The panorama of a slow recovery for the whole of the euro area has been confirmed. The latest confidence figures still point to recovery and the main factors that could add downside risks to the region's growth seem to be under control and are gradually diminishing. European authorities continue to make progress towards the banking union, which might encourage more credit to flow in the private sector and help to reduce the financial fragmentation between the periphery and core. Mediterranean Europe is making headway with its fiscal consolidation and correction of imbalances with increasingly less pressure on the part of European authorities, which will help their short-term growth. All this within a context of expansionary monetary policy that is helping to maintain an accommodative financial environment, although the US Federal Reserve had already announced it would start to reduce its bond purchases in January, while keeping interest rates low.

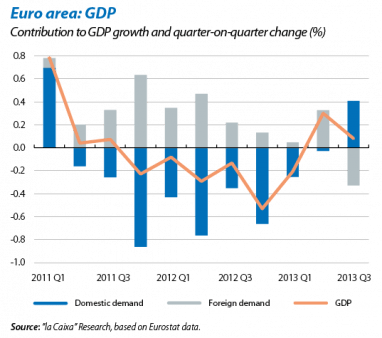

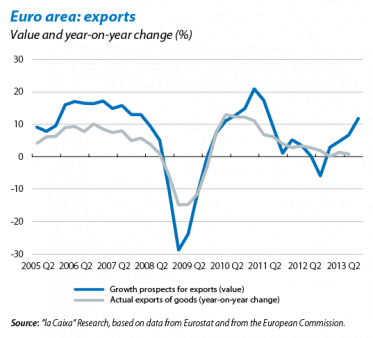

Domestic and foreign demand have swapped roles. The 0.1% moderation in GDP has been confirmed for Q3 (compared with 0.3% in Q2). The publication of contributions to this growth reveal the good performance by domestic demand thanks to investment (up by 0.4% quarter-on-quarter) and public consumption (0.2% quarter-on-quarter). This improvement contrasts with the dip in foreign demand, which has been the driving force behind the exit to the recession until now. This slowdown in net exports has occurred due to a reduction both in exports and imports. However, it is worth noting that the slump in exports has been more pronounced, partly because the euro is now more expensive compared with the rest of the currencies.

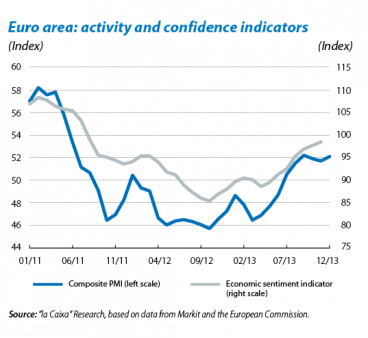

Confidence indicators are in line with moderate growth. In November, the economic sentiment indicator published by the European Commission maintained its upward trend started a year ago, reaching the same level as in the summer of 2011. The dynamism of German confidence and gradual improvement in the peripheral economies lie behind this trend. The index for France, however, fell for the first time since the start of 2013, revealing the weakness of the French economy. The message that can be inferred from the PMI data, another business sentiment indicator, is along the same lines: the composite PMI for the euro area rose to 52.1 points in December (compared with 51.7 in November), boosted mainly by the increase in the manufacturing index, up by 1.1 points, unlike confidence in the services sector which fell slightly for the third month in a row. The improvement in activity is supported by Germany's good performance, contrasting with the downward trend of France whose composite PMI has been in the zone of economic contraction for two consecutive months (see the Focus «Differences in the core of the euro area»). Nevertheless, in aggregate terms the PMI is still in expansionary terrain (above 50 points), confirming that the euro area's recovery is consolidating slowly, albeit at different speeds and with Germany leading the recovery.

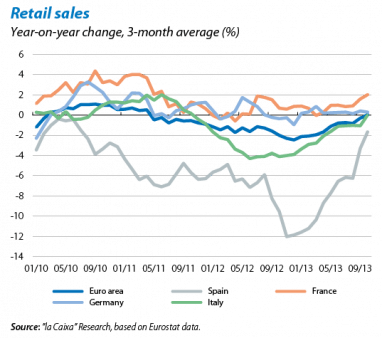

Activity figures are also encouraging for Q4. The data published for Q4 continue to show an underlying positive trend. In October, the euro area's industrial production advanced by 0.2% year-on-year, a clearly higher level than in Q3. This trend can be seen in the main countries of the euro area. Particularly noteworthy is the progress made by Germany, namely 1.1% year-on-year, as well as the significant improvement in Spain and Italy, which are still in negative terrain but much less so than a few months ago. The trend in retail and consumer goods is also relatively favourable. In October these increased by 0.3% year-on-year for the whole of the euro area. The improvement occurring in Spain is also particularly notable in this case, going from a year-on-year change of –12% at the beginning of year to higher than

–2% in October. In short, if we also take into account the confidence indicators for Q4 for the euro area as a whole, all the evidence seems to suggest that there will be a slight improvement for the end of 2013.

