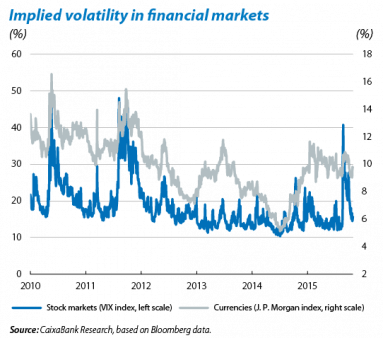

The uncertainty hovering over the global environment has eased, making way for a more favourable climate and the episodes of instability that had peppered the international financial scene between August and September were calmed by the messages and actions of central banks. On this occasion the European Central Bank (ECB) has taken the lead after forcefully stating that more monetary stimuli would very probably be adopted in December. At the same time, the more specific message given out by the Federal Reserve (Fed) regarding the path it plans to take with interest rates and the expansionary measures implemented by China's central bank (PBOC) have also had a positive effect. In this environment, risky assets and government bonds of the advanced bloc have benefitted the most although prices are still below the levels reached in June. The other side of the coin is represented by commodities, still immersed in their own particular adjustment, overlooked by the increase in risk appetite.

The steps taken by the Fed and the news coming from China will be the main factors modulating investor sentiment in the short and medium term and conditions are now more favourable for the upward trend in the different financial markets to continue until the end of the year. Evidence of China's transition towards a new model of growth should also help to support this positive scenario, as well as the seasonal factor of the period we are about to enter. However, the materialisation of this scenario is very likely to be accompanied by possible episodes of volatility that could be considerable in size.

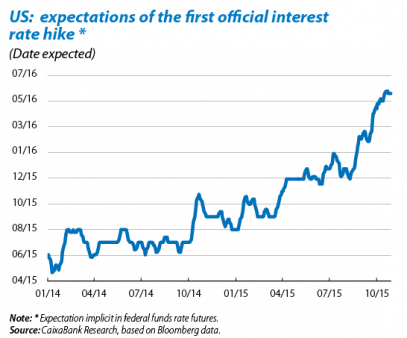

The Fed clarifies the prospect of a possible interest rate hike in December. In the communication issued by the Federal Open Market Committee (FOMC) in October, Janet Yellen shifted the focus back onto the domestic economy, eliminating the previous mention of «global economic and financial developments» but maintaining comments regarding the monitoring of domestic factors. Moreover, for the first time reference was made to the next FOMC meeting in December to decide whether it was the right time to start raising interest rates. The probability assigned by the markets that the start of monetary normalisation will be announced then (our main scenario) has increased notably (currently 48%) compared with a hike in 2016. All this is supported by a positive macroeconomic environment, with private consumption and investment remaining firm in spite of lower GDP growth in 2015 Q3 due to a reduction in stocking.

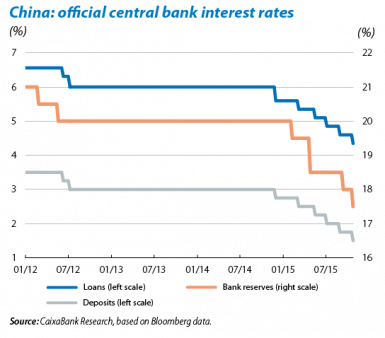

China is still an important focus of attention but the perceived risk regarding this area has improved. Investors welcomed the GDP growth figure for 2015 (6.9% year-on-year), higher than expected by the consensus of analysts and tempering the weak pulse suggested by some recent activity indicators. The decision of the PBOC to cut official interest rates on loans, deposits and bank reserves also had a positive effect on investor sentiment. The response and scope of the measures adopted by the PBOC confirm its willingness to act quickly to limit any tail risks, helping to dilute fears regarding a possible abrupt slowdown in the Chinese economy. The PBOC's decision to eliminate the current restrictions on returns for bank deposits is also a remarkable step and shows that the Asian giant has made notable progress towards liberalising interest rates. In the short and medium term the Chinese government's communication policy will be key to ensuring the measures announced do not result in high levels of volatility.

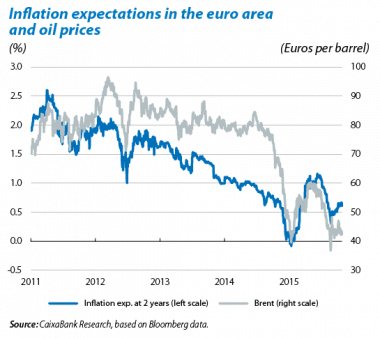

The ECB increases the accommodative tone of its messages and suggests more monetary stimuli in December. After its October meeting, the Governing Council of the ECB showed a clear readiness to implement additional expansionary measures and stated that these might be announced at its next meeting on 3 December. Mario Draghi once again placed particular emphasis on the continuation of downside risks for growth and particularly inflation. In spite of an improvement in monetary and credit aggregates, the ECB wants to cut short the counterproductive effects of tougher financial conditions. Specifically, the ECB President repeated the possibility of adjusting the bond acquisition programme (QE). This time, however, he also added that the option of cutting the deposit rate is also being considered by the ECB. This willingness to lower the official rate is one aspect that helps to strengthen the institution's commitment to achieve its inflation target. In any case, the decision to revise the accommodative degree of monetary policy will depend on the macroeconomic forecast presented by the authority in December. Nevertheless, the ECB may still opt to wait until January 2016, particularly given that the ECB's meeting in December comes before the Fed's meeting.

