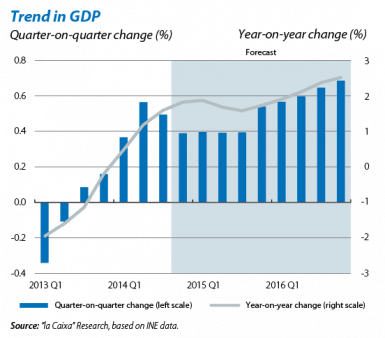

GDP grew by 0.5% quarter-on-quarter in Q3. Although a slightly lower rate of growth was expected than in Q2 (0.6% quarter-on-quarter), in the end the slowdown has been very modest, only 0.1 pp. With this figure, the Spanish economy has enjoyed five consecutive quarters of growth and the year-on-year rate of change for GDP is 1.6%. Although the GDP's breakdown by component has yet to be published, the bulk of the evidence available suggests that growth is still being driven by domestic demand and especially by household consumption and investment in capital goods. Given such good figures, we have improved our growth forecast for 2014 by 0.1 pp to 1.3%. Our central scenario predicts this expansion will continue but at a slightly slower rate, namely 0.4% quarter-on-quarter, bringing growth in 2015 to about 1.7%.

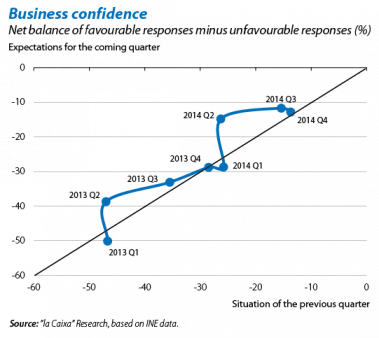

Economic activity has remained expansionary but is expected to ease slightly. October's business confidence index, based on the expectations of entrepreneurs regarding how business is going, rose by 0.2% in relation to Q3, a very modest increase compared with the substantial rises recorded in previous quarters. Moreover, the component of expectations has remained at the same level as in Q3 without any further rises. For their part industrial orders, which usually anticipate the trend in industrial production over the coming months, dipped slightly in August due to the slowdown in external orders both in the euro area and the rest of the markets. The recovery in domestic orders points to domestic demand continuing to grow at a good rate, which might temporarily offset the fall in foreign demand. It therefore looks like the Spanish economy is withstanding the recent slowdown in activity in Europe. After extensive correction in macroeconomic imbalances and the structural reforms implemented, it is less vulnerable and more prepared for growth. In any case, the economy's resilience to external weakness is limited and, ultimately, its recovery still depends on the euro area overcoming its most recent setback.

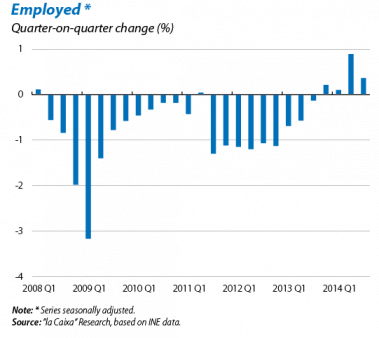

The good tone in economic activity is reflected in the figures for the labour market. In Q3 the number of employed increased for the fourth consecutive quarter (0.4% quarter-on-quarter, seasonally adjusted), a figure that was expected after the good data for workers registered with Social Security. As has been the case over the last few quarters, employment grew in the private sector (+154,900) but fell in the public (–3,900). The unemployment rate fell by slightly more than expected, from 24.5% to 23.7%, thanks to job creation but also due to a reduction in the labour force (–58,000 people), especially among foreign workers.

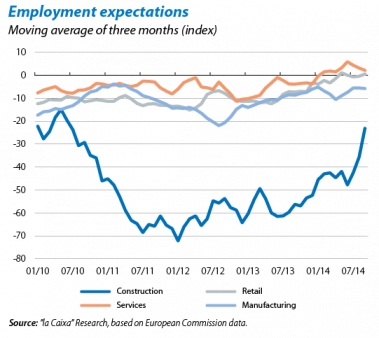

Employment's revival moves beyond the services sector, making the recovery more solid. Apart from agriculture, which is highly volatile, employment rose in services (+108,800), industry (+71,800) and, for the second consecutive quarter, construction (+43,500). Moreover, employment expectations also continued to improve, suggesting a good employment trend in the coming quarters. After the significant increase in Q2, expectations for the services and retail sectors remained at the levels achieved in Q3. However, employment expectations in industry and construction, which had fallen slightly in Q2, improved considerably in Q3 and especially in the latter sector, going from –44.7 in April to –23.2 in September. This recovery in construction employment certainly suggests that job creation is spreading, albeit very gradually, throughout the different sectors.

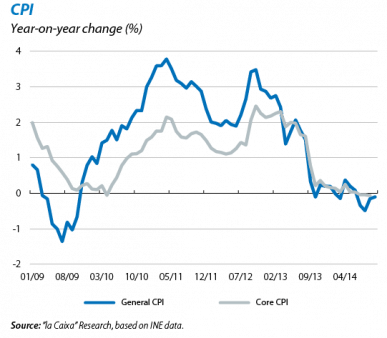

The fall in prices is easing off. October's inflation rate stood at

–0.1%, 0.1 pp higher than the figure for the previous month. This increase can be partly explained by the rise in food prices. Although inflation has been in negative terrain for the last four months, a tentative change in trend can now be seen, supported by the recovery in domestic demand and the euro's depreciation, and we expect the risk of deflation to gradually disappear within a context of gradual recovery.

