The recovery continues at a good rate but there are still risks

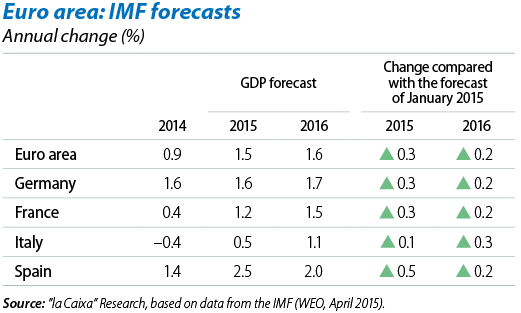

The International Monetary Fund (IMF) has confirmed the euro area's improved economy and revised its forecasts upwards. The institution points out that the economic recovery has been boosted by temporary favourable factors such as falling oil prices and the measures carried out by the European Central Bank (ECB). The ECB's expansionary monetary policy is playing a decisive role in the recovery, improving the economy's financial conditions by substantially reducing interest rates and improving inflation expectations. It has also led to the euro's depreciation, boosting the trade balance. These events have led the IMF to raise its growth forecast for the euro area from the estimate announced in January (+0.3 pps to 1.5% in 2015), albeit highlighting the risks of a prolonged period of low growth and inflation. To avoid this, it recommends continuing with expansionary monetary measures, furthering structural reforms and increasing investment, in particular in those countries with greater fiscal margin.

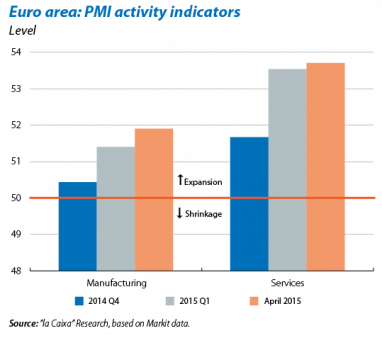

The recovery continues in Q2 but with no signs of accelerating. After a Q1 in which the euro area gained traction, the initial figures for Q2 point to the expansion continuing at a good pace, albeit with some moderation. The composite PMI for the euro area reached 53.5 points in April, slightly above its level in Q1 (53.3 points) but below March's level (54.4 points). The same trend can be seen both in manufacturing and services. By country, Germany has posted the same pattern of strong growth at the start of Q2 but with some moderation both in the PMI and the ZEW (the index of investor and analyst expectations), recording a slight drop compared with March's figure. However, the IFO (business climate index) continued to rise. In France the PMI fell significantly, once again coming very close to 50 points (the usual boundary between expansion and contraction) after posting encouraging figures the last few months. Unlike Germany and France, the PMI for the rest of the euro area countries increased significantly, up to the highest levels seen since August 2007, confirming that most countries are taking part in the recovery.

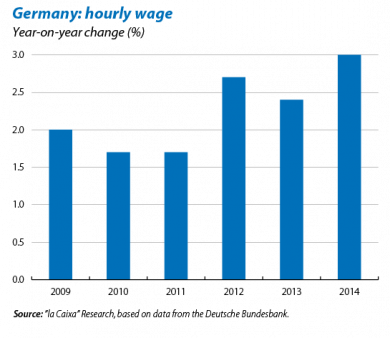

Private consumption remains healthy. Greater optimism regarding the economic outlook boosted consumption in the euro area in Q1 with February's retail sales growing by 3.0% year-on-year. Private consumption should continue its good performance in Q2 in spite of the slight adjustment in consumer confidence in April, after a notable increase in Q1. The upward trend in wages in Germany, the driving force for the euro area's activity, will continue to support private consumption. In 2014 Germany posted the highest wage increase in 20 years and wages are expected to rise by almost 3% in 2015, partly due to the introduction of a minimum wage as well as the wage rises established in collective bargaining agreements.

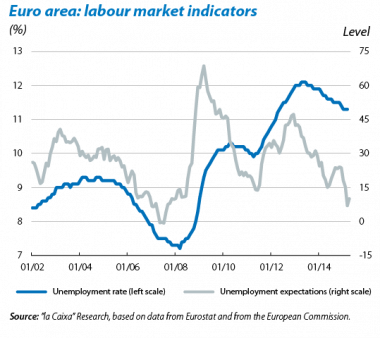

The recovery in economic activity in 2015 Q1 is also reflected in the labour market. In March the euro area's unemployment rate stood at 11.3%, 0.4 pps below the level a year ago. In Q1, the employment expectations recorded by the European Commission advanced notably for the euro area as a whole. Employment is therefore expected to have increased more in Q1 than in Q4, which rose by 0.1% quarter-on-quarter. The outlook for the labour market is still favourable at the start of Q2 although, as with the rest of the supply and demand indicators, a slight slowdown is predicted in the rate of growth in employment. Specifically, in manufacturing and services, April's employment expectations fell by 0.2 and 0.1 pps to –2.7 and 4.5 points respectively. For the moment, however, they are both still above the figures posted on average in Q1.

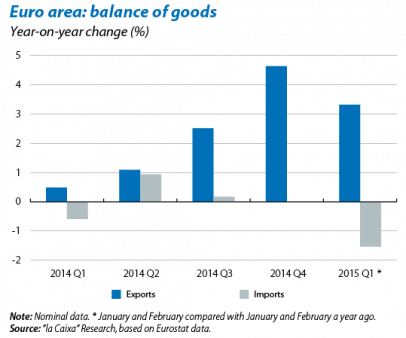

The euro's depreciation contributes to the trade balance surplus. The foreign sector continues to support the recovery in economic activity, helping growth between domestic and foreign demand to be relatively balanced. Exports of goods, which ended 2014 up by 4.6% year-on-year in Q4, continued to advance significantly at the start of 2015, recording an average annual increase of 3.3% in the first two months of the year. This is partly thanks to the euro's depreciation over the last few quarters. Specifically, the trade balance surplus, which totalled 22 billion euros in February seasonally adjusted (21.2 billion in January), has helped the euro area's current account balance to remain healthy with a surplus of 2.4% of GDP in February (cumulative over 12 months), 0.4 pps above the figure for the same month a year ago. We expect the euro's exchange rate to remain low over the coming months; in fact, further depreciation cannot be ruled out once the Fed starts to raise interest rates towards the end of this year.