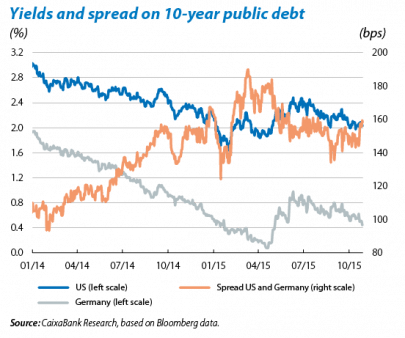

Sovereign debt is following the lead taken by the central banks. Yields on 10-year US and German bonds have fluctuated again with the messages issued by the monetary authorities which, in turn, have been influenced by growing concern for weak inflation. The latest version of Mario Draghi's «whatever it takes», promising to revise the monetary expansion programme in December, has widened the spread between yields on US and German bonds with the latter falling although we expect this trend to reverse in the first half of 2016 as global deflationary pressure eases.

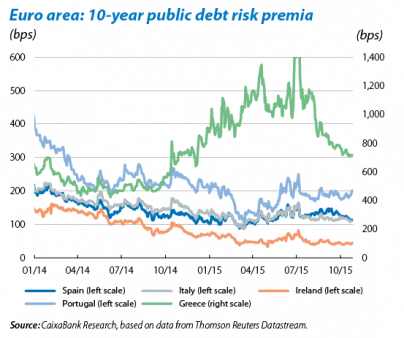

Meanwhile periphery sovereign debt has remained firm in spite of several impending elections. In October, yields on periphery public debt continued the downward trend started the previous month with the accommodative messages of central banks as a backdrop. The gradual improvement in the macroeconomic situation of countries such as Spain, Italy and Portugal, together with the irrefutable safety net provided by the ECB, have strengthened the stability of the sovereign debt of these countries in a period with several general elections being held. Spain's 10-year risk premium has fallen to levels close to those of Italy (around 110 bps), helped also by the sovereign rating upgrade (from BBB to BBB+) by the S&P agency.

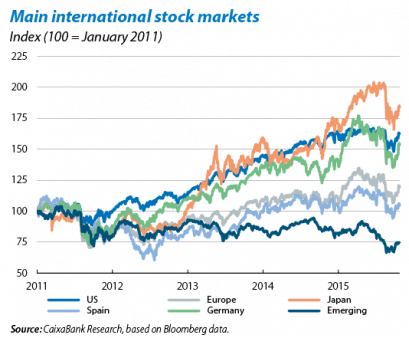

International stock markets advance in unison after the ups and downs of August and September. The general tone of equity markets was firm in October although share prices are still a considerable distance from the levels reached in spring. Although not definitive, this shift in the sources of uncertainty resulting from the summer correction has supported the upward trend. This has had a greater effect on investor mood than the lacklustre corporate earnings campaign in the US although it is true that, out of the 230 companies in the S&P 500 that have published their accounts, 75% have reported higher profits than expected. The weak tone in revenue and turnover has not gone unnoticed, however. In this case the ratio of positive surprises is 43% while negative surprises reached 56%. Nonetheless the stock market rally in advanced markets is very likely to continue until the end of the year. The flow of positive news from China, the more specific information provided by the Fed and the reinforcement of accommodative monetary conditions in the euro area should provide the main leverage. In the emerging area stock markets will continue to deal with the now-familiar obstacles although flows of portfolios towards these countries posted a positive trend in October.

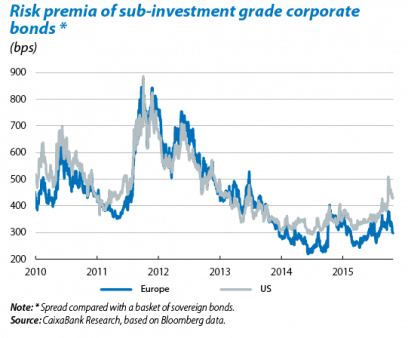

The private bond market is following in the wake of the stock markets. Over the last few months there have been widespread and significant increases in corporate bond spreads (particularly in sub-investment grade bonds). Of note is the leading role played by bonds issued to finance the growing activity in mergers and acquisitions. The number of mega-operations (above 10 billion dollars) since the beginning of 2015 is now higher than the figure recorded for the whole of 2007.

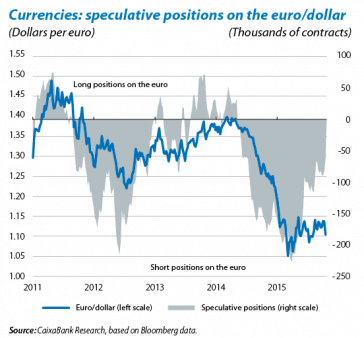

The commodity crisis continues to keep world growth on tenterhooks. After the slight appreciation of the euro in the first half of October, the ECB's meeting resulted in the currency falling by more than 3%, pushing down the dollar/euro exchange rate from 1.14 to 1.10 in just two days. Attention has turned particularly to the currencies of emerging economies such as Brazil and Turkey which have once again suffered from domestic tensions and weak commodities. In this area, after a notable rally at the beginning of October thanks to subsiding fears regarding global growth, crude oil returned to its downward path, losing 2.4% in October and 17% since the beginning of the year. One positive note was provided by copper, a leading indicator of industrial activity, which had lost 16% for the year to date but picked up by 2.4% in October.