The emerging countries are overcoming this summer's capital outflows

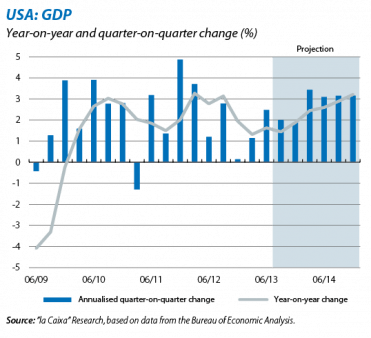

The short duration of the shutdown suggests its effect on the USA's economic activity will be modest. After bitter dispute between Republicans and Democrats, the US Congress reached two temporary agreements regarding the budget (see the Focus «Should we be worried about the consequences of the USA's fiscal debate?»). One to put an end to the partial government shutdown that had resulted in the suspension of non-essential discretionary budget items (1/6 of federal spending) and for two weeks sent home 800,000 «non-essential» public employees without pay. After several failed attempts, Congress approved payments to ensure the administration would be able to function up to 15 January 2014, while another agreement was also made to suspend the debt ceiling until 7 February 2014. After this positive outcome, and considering the short duration and limited scope of the items of expenditure affected, we have decided to maintain our GDP growth forecasts for 2013 and 2014 at 1.6% and 2.8%, respectively.

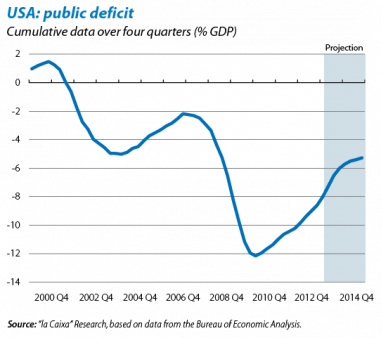

The challenge still facing US policymakers is to agree on a long-term plan for fiscal adjustment. The IMF itself,

in its latest World Economic Outlook, states that the tactic of permanent threats (sequester, debt ceiling, etc.) constitutes an «excessive and inefficient» way to reach agreements on the country's public finances. In this respect, October's ferocious clash might have been a turning point, given that it has come at great political cost for the Republican Party in terms of its public image. Although more battles will undoubtedly be fought, it seems unlikely that a fiscal crisis of such magnitude will be repeated in 2014 (unless differences of opinion within the Republican Party prevent them from reaching an internal compromise given the impending legislative elections).

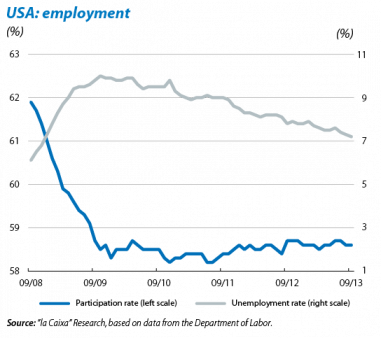

A less dynamic rate of job creation delays our prediction regarding the start of tapering until 2014 Q1. Labour market figures confirm the USA's recovery although at a slightly more moderate rate than expected. The 148,000 jobs created in September came as a disappointment since they indicate a clear slowdown compared with the figures recorded in the first half of 2013, largely due to the high number of discouraged workers. This encourages us to be cautious concerning the outlook for disposable income and housing demand, two of the pillars supporting our forecasts for 2014. Given these greater risks and the difficulty entailed in interpreting October's activity figures (due to the effect of the shutdown), the Fed is unlikely to begin its tapering until well into 2014 Q1.

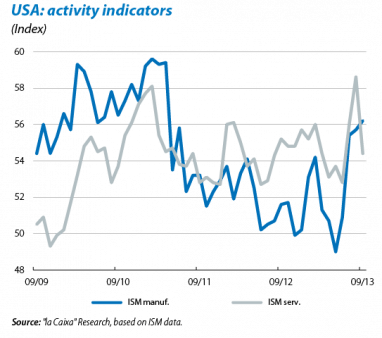

The rest of the activity indicators confirm this somewhat tepid recovery in the US economy. US entrepreneurs are curbing their optimism: the ISM manufacturing index rose to 56.2 points in September but the services index disappointed, remaining at 54.4 points (58.6 in August). Retail sales increased by 0.4% in September over the previous month (3.9% year-on-year), slightly above August's figure although retaining the tone of moderate growth. On the other hand, albeit not changing our positive perception, data from the real estate sector were weaker than expected. In particular, house prices (Case-Shiller index) rose again in August (0.9% month-on-month) but at a slower rate than in the first half of the year. Along the same lines the number of house sales also fell in month-on-month terms.

