries predominate, such as in Latin America, than in Eastern European countries where the branch model is more widespread.

Another crucial factor that affects the intensity of the international transmission of monetary policy is the currency in which bank transactions are carried out. And here there is no argument: the US dollar is the currency par excellence although other currencies are also used frequently in some jurisdictions, such as the Swiss franc and the euro in Eastern Europe. However, the US currency is so important that the value of assets issued in dollars held by banks outside the US is roughly equal to the total value of the financial assets of US banks, namely around 10 trillion dollars. Nevertheless, the importance of the dollar is not the same as a dollarized economy. For example, it is notable that around 20% of the bonds issued by European banks are Yankee bonds.6

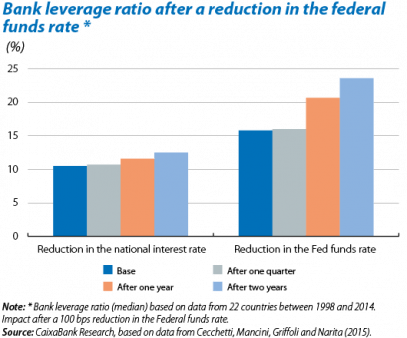

In a highly dollarized global banking system, the decisions taken by the Federal Reserve (Fed) have a direct effect on banks’ loan supply and risk appetite throughout the rest of the world. A recent study by the IMF is highly illustrative of this situation. The study compares the impact of accommodative monetary policy on the leverage ratio (assets to capital) of credit institutions in 22 countries during the period 1998-2014. The findings show that the impact on the leverage ratio is very limited in the short term (one quarter after a 100 bps cut in the official interest rate of the bank’s own country). However, the effect is much greater if the accommodative monetary policy continues for some time: the leverage ratio typically increases from 10.5 to 12.5 in two years. But the most significant finding is that the impact is much greater in response to the Fed’s policy than the country’s own policy. In particular, banks located outside the US see a much larger spike in their leverage ratio, from 15.8 to 23.6, after two years of expansionary monetary policy by the Fed (see the graph). These findings corroborate the argument presented by Bruno and Shin,7 namely that the risk appetite of global banks plays a crucial role in the international transmission of monetary policy.

As the sources of funding for global banks are highly dollarized, it comes as no surprise that, in response to the Fed lowering the Fed funds rate, a significant part of the new flow of credit out of the US should also be in dollars. Although this can be beneficial as it increases the availability of credit to the private sector at lower interest rates, it is also true that this practice results in borrowers taking on an exchange rate risk that is difficult to hedge against. Empirically, McCauley et al (2015)8 find that, since 2008, a 100 bps reduction in the Fed funds rate increases credit in dollars in other countries.

In summary, the risks related to spillovers of ultra-accommodative monetary policy in the main advanced economies are not to be ignored. Proof of this is the strong growth in bank loans in foreign currencies in many emerging countries since the Fed relaxed its monetary policy in 2008. In the last few years macroprudential policies have been adopted to mitigate such risks but their effectiveness has yet to be confirmed. Given this situation, greater coordination of monetary policy at an international level would be beneficial, something which, as discussed in the article «Policies to coordinate the monetary and financial system» in this Dossier, does not seem viable in the near future.

Judit Montoriol Garriga

Macroeconomics Unit, Strategic Planning and Research Department, CaixaBank

1. See Claessens and Van Horen (2014), «Foreign banks: Trends and impact», Journal of Money, Credit and Banking, vol. 46 (1).

2. Global banks issue many different financial instruments, generically called wholesale funding, ranging from short-term instruments such as repos and commercial paper to longer-term instruments such as bonds.

3. See Cetorelli and Goldberg (2012), «Banking Globalization and Monetary Transmission», Journal of Finance, 67 (5), for a detailed analysis of the factors that determine the distribution of liquidity between the parent and subsidiaries of global banks.

4. Calvo, Leiderman and Reinhart (1993) coined the terms push and pull factors to explain international flows of capital towards emerging economies in the 1990s.

5. De Haas, Ralph, 2014, «The dark and the bright side of global banking: a (somewhat) cautionary tale from emerging Europe», Comparative Economic Studies.

6. Bonds in dollars issued by institutions located outside the US. See Azahara, Luna and Roma González, 2016, «The Drivers of European Banks’ US Dollar Debt Issuance: Opportunistic Funding in Times of Crisis?», Bank of Spain Working Paper.

7. Bruno, Valentina and Hyun Song Shin, 2015, «Capital flows and the risk-taking channel of monetary policy», Journal of Monetary Policy.

8. McCauley, Robert, Patrick McGuire and Vladyslav Sushko, 2015, «Global dollar credit: links to US monetary policy and leverage», BIS Working Papers No. 483.