Growth is taking hold in the euro area and gradually building up a head of steam

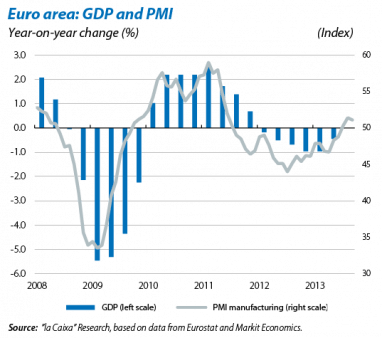

Growth is taking hold in the euro area and gradually building up a head of steam. The battery of economic figures published during September confirms that the GDP growth started in 2Q 2013 has consolidated during the third quarter. One of the best indicators in this respect, the PMI, has continued to advance and is now clearly above the levels posted the previous quarter. Worthy of note is the fact that the correction in some of the imbalances between the core and the periphery, especially in the area of labour costs, is leading to a change in the sources of growth in GDP. On the one hand, the periphery's improved productivity is boosting its foreign sector and, on the other, low levels of unemployment in the core, particularly Germany, are driving domestic demand.

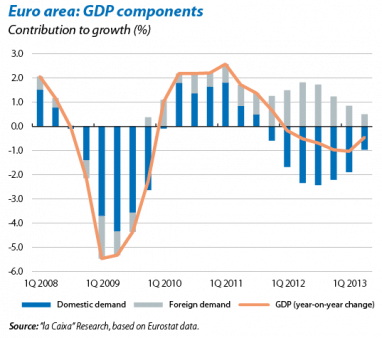

Domestic demand is adding to the recovery. The foreign sector has been crucial in alleviating the impact of the decline in domestic demand on GDP growth. In fact, its contribution to growth has been positive almost constantly since 3Q 2009. Given the difficulty in improving these figures, the key to consolidating the recovery lies in domestic demand and, in this respect, the news is good. In 2Q 2013 its contribution to quarter-on-quarter growth in GDP was already positive. Noteworthy is both the rise in private consumption and also investment, posting increases of 0.2% and 0.3% respectively. Public consumption also posted positive growth rates, although this is unlikely to become a source of growth in the medium term given the fiscal adjustment being carried out in several countries.

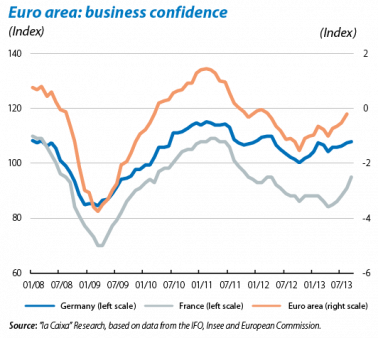

Investment is building up a head of steam. This already posted positive growth rates in 2Q 2013 and the bulk of the evidence available suggests it will increase its support for growth during the second half of the year. The business sentiment index, for example, has risen substantially in the last few months. This improvement, moreover, has been widespread in the main countries of the euro area. Of particular note is the increase taking place in France, a country where the drop had been acute and which, up to a few months ago, was showing no appreciable signs of progress, while in most countries of the euro area there had already been a shift in trend. In Germany the Ifo index

has firmly established for months now at levels compatible with positive rates of growth in investment. As the uncertainty surrounding the sovereign debt crisis diminishes and the recovery gains ground, this improvement in investment should consolidate.

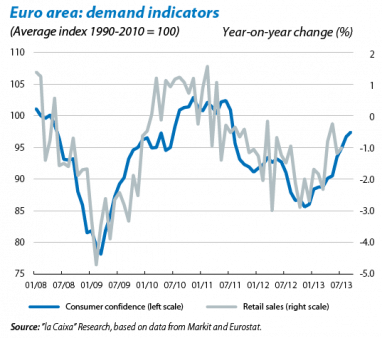

Household consumption is gradually picking up. Most consumption indicators performed well throughout September. The confidence index, for example, has risen continuously since November 2012 and in September stood at 97.4 points (just 6 points below its historical average), the highest level since July 2011. Improvement is widespread in most countries. In Germany, this was already above its historical average, while in France, Italy and Spain it is slightly below this level. The close relationship between consumer confidence figures and those for retail and consumer goods therefore allows us to be optimistic. The latest figure available for retail and consumer goods is from July, a month when there was still a decline in year-on-year terms of 1.3%. However, if confidence continues to advance at this rate, sales could be posting positive figures by the end of the year.

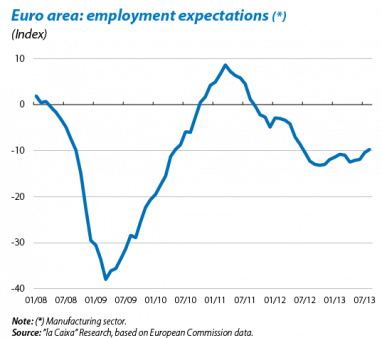

The labour market is stabilising and points to a shift in trend. At present the recovery in activity has not led to a reduction in the unemployment rate in the euro area as a whole. In July, this remained stable at 12.1% for the fifth consecutive month. However, employment expectations continued to improve and suggest that a change in trend

is imminent. This change is unlikely to be led by Germany as its unemployment rate is currently at an all-time low (in July this fell by 0.1 percentage points to 5.3%). It is in countries such as France, where the unemployment rate is at 11.0%, and especially in the periphery countries where the potential reduction is the greatest. In Italy this has reached 12.0%; in Ireland, 13.8%; in Portugal, 16.5%; and in Spain, 26.3%. As doubts regarding the sovereign debt crisis gradually fade and the recovery gains credibility, companies should start to invest in the labour factor again.