JAPAN

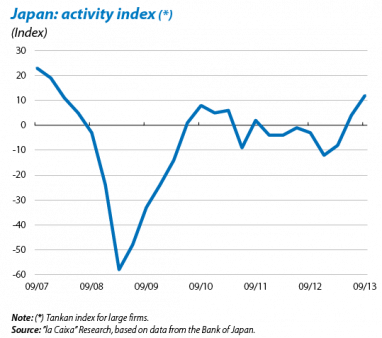

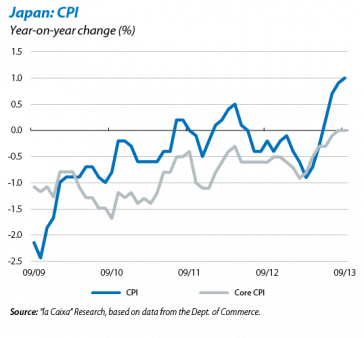

The data confirm the good tone of Japan's economic activity although deflation is still a threat. After the sharp increase in GDP growth for Q2, the Tankan index, which measures business sentiment, reached a six-year high in Q3. The rise in this index (calculated quarterly based on a survey of over 10,500 firms) is due to the expected improvement in foreign demand and the domestic consumption of services. Undoubtedly, this good figure for the Tankan index provides arguments for the decision to raise VAT in April 2014 (from 5% to 8%). Exports also grew strongly in September, by 13.5% year-on-year, although the trade deficit persists. Within this dynamic environment, September's general CPI rose by 1% year-on-year, its highest rate in five years, although the core CPI (without energy imports) stood at 0% year-on-year, a somewhat lower rate than in August.

EMERGING ECONOMIES

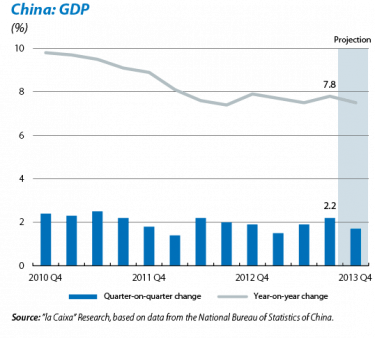

China is speeding up compared with the first half of the year, allaying fears of a hard landing for its economy. GDP grew by 7.8% year-on-year in 2013 Q3, above our forecasts, and by 7.5% in Q2. In quarter-on-quarter terms, the economy grew by 2.2%, a slightly higher rate than the figures of 1.9% and 1.5% posted in Q2 and Q1, respectively. This suggests that the worrying series of nasty surprises from the beginning of the summer, which had led to fears of a hard landing, has now been left behind. Several activity indicators in August and September (for example, retail and consumer goods, industrial production and the PMI) were already surprisingly high after the economic authorities introduced further stimuli (tax rebates for small firms). Now the GDP figure has confirmed the improved tone of the economy, which once again has investment as its key factor. This will undoubtedly continue to be an important factor in the short and medium term until the structural reforms required by the country (financial, hukou mobility system, extension of social networks, etc.) lead to a change in China's customary pillars of growth: a change toward a new model of growth where domestic consumption and services will become more important, with significant but more moderate growth rates.

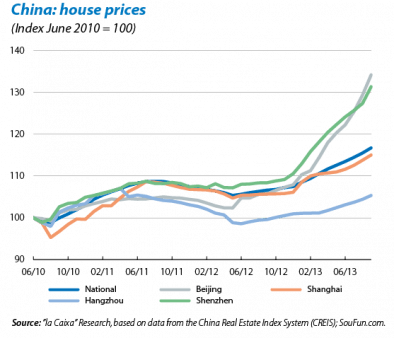

Nonetheless, there are still risks for the Asian giant. In the short term there are three obstacles that could harm activity. Firstly, the renewed impetus of real estate prices (particularly in the large coastal cities and Beijing) may revive concerns about the formation of bubbles. Secondly, the large quantity and low transparency of debt held by local governments (largely channelled in the form of bank loans to special investment vehicles) increases fiscal and financial risks. Lastly, the rise in credit outside the regulated area (shadow banking) also magnifies financial risk.

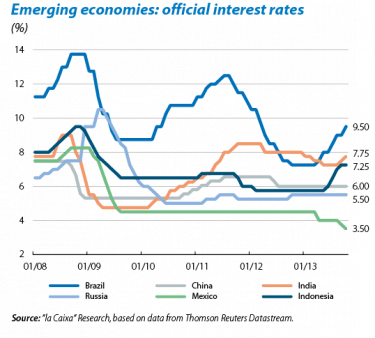

The rest of the large emerging economies are overcoming this summer's capital outflows while we expect them to start a new round of reforms. The most recent PMI indicators have once again come as a pleasant surprise. Given this evidence, we expect a gradual improvement in GDP figures for Q3 in most emerging countries. The substantial rate of growth we predict in the medium term is based on these countries overcoming the numerous challenges facing them: infrastructures, financial system, labour market, etc. Mexico is leading the reformist drive after approving its labour, education, telecommunications and financial reforms, with approval still pending for fiscal and energy reforms. Both are controversial as well as fundamental in determining the country's long-term growth rate. In the short term, and after a slowdown in GDP in Q2, we expect a steady upswing in the Mexican economy. August's new rise in the economic activity index or IGAE (0.22% month-on-month) reaffirms this scenario of gradual reacceleration. The further cut in the official interest rate of 25 bps (to 3.50%) at the end of October will also help

to improve the economic situation. Lastly, India seems to have joined the reformist drive started by Mexico, while Brazil still appears tentative given social discontent and electoral pressure in 2014.