Global growth is on the up, with downside risks

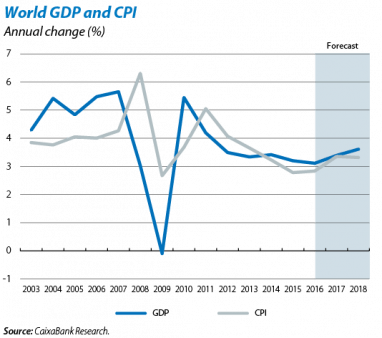

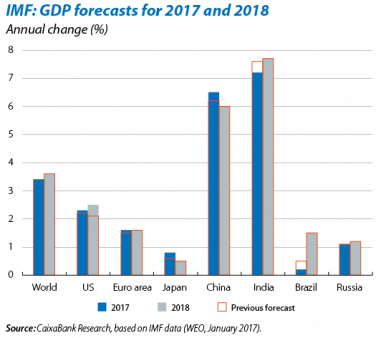

World growth will accelerate in 2017. Activity indicators tended to improve towards the end of 2016, endorsing the CaixaBank Research benchmark scenario for 2017, when world GDP is expected to grow by 3.4% (compared with the estimated 3.1% growth for 2016). In 2018 the activity rate will increase even further to 3.6%. Inflation will rise slightly in 2017 and 2018, especially in advanced economies. The factors underlying this expansion are well known. Firstly, in the advanced economies monetary policy will still be expansionary (even in the US, whose monetary normalisation will continue to be very gradual). A second global factor supporting the acceleration in activity is the recovery in oil prices, which will boost exporters without excessively eroding growth for importers. Thirdly, the recovery of the emerging economies, glimpsed towards the end of 2016, will probably intensify: Russia and Brazil are expected to exit their recessions, with expansion likely in other economies such as India and emerging Europe. Obviously the most notable exception to this trend is China, which will continue its gradual slowdown in 2017 and 2018.

The balance of risks is still downside, leaning towards less growth. In spite of this reasonably satisfactory outlook, risks at a global level are still high. In particular, CaixaBank Research notes increasing global debt, the rise in populism, geopolitical uncertainty, questions regarding the policy stance of Trump’s administration, doubts concerning China’s soft landing and financial, real estate and foreign exchange risks, as well as the impact of tougher international financial conditions on emerging economies with more external vulnerabilities. This interpretation is broadly in line with consensus estimates, as can be seen in the IMF’s recent update of its World Economic Outlook. Some of the risks highlighted by the IMF are protectionism, the combination of low growth (due to the absence of structural reforms) and high debt of some advanced economies and the vulnerabilities still shown by some large emerging countries.

UNITED STATES

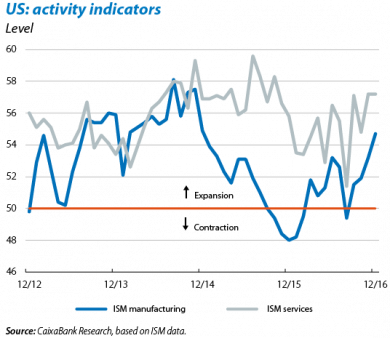

The world’s largest world economy; the world’s largest risk? The US situation is paradoxical. Its activity rate is showing evident signs of acceleration, leaving behind the relative slump in the first part of 2016, but its favourable cyclical outlook is being affected by uncertainty regarding the economic policy of Trump’s administration. In any case, the machine is still purring along, at least for the time being. For example, business confidence indicators (ISM) for manufacturing and services were clearly above 50 points in December, suggesting a clear expansion in secondary and tertiary activity. The consumer confidence indicator suggests a similar view, at its highest level for the past 15 years.

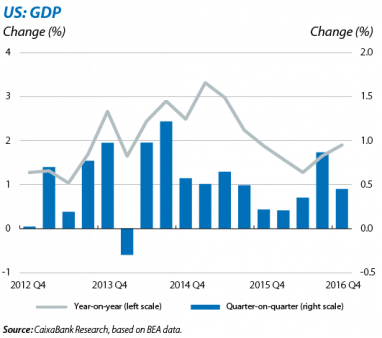

The positive situation at the end of 2016 was confirmed overall with the publication of Q4 GDP figures. In this period, quarter-on-quarter growth was 0.5% (1.9% year-on-year). Although this rate is lower than in Q3, it is still high and its composition (with strong domestic demand) points to a momentum that should continue over the coming quarters. A complicated year has therefore come to an end, filled with moments of uncertainty and made up of two clearly different phases; a first half of the year with disappointing growth rates and a second half with clear economic expansion.