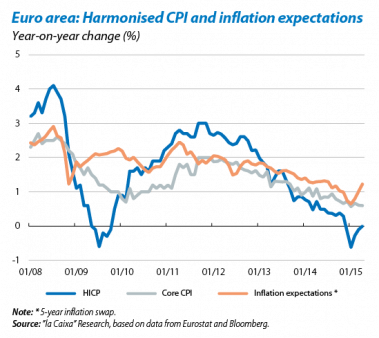

The rebound in inflation is gradually being confirmed. In April general inflation in the euro area rose by 0.1 pps to 0.0%, leaving negative terrain for the first time in four months. Over the coming months we expect inflation to continue its upward trend and end the year close to 1.5%. On the one hand growing employment and less wage adjustment, especially in Germany where wages are already growing at a good rate, will boost the euro area's consumption and push up prices. On the other hand the euro's depreciation against the dollar will make imports more expensive, which should also result in higher prices. The upward effect of the euro's depreciation on inflation will continue until the beginning of next year.

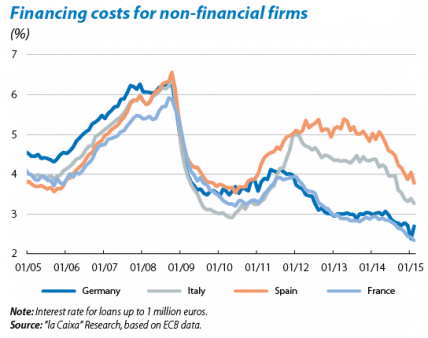

Financial integration is getting stronger, by degrees. One of the positive effects of the ECB's quantitative easing programme has been improved confidence in the recovery of the euro area, leading to a reduction in the spread between the interest rates charged to firms for financing compared with Germany. In February in Spain and Italy, financing costs for non-financial firms stood at 3.8% and 3.3%, respectively, 1.1 pps below the rate recorded the same month a year ago. In Germany the reduction was smaller, however, namely 0.3 pps, reaching 2.7%. The reduction in financial fragmentation has therefore been considerable although the disparity in financing costs is still high, making it difficult for credit to reach the real economy, especially in the periphery. The significant advances made towards monetary union and structural reforms by some periphery countries have undoubtedly helped to reduce fragmentation. Nonetheless, as the IMF once again stated in its World Economic Outlook in April, for this improvement in the euro area's economic situation to consolidate there must be continuity in the ECB's monetary policy, in strengthening the balance sheets of the euro area's banks, in the fiscal consolidation being carried out by countries with high debt and also in structural reforms.

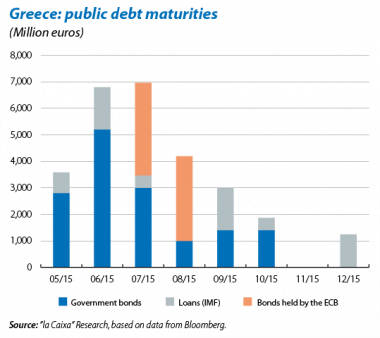

Greece is still a source of uncertainty. The demanding schedule of maturities for its public debt and lack of agreement with the Eurogroup means that Greece's situation still represents a significant risk for the euro area. For the moment negotiations are continuing between the European institutions and the Greek government to reach an agreement that will release the 7.2 billion pending of the bail-out but without producing any result. However, at the end of April the Greek government announced a change in its negotiating team that might help to redirect this process. From now on, discussions with the European institutions will be led by the number two in the Foreign Ministry instead of the Finance Minister, Yanis Varoufakis, who will nevertheless still supervise the negotiations. This change in interlocutor could help an agreement to be reached if the Greek government ends up accepting the reforms demanded by the institutions.

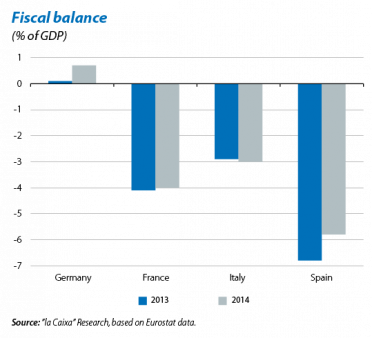

Disparity in public accounts. The public deficit reached 2.4% of GDP (2.9% in 2013) for the euro area as a whole but this figure hides notable differences between countries. At one end of the scale is Germany, posting a surplus of 0.7% of GDP after two consecutive years of its public accounts remaining practically at equilibrium. At the other end are those countries exceeding the maximum deficit allowed by the European Commission of 3%: France, Greece and Spain, among others. The largest adjustments in national accounts can be seen in some of the periphery countries which started from big deficits. In Spain the deficit stood at 5.8% of GDP in 2014 (6.8% in 2013), in Ireland it was 4.1% of GDP (5.8% in 2013) and in Greece it was 3.5% of GDP (12.3% in 2013). In the euro area as a whole, debt reached 91.9% of GDP in 2014, indicating that fiscal efforts must continue, especially in those countries with high levels of debt.