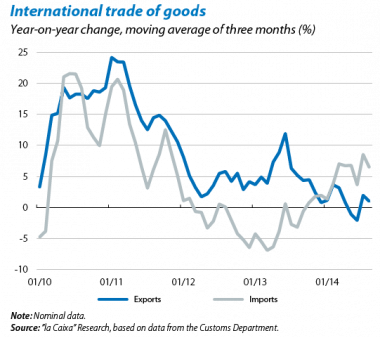

Tourism looks like enjoying another record year. For the first time the number of tourists in September went above seven million, a year-on-year increase of 8.1%, auguring record figures for 2014. The tourism industry's superb performance contrasts with the trend in exports of goods which fell by 5.1% year-on-year in August. Although substantial, this drop can be partly explained by the series' own volatility. The average for the last three months, which shows the underlying trend, is somewhat more favourable although still lower than imports. These figures are reflected in the current account balance, accumulating a deficit of 4.6 billion euros between January and August compared with an 8.7 billion surplus over the same period in 2013. We expect this trend to change direction over the coming months, with exports also contributing once again to GDP growth. Firstly, the improvement in global demand should boost exports. Secondly, the growth in domestic demand, and in imports, should moderate. There are downside risks due to the uncertainty surrounding these factors, however. What does seem clear is that the current account balance is unlikely to repeat the figure posted in 2013 (0.8% of GDP).

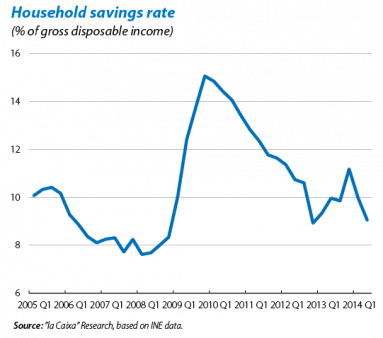

Private consumption continues to drive growth. September's strong increase in retail sales (1.1% year-on-year in the series adjusted for seasonal and calendar effects) suggests that private consumption will have performed well in Q3. As in Q2, domestic consumption will have driven growth, supported both by the improved labour market and a fall in the savings rate. According to the latest data available, the savings rate of households fell to 9.1% of their gross disposable income in Q2, in a context in which gross disposable income is still falling (–0.2% quarter-on-quarter). With a view to the coming quarters, this downward slide in savings appears to be limited so further growth in consumption would have to be supported by an increase in gross disposable income. Household wealth, which reached maximum levels in Q2, should also be a significant support for consumption in the medium term.

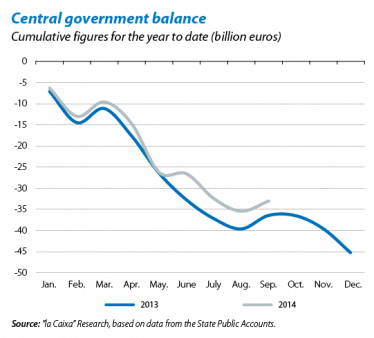

The improvement in activity boosts fiscal consolidation. Higher tax revenues helped the central government to reduce its deficit to just over 33 billion euros in September (3.1% of GDP), 9.3% lower than in 2013. The fiscal balance for the rest of the administrations has followed suit, apart from the autonomous communities which, according to the latest figures from August, had already reached their deficit target for 2014 as a whole (1.0%). We have therefore maintained our forecast of a slight deviation from the deficit targets for this year.

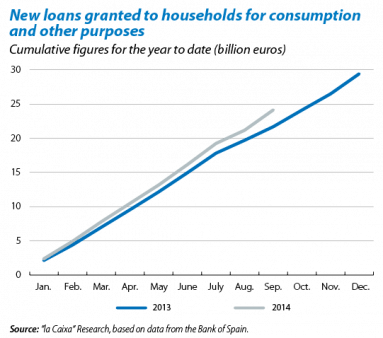

After successfully withstanding the ECB's stress test, the banking sector is starting to grant new loans. After the extensive restructuring carried out by Spain's banks over the last few years, the results of the European stress test showed that all Spanish banks are solvent enough to withstand an adverse scenario in which the euro area's GDP in 2016 would be 6.6% lower than the baseline scenario. Only one Spanish bank had not passed the test at December 31, 2013 but this has now covered its capital requirements detected with issuances carried out in 2014. These results demonstrate the solvency of the sector which is now ready to start injecting credit into the real economy again. This can be seen in the data for new loans. Between January and September, new loans for acquiring housing reached nearly 19 billion euros, 18.9% more than in 2013. New loans given to households for consumption and other purposes also performed well with 24 billion euros being granted between January and September, 11.4% more than in the same period of 2013. New loans to SMEs also increased (105 billion euros, 7.4% more than in 2013) but credit to large firms is still far from the levels reached in 2013, partly because these companies prefer other sources of financing. Such figures for new loans contrast with the considerable drop still being seen in the outstanding balance for credit, with a year-on-year change of –8.0% in September, somewhat lower than the previous month (–8.3% in August). The overall volume of credit will still take some time to stabilise as the deleveraging of firms and households, now relatively advanced in some segments, has yet to be completed.