The economy continues to advance at a good pace

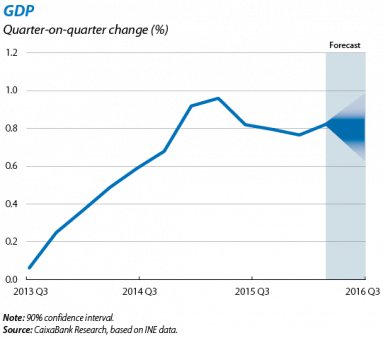

The growth rate remained high in Q3. Although the information available is still incomplete, high frequency business indicators point to the rate of expansion still being very vigorous between July and September. Specifically, the CaixaBank Research GDP forecast model places quarter-on-quarter growth at 0.8%, a similar figure to the one posted in the last four quarters. The good performance by activity for the year to date, better than expected, has led many analysts to revise upwards their growth forecasts for GDP for the whole of 2016 (at CaixaBank Research we have kept our forecast at 3.1% given that we already improved it last month). The forecast for 2017, however, has not been revised and stands within a range that is considerably lower than 2016, between 2.1% and 2.5% (the CaixaBank Research forecast is 2.4%). This means that, in the final part of this year and especially in the coming year, a slowdown is expected in activity with GDP growth rates of around 0.6% quarter-on-quarter.

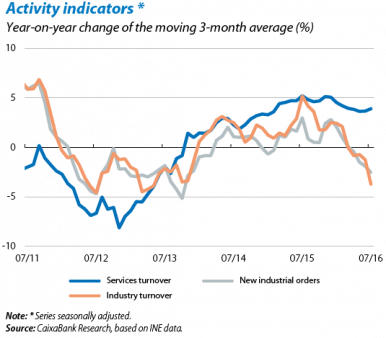

On the supply side, the services sector is consolidating its role as the main engine of the recovery. Since improvement began in 2013 Q3, the activity sector leading the recovery on the supply side is market services (the services sector excluding public administration, healthcare and education). And, for the time being, this upward momentum does not seem to be running out of steam. This can be seen in the turnover for the services sector, up by a considerable 4.4% year-on-year in July. However, the signs of slowdown in industry are increasingly evident: in July the index for industrial turnover speeded up its decline to –2.8% year- on-year while new industrial orders posted –8.0%. In any case these negative figures are offset by two relevant aspects. Firstly, the decline in industry can be largely explained by the energy sector: turnover for industrial business without energy grew by 0.5% year-on-year in July. Secondly, the drop in producer prices is also having a negative effect on turnover for the sector. If we analyse volume-based indicators (instead of value-based) such as the industrial production index, and exclude divisions related to energy (and, for example, «Supply of electricity, gas, steam and air conditioning»), the outlook is more encouraging: in July the rate of year-on-year change stood at 1.4%. Another positive note is provided by the manufacture of automobiles with a cumulative growth in production of 30% between January 2013 and July 2016.

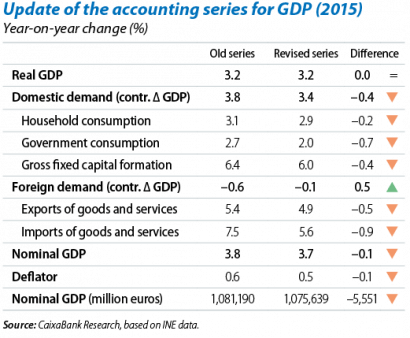

The contribution of the foreign sector is gaining in importance for demand. The update of the accounting series for GDP carried out every year by the INE has revealed that domestic demand made a smaller contribution to GDP growth in 2015 (3.4 pps compared with 3.8 pps estimated previously). However, this was offset by a lower negative contribution negative by external demand (–0.1 pps compared with –0.6 pps previously). This improved trend in the foreign sector reinforces the idea that a shift is occurring towards a more sustainable model of growth based on greater export capacity among Spanish businesses and less dependence on imports. This trend continued in the first two quarters of 2016: the excellent performance by exports (and the more subdued growth in imports) meant that exports contributed positively to GDP growth in year-on-year terms.

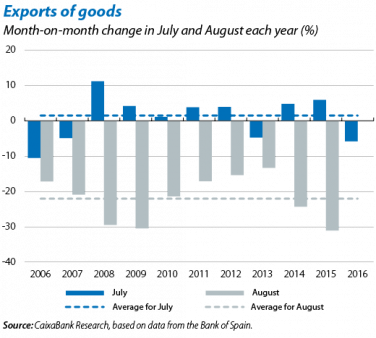

The temporary dip in the exports of goods in July is not a cause for concern, at present. The decline (–9.1% year- on-year) can be explained, to a large extent, by a calendar effect so that a large part of this bad figure is expected to be made up in August. More worrying is the slowdown in world trade and the impact this might have on Spain’s export sector, which is looking very resilient at the moment. The larger decline in imports in July (–12% year-on-year) helped to improve the trade deficit, standing at 8,436 million euros in cumulative terms from January to July (compared with a deficit of 12,876 million in the same period of 2015).

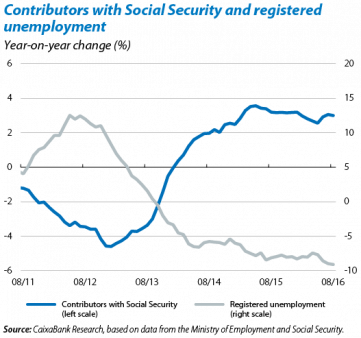

The recovery in the labour market continues at a good rate. The number of registered workers affiliated to Social Security fell by 144,997 people in August, a very similar seasonal decline to the one seen by registered workers in August every year. A large part of this drop was concentrated in sectors that tend to stop in the holiday period and begin again in September, such as education (–58,052) and construction (–12,011). The year-on-year rate of change therefore remained at a high 3.0% (3.1% in July). Moreover, the significant improvement in employment expectations in September, both for services and retail activity, suggests that employment will continue to evolve favourably in the final part of the year.

