The emerging countries are driving the global economy in the second half of 2016

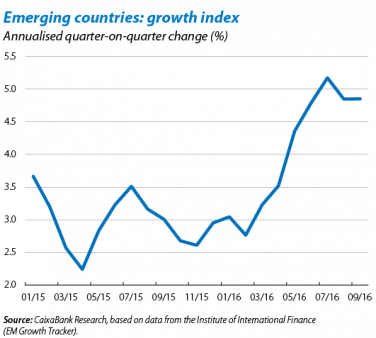

The global economy is en route to recording 3.1% growth in 2016 and 3.5% in 2017. The acceleration of the emerging economies in the second half of 2016 will support the improvement in global growth throughout the coming quarters. The aggregate index of economic growth produced by the Institute of International Finance points to growth rates of 4.5% (annualised quarter-on-quarter) for the emerging economies as a whole compared with the more moderate 3.5% recorded at the start of 2016. The still significant growth rates in China, the acceleration in India and the improvement in Brazil and Russia (now moving away from the most severe phase of their respective recessions) all support this scenario.

The IMF maintains its global growth forecasts but warns of political risks. Given this situation, in its «World Economic Outlook» in October (WEO) the Fund kept its forecasts for world economic growth unaltered: namely 3.1% in 2016 and 3.4% in 2017 (a scenario in line with the CaixaBank Research forecasts). The main risks according to the international institution are of a political nature, particularly the shift towards protectionist policies and populist measures. Risks of a macrofinancial nature (such as financial volatility and capital flows towards the emerging countries), as well as concerns regarding China’s capacity to avoid a hard landing, are still present but have once again become slightly less prominent.

UNITED STATES

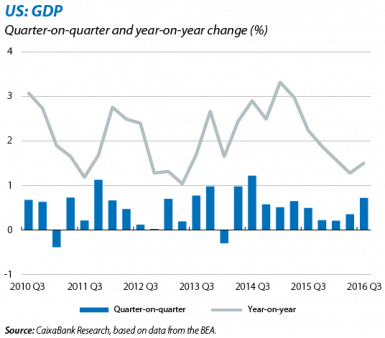

Good GDP figures for Q3. The US economy grew by 0.7% quarter-on-quarter in 2016 Q3 (1.5% year-on-year), faster than the more moderate growth rates recorded in the first half of 2016 (0.3% quarter-on-quarter on average). On the side of demand, this improved figure was largely due to strong growth in exports and the positive contribution made by inventories after five quarters of negative contributions. Private consumption, which represents close to 70% of GDP, also continued to record significant growth and corporate investment started to show signs of improvement (+0.3% quarter-on-quarter in Q3 compared with –0.3% on average in the first half of the year). As a whole, growth for Q3 is in line with the CaixaBank Research forecasts, so we have not altered the annual growth figure predicted for 2016 of 1.5%, or the 2.1% forecast for 2017.

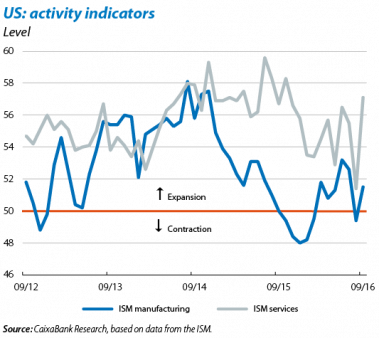

Beyond the GDP figures for Q3, business indicators also improved substantially in September and October after the weakness shown in August. This dispelled some of the doubts hovering over the US economy’s capacity to advance. The (ISM) business sentiment index for manufacturing rose to 51.5 points, leaving behind the poor figure posted in August which was below the 50-point threshold (49.4). Meanwhile the similar index for services climbed to 57.1 points (51.4 the previous month), posting the largest month-on-month increase for the series. The Conference Board consumer confidence index stood at 98.6 points in October; although below September’s post-crisis peak (103.5) it is still above the historical average, confirming the strength of private consumption as the mainstay of the country’s economic growth.

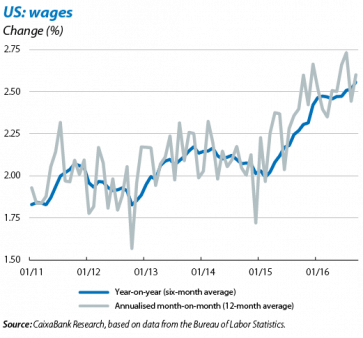

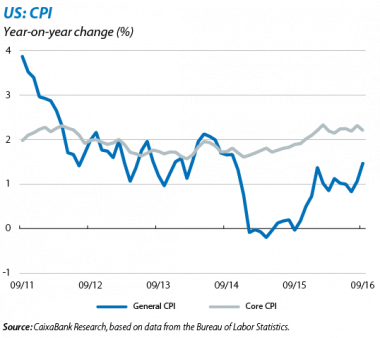

The labour market continues to post healthy figures, supporting the dynamism in consumption and justifying the Fed’s second fed funds hike. 156,000 jobs were created in September, bringing the monthly average for the year to date to 178,000. Unemployment remained at a subdued 5.0% and wages continued to post significant growth (2.6% year-on-year). Given this situation, inflation continued to recover: headline inflation stood at 1.5% in September, 0.4 pps above the previous month’s figure (the highest since October 2014). Undoubtedly this recovery and the solidity of the labour market justify the Fed continuing to raise the fed funds rate, an action which began in December 2015. Nonetheless the process of monetary normalisation will be very gradual (more than expected a few months ago), with hikes of between 0.50 and 0.75 pps per year in 2017 and 2018.