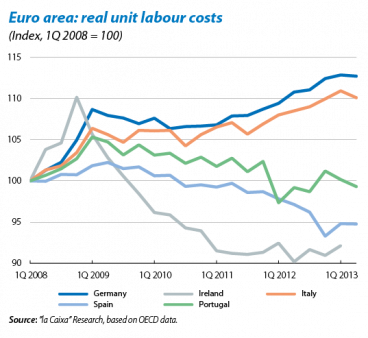

The periphery is continuing to regain the competitiveness it lost during the years prior to the crisis. Except in Italy, there have been notable reductions in unit labour cost indices. Between 1Q 2008 and 2Q 2013, these fell by 5.2%;

in Portugal, by 0.7%; and in Ireland, by 7.8% (in this case up to 1Q 2013, the latest figure available). This improvement in competitiveness is even more remarkable when we compare the trend in labour costs in these countries with what has happened in the countries in central Europe. In Germany, for example, they have risen by 12.7% over the same period of time. In fact, the roles seem to have been reversed between the periphery countries and Germany. While competitiveness was lost and domestic demand led growth in the periphery countries during the years prior to the crisis, now the situation is the opposite. In Germany, the situation has also turned around: domestic demand, which remained detached from the expansion occurring in the periphery countries, has finally woken up, accompanied by the good performance seen in the labour market.

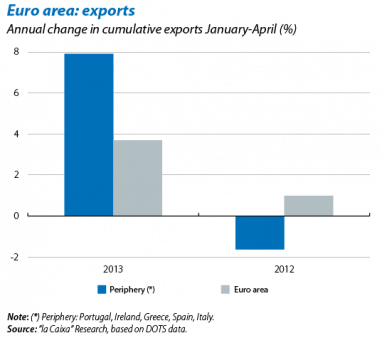

The foreign sector is being driven by the periphery. Just as the core countries are leading the recovery in domestic demand, the periphery countries have been supporting the growth in European exports observed over the last few months. Cumulative exports from periphery countries to countries from outside the euro area from January to April increased by 7.9% in year-on-year terms, a figure clearly above that of the euro area as a whole, which is 3.7%. This pattern has little to do with what happened in 2012, when the periphery countries saw a fall in their exports while these continued growing for the euro area as a whole. Given such figures, it seems as if the reforms undertaken by the different countries in the periphery are having the desired effect: an improvement in competitiveness that is helping to correct their external imbalances and boost their economies. In this respect, it is worth noting the good performance by the current accounts of these countries. In Spain, this has been corrected from –10.1% in 2Q 2008 to 1.2% at present. In Portugal it has gone from –13.3% in 2008 to the present figure of 0.3%; and in Greece, from –16.3% in 2008 to –0.5% in 2013.

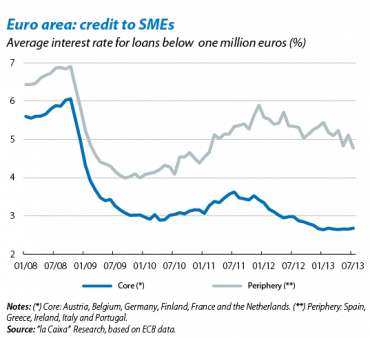

Correcting financial fragmentation still remains a challenge. While the correction of the main macroeconomic imbalances is on track in Europe's periphery countries, financing costs are still vary widely. For example, in July the interest rate for loans to small and medium-sized firms was 2.7% on average in core countries but 4.8% in periphery countries. This difference is partly due to the higher credit risk in periphery countries because, in general, their macroeconomic situation is weaker. But it is also true that part of this disparity is still due to a lack of confidence in the euro and in European institutions. In this respect, the steps that have been taken towards the so-called banking union are very important. Specifically, on 12 September the European Parliament approved the creation of the Single Supervisory Mechanism. This means that, as from 4T 2014, the ECB will ultimately be responsible for supervising Europe's banking system. This is undoubtedly a significant step forward but it has not completely satisfied those who also want greater integration in other areas, such as the Single Resolution Mechanism, the instrument responsible for defining the strategy that should be applied to banks in difficulty. The path taken towards greater European integration is not the fastest but the direction it is taking seems clear and the steps being taken are firm.

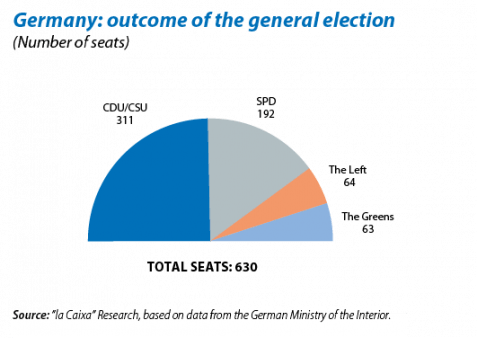

Merkel won the German general election with authority. The growing importance of the German chancellor in the process of constructing Europe has meant that the elections held on 22 September were closely watched by all EU countries. This outcome confirms what most of the polls had predicted, namely wide support by the German population for Angela Merkel, although the categorical nature of her victory was surprising. She did not achieve an absolute majority, falling short by just four seats, but the way she has handled the sovereign debt crisis received clear support from her citizens. Neither the course, i.e. greater integration both in fiscal and economic terms, nor the pace, namely the speed required for the process to be carried out successfully, will change.