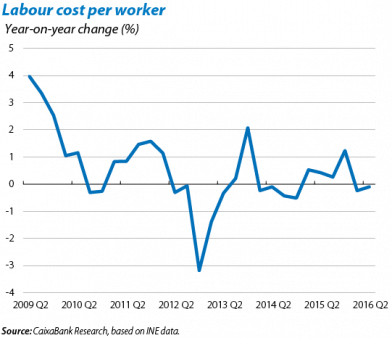

Labour costs are still moderate. One factor that may be contributing to the dynamic job creation rate are the contained labour costs per worker, which continue almost at a standstill. According to the Quarterly Labour Cost Survey in 2016 Q2, this stood at 2,589 euros per worker and month, representing a year-on-year change rate of –0.1%. In a context of low inflation (0.3% in September) and high unemployment (20.0% in Q2), it is likely the wage containment will continue and that the improvement in the disposable income of households will continue to come from an increasing number of employed people.

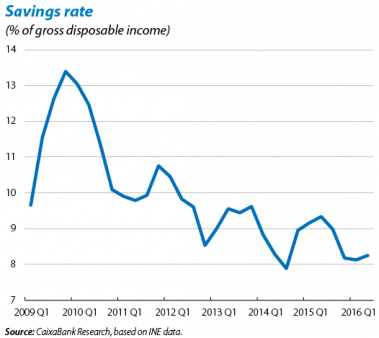

A sharp increase in consumption keeps savings at moderate rates. The good trend in the labour market can also be seen in wage income which grew by 3.9% year-on-year in Q2 and offset the drop in non-wage income (–4.3% year-on-year), although this did not prevent gross disposable household income (the sum of wage and non-wage income) from slowing down to 1.7% year-on-year. The lower growth in disposable income and strong boost by private consumption in Q2 (2.9% year-on-year in nominal terms) meant that the savings rate stood at 8.3% of gross disposable household income, 1 pps below the figure of 2015 Q2.

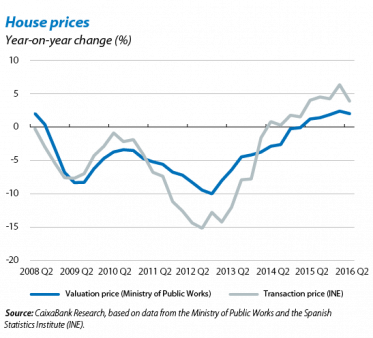

House prices retained their expansionary tone in 2016 Q2. The index based on sales grew by 1.8% quarter-on-quarter (3.9% year-on-year) while price valuations grew by 0.9% quarter-on-quarter (2.0% year-on-year). Sales also are evolving favourably (13.5% year-on-year in July). With a view to the coming quarters, the upward trend in prices is likely to continue thanks to the boost provided by demand for housing, a still very low level of activity in construction and the scarcity of housing for sale in certain prime areas (for instance in large cities). This is suggested by the sharp increase in land prices, up by 6.6% year-on-year in Q2, which tends to anticipate the future trend in house prices by a few months.

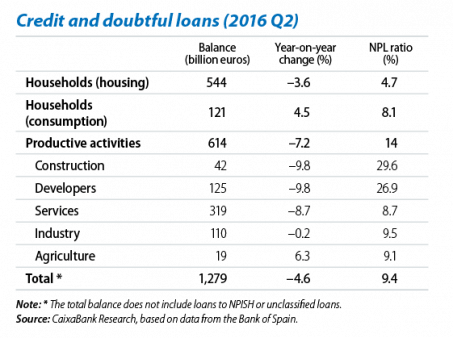

Growth in bank lending continues to support the recovery. Easier financial conditions are also playing an important role in the recovery in the real estate sector. In July new mortgages for purchasing housing rose by 27% year-on-year (cumulative over 12 months), providing fundamental support for demand. In any case the outstanding balance of mortgage credit is still falling (–3.6% year-on-year) while the outstanding balance of consumer credit continues to increase at a good rate (4.5% year-on-year). With regard to loans to non-financial firms, a breakdown of bank loans in 2016 Q2 by segment shows a moderation in the decline in credit to production sectors although developer credit and loans for the construction industry still fell at high rates. The NPL ratio held steady at 9.4% in July but the reduction in the NPL ratio for developer loans over the last year was particularly noticeable.

The adjustment in public accounts is still pending. In July the deficit for public administrations as a whole, excluding local corporations, stood at 3.1% of GDP (without including losses due to financial aid, namely 0.2% of GDP). This figure is the same as the one for July 2015 and therefore shows the lack of adjustment in public accounts this year. It should be noted that the measures announced by the government (increased advanced payments of corporation tax) should correct this trend in the final part of the year. However, doubts still remain regarding the country’s capacity to meet its fiscal consolidation targets in the medium term, making the Spanish economy more sensitive to possible changes in international investor sentiment. This aspect is of vital importance given the high level of public debt. Specifically, in 2016 Q2 this reached 100.5% of GDP, a figure that is far from the forecasts sent to Brussels as part of the Stability Programme 2016-2019, where debt was expected to end the year at 99.1% of GDP.