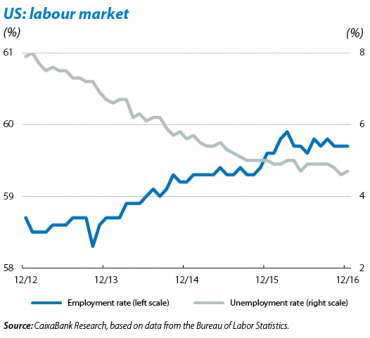

Is the proposed economic stimulus necessary? Activity is speeding up at a time when the economy is close to full employment. 156,000 jobs were created in December, bringing the monthly average for 2016 to the high figure of 180,000. Unemployment also ended the year at a low 4.7%, far from the 10% recorded in 2009, while wages continued to rise considerably (up by 2.9% year-on-year, the highest since 2009). Given this situation, the announcement of a substantial fiscal stimulus after the elections via a combination of tax cuts and increased public investment has sparked discussion, as it could end up causing inflationary tensions and an even greater trade imbalance, with merely a limited improvement in growth in return.

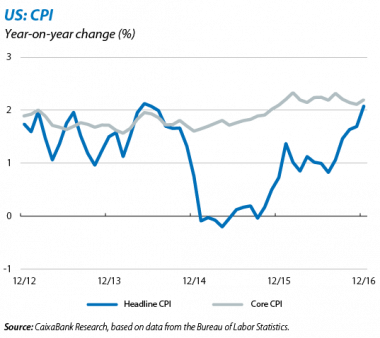

Inflation, about to hit higher levels. This diagnosis is reinforced by inflation’s recent behaviour. In December, the CPI grew by 2.1% year-on-year, 0.4 pps above the previous month’s figure, due to the contribution of owners’ equivalent rent and energy. As oil prices are expected to rise over the coming months, inflation will exceed 2.5% in 2017 Q1. Adding together the different elements indicating a mature phase of the cycle, it is logical that the Federal Reserve (Fed), after months of hesitation, raised the Fed Funds rate last December to 0.5%-0.75%, and also to propose three additional hikes in 2017 (a scenario that CaixaBank Research agrees with completely but not the majority of the market).

EMERGING

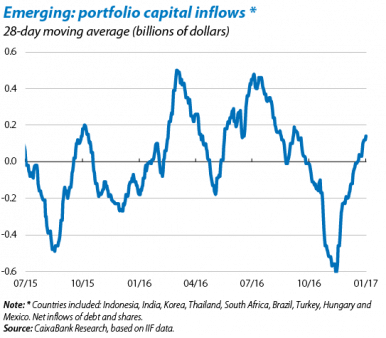

Economic activity and capital flows boost the emerging economies. After several months of an uncertain trend in activity, indicators started to move upwards towards the end of 2016. Albeit with some exceptions (Turkey and Latin America are the most notable), the emerging economies are now enjoying more solid growth. This improvement has been accompanied by an upturn in net portfolio capital inflows (debt and shares), totally reversing the intense episode of capital outflows from the emerging countries that followed the US presidential elections.

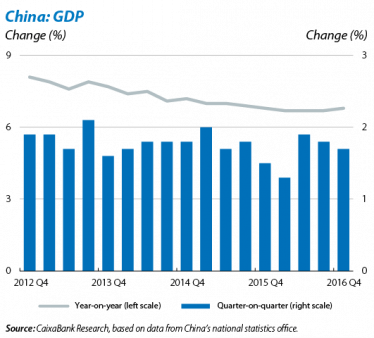

China dispels more immediate doubts but risks are still high. The trend in China’s growth has been closely watched for several years now. The biggest doubt concerns the economic slowdown being managed by the government and whether this will be orderly or abrupt (in other words a «soft landing» or a «hard landing»). For the time being, the first scenario is still the most likely. 2016 Q4 growth was 6.8%, almost identical to the 6.7% of the three preceding quarters, with the year’s figure ending up at 6.7% (6.9% in 2015). This provides a solid starting point for 2017 and supports the CaixaBank Research forecast that China will grow by 6.4% this year. But the fact that the slowdown is proceeding according to plan does not dispel doubts concerning a number of risks, both financial (excessive debt, shadow banking, etc.) and also related to real estate and foreign exchange.

Russia and Mexico, the two sides of the emerging coin. The month has been a mixed bag for the other large emerging economies. Russia is the perfect example of an emerging commodities exporter that is starting to be perceived with a less severe balance of risks than in preceding months. The view of CaixaBank Research is much less complacent. Although Russia’s activity is certainly benefitting from the upswing in oil prices, part of this improvement is more a «rebound» after a deep recession than a recovery based on solid macroeconomic adjustments. Nevertheless, it is true that other major emerging countries face more serious risks. For instance, Mexico. In particular, there are serious doubts concerning the impact of the new US trade policy on the structural foundations of Mexico’s economy. For the time being, in 2016 Q4 the Mexican economy grew by 0.6% quarter-on-quarter, an appreciable slowdown compared with the 1.0% posted in Q3. The effects of the substantial depreciation in the peso during 2016 are also being passed on to the prices of imported goods, especially food and petrol. In this last case, the impact of the gradual liberalisation of petrol prices is in addition to the effect of the peso’s depreciation. This is a necessary measure (public subsidies for petrol amount to approximately 0.7% of GDP) but one which is undoubtedly occurring at a sensitive time.