Spain: substantial growth in 2016 and a positive outlook for 2017

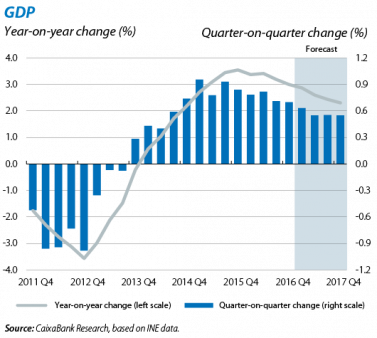

The Spanish economy grew strongly by 3.2% in 2016. In Q4, GDP growth was 0.7% quarter-on-quarter, a much higher figure than the average for euro area countries and similar to the one posted the previous quarter. The main engine for growth in 2016 was domestic demand, boosted by the improvement in the labour market and business confidence. Net external demand also performed well and is gradually moving centre stage thanks to the good trend in exports and a more contained increase in imports. This exceptional performance by the Spanish economy throughout the year is due to the convergence of several temporary support factors such as low oil prices and the ECB’s highly expansionary monetary policy, as well as the positive effects of the structural reforms carried out over the past few years.

The outlook for 2017 remains positive. Growth in 2017 will be underpinned by the effects of structural reforms (which have helped to boost competitiveness), a more dynamic labour market, the upturn in the real estate sector and a healthier banking sector. However, the temporary support enjoyed by the Spanish economy will gradually lose traction, resulting in a slight slowdown in growth. According to the CaixaBank Research forecast, GDP growth will be 2.6% in 2017. Nonetheless, the risks surrounding this macroeconomic scenario are still high. In particular, the policy ultimately implemented by the new US administration, the electoral agenda in Europe and financial fragility of several emerging countries, especially China. Domestically both public debt and net external debt are still very high, making Spain’s economy more vulnerable.

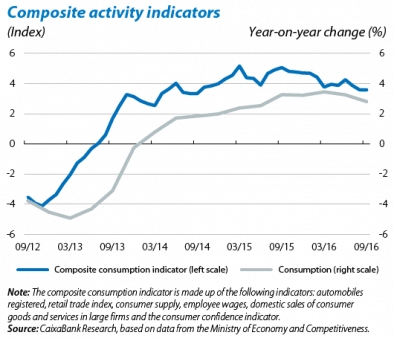

Business indicators already pointed to strong growth towards the end of 2016. Manufacturing indicators performed particularly well towards the end of the year after a weaker initial six months. The PMI business sentiment index for manufacturing rose to 55.3 points in December, the largest monthly increase since January 2016, and industrial production picked up strongly in November (3.2% year-on-year). The sharp rise in new industrial orders in November (5.4% year-on-year) confirms this good trend in manufacturing. The services sector has maintained its good growth rate. The PMI services index remained at 55.0 points in December, clearly above 50 points, the threshold as from which positive growth rates tend to be observed. Regarding demand, the main indicators for the trend in private consumption and business investment are at high levels. This suggests these two components of domestic demand will remain the main engines of growth.

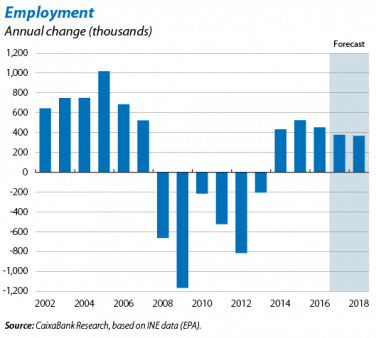

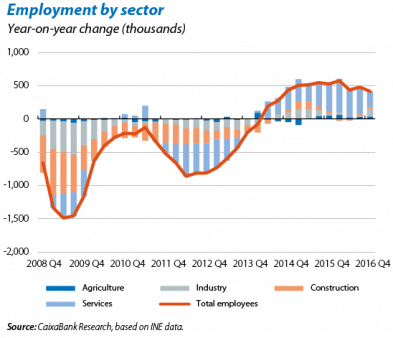

In spite of the figures posted in Q4, the labour market trend looks positive. According to the LFS, the number of employed fell by 19,400 in Q4. CaixaBank Research had predicted an increase (+85,000) in line with the good trend in registered workers affiliated to Social Security (+62,000 on average for the quarter) and the positive figures posted in 2015 Q4 and 2014 Q4. This deviation is partly due to job losses in education (fewer school days). Seasonally adjusted, job creation is still strong (0.4% quarter-on-quarter). 2016 saw an additional 452,700 employees (2.7% average annual growth) and unemployment fell to 18.6% in Q4. Most of the recovery in employment last year was concentrated in services, with 240,000 more jobs than in 2015 thanks partly to the extraordinary tourist season. 75.6 million tourists came to Spain in 2016, 10.3% more than in 2015. Job creation will be slightly less dynamic in 2017 with less support from the temporary factors that have boosted the economy to date. Nevertheless, in spite of the jobs created over the past few years, the quality of employment in Spain is still a source of concern (see the Focus «Investing in human capital: the key to good quality employment» in this Monthly Report).

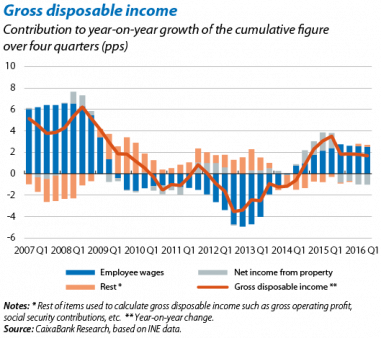

Growth in employment has boosted gross disposable household income. In 2016 Q3, household gross disposable income (GDI) rose by 1.8% year-on-year (cumulative over four quarters), helped by employee wages, mostly due to the increase in employment. This higher GDI has undoubtedly helped private consumption, posting a year-on-year growth rate of 1.7% in Q3. The strong increase in retail sales in December (2.9% year-on-year) suggests this trend continued in Q4. In spite of the good growth in private consumption, the household savings rate was 8.2% in Q3, only 0.2 pps below the previous quarter.

The upward trend in inflation is confirmed. In January, the CPI rose by 3.0% year-on-year as a consequence of higher electricity and oil prices. This figure contrasts with the negative rates of the past last years (–0.2% in 2016 and –0.5% in 2015) and will soon force us to raise our 2.4% forecast for the whole of 2017.

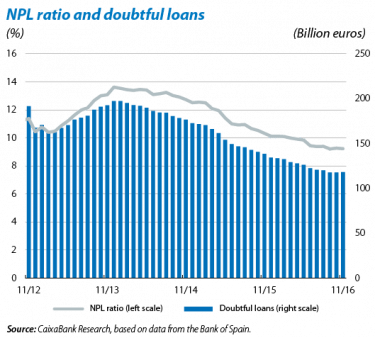

Given this favourable situation, the private sector is continuing to deleverage while banks improve their position. In 2016 Q3, the debt of households and non-financial firms stood at 65.2% and 102.3% of GDP respectively, similar levels to those of the euro area. Banks are also improving their balance sheets, as shown by the continued reduction in the NPL ratio (down to 9.2% in November). Financial institutions are therefore in a better position to increase bank lending. In fact, over the next three months banks expect credit demand from enterprises and households to increase, as shown in January’s bank lending survey produced by the Bank of Spain.

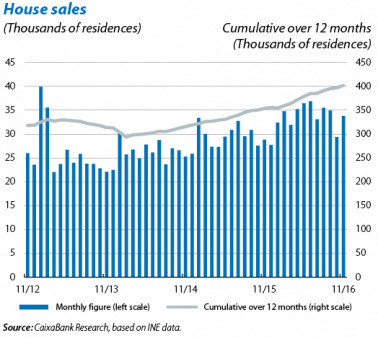

Increased gross disposable income, investor appetite and credit supply boost housing demand. In November, house sales grew by 13.6% (cumulative over 12 months). This strong demand, which will continue in 2017, in addition to the slight recovery in real estate activity, albeit far from the peaks of 2008, suggests that the upward trend in house prices will continue throughout this year, especially in urban zones.