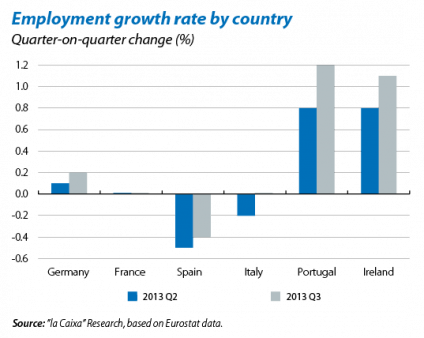

Job losses seem to have bottomed out and prices are starting to rise, albeit moderately. Employment figures for Q3 show some stabilisation compared with the previous quarter, now posting two consecutive quarters without job losses. This, together with the gradual economic recovery, points to the net creation of jobs being imminent. Looking at the trends by country, Germany continues to create employment at a moderate rate (0.2% quarter-on-quarter in Q3 compared with 0.1% in Q2) and France has not lost any jobs for the last three quarters in a row. However, what is most notable are the figures for the periphery countries, some of which are starting to create employment at quite a considerable rate, as is the case of Ireland (1.1% in Q3) and Portugal (1.2% in Q3). With a labour market that is still weak, the pressure on prices is downwards. In November, inflation for the euro area as a whole stood at 0.9% year-on-year compared with 0.7% the previous month. The increase in inflation has been widespread in most countries of the euro area, due largely to the smaller deceleration in energy prices compared with the previous year. Nonetheless, with the labour market stabilising and the gradual improvement in domestic demand, we expect prices to continue rising, albeit moderately (see the Focus «Outlook of moderate inflation in the euro area»).

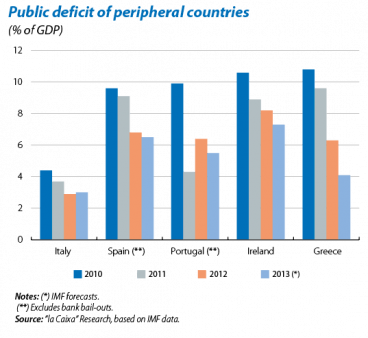

The path of fiscal consolidation eases in 2014. Between 2010 and 2012, the countries of the euro area made a significant fiscal effort to contain, as far as possible, the rise in public debt. In the budgets for 2014 we can observe, in general, a reduction in the fiscal effort planned by the periphery countries. Fiscal policy also appears to be focusing more on public spending cuts than on boosting revenue, as had been the case to date. All this will help to consolidate

the recovery.

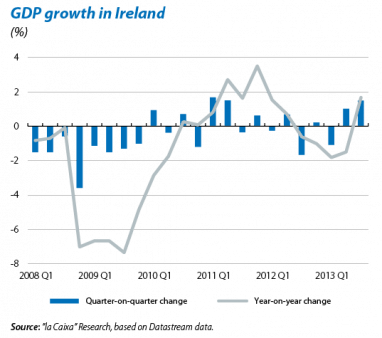

The periphery countries join the economic recovery. The correction of imbalances in the peripheral economies has not only occurred at the level of national account sustainability but highly significant advances have also been made in terms of external imbalances, gains in competitiveness and private sector deleveraging. The most outstanding case is Ireland, which, in December, successfully completed its bail-out programme financed by the troika. Similarly, the first few weeks of January will also see the end of the recapitalisation programme for Spain's banks and, if everything goes as planned, Portugal will complete its bail-out programme in June. Although in this last case there are still important questions to be resolved, the sovereign debt crisis does seem to be coming to an end, albeit little by little.

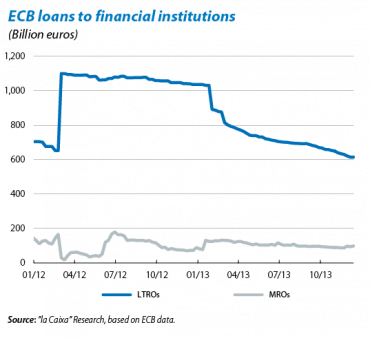

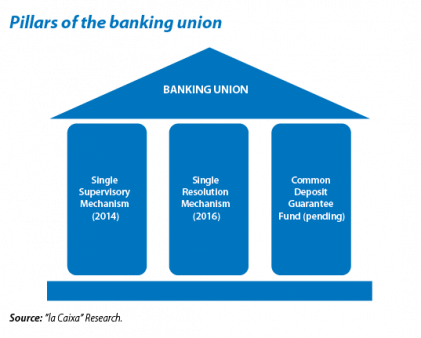

The economic and financial environment for banks is still challenging. Although the financial sector of many euro area countries has already been rectified or is in the process of being sorted out, the operational environment is still stressed, weakening banks' profitability. Given this situation, it is important to note that, in the last few months, banks have started to speed up the rate at which they are returning their three-year refinancing loans (LTROs) granted by the ECB. Banks are also starting to prepare their balance sheets for the stress tests that will be carried out throughout 2014, constituting the starting point for the first pillar of the banking union, namely the single banking supervisor.

Decisive advances in the strengthening of monetary union via a fundamental pillar: banking union. In December, the European Council ratified the agreement reached by the Economic and Finance Ministers of the European Union (ECOFIN) on the Single Resolution Mechanism for banks (SRM). This agreement determines when the SRM will come into force, who will take the decisions and the main features of the common fund that will be set up to help those banks with solvency difficulties. In the end, the agreement reached has left in the hands of the Member states the final decision of whether to wind up a bank or resort to the common fund to finance bankruptcies and restructuring. This common fund will consist of 55 billion euros, provided by the financial institutions themselves between 2016 and 2026. Spain's banks are expected to provide 8.5 billion euros. Although this still lacks final approval from the European Parliament, which has expressed misgivings regarding the agreement reached, no significant changes are expected.