In the longer term, the reduction in the growth potential of the US is of concern. Although this potential is still significant (~1.9% compared with previous estimates of ~2.3%), several factors could push it down further: the ageing population, a slowdown in the advance of human capital and the end of a period of exceptional productivity (between 1995 and 2004) driven by information technology. Nonetheless the country’s institutional quality and its capacity to innovate and attract talent will keep the US economy at the head of world development. Given this situation, the outcome of the presidential elections and those for the House of Representatives and the Senate is particularly relevant. At the time of writing, the polls give some margin to H. Clinton in the presidential race, whose economic agenda appears to be more sensitive towards this issue with specific measures both for taxation and infrastructures and also education, which could support growth somewhat in the medium and long term (see the Focus «Clintonomics vs. Trumponomics» in MR10/2016 for an economic analysis of the proposals of the two main presidential candidates in the US).

JAPAN

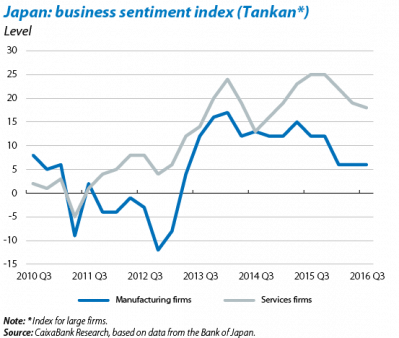

Still fragile. The Tankan index for Q3, which measures business sentiment, has remained weak over the last few quarters. Specifically the index for large manufacturing companies stood at 6 points (compared with 12 points in 2015 Q4) while the index for large services firms stood at 18 points, below the 25 points recorded in 2015 Q4. The appreciation of the yen (+16% against the dollar for the year to date) and persistent deflationary pressures (headline inflation stood at –0.5% in September) are factors that weigh heavily on this business sentiment. Consequently, the CaixaBank Research forecast for 2016 has been kept at a contained 0.6% in 2016 and 1.0% in 2017 although a slight acceleration has been predicted, supported by the fiscal stimuli announced last summer.

EMERGING ECONOMIES

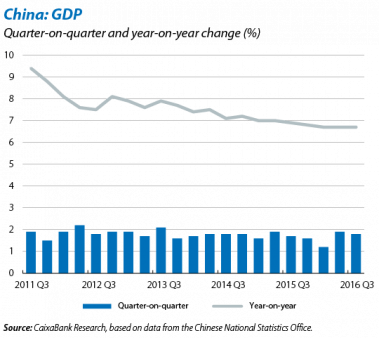

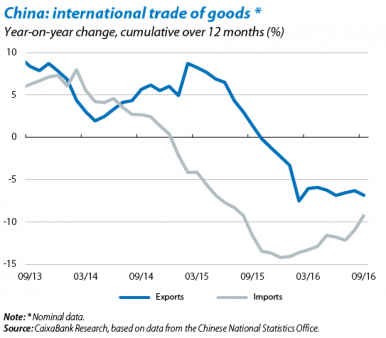

China continues to record significant growth. The Chinese economy grew by 6.7% year-on-year in Q3, the same rate as in the first half of 2016 and slightly above the CaixaBank Research forecasts and those of the consensus of analysts, while most business indicators remained dynamic in September: retail sales grew considerably by 10.7% year- on-year, the largest increase of the year, while industrial production was up 6.1%, just 0.2 pps less than in August. The foreign sector was actually the only element to show some weakness in the most recent figures posted by the country: exports fell by 6.8% year-on-year (cumulative over 12 months) compared with –6.3% in August. Beyond this short-term perspective, however, there are still important sources of risk. Of particular concern is the sizeable and growing corporate debt, largely financed by the country’s banking system (see the Focus «China’s financial system: a giant with feet of clay?» in this Monthly Report).

Russia and Brazil, two large emerging economies, can see the light at the end of the tunnel. Although both countries will still report declines in their annual growth figures for 2016 (–0.8% in Russia and –3.3% in Brazil), the latest activity indicators for Q3 point to some improvement in both economies. In particular Russia is expected to post positive growth in GDP in Q3 (in quarter-on-quarter terms) while, in Brazil, the drop in activity seems to have bottomed out and a minimal decline is expected in quarter-on-quarter terms. Nonetheless there are still big doubts in the Latin American country regarding its capacity to reduce its hefty public deficit and its willingness to undertake measures that could improve its medium-term growth capacity.

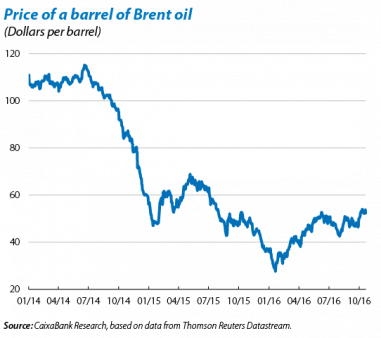

Mexico posts surprisingly good GDP figures. GDP grew by 1.0% quarter-on-quarter in Q3, higher than the consensus forecasts of analysts and than Q2’s figure of –0.2%. This somewhat better figure than expected, together with the increase in oil prices (boosted by OPEC’s potential agreement to limit the supply of crude oil), diminishing financial uncertainty and a better GDP trend in the US in the last part of the year, suggest that this improvement should continue over the coming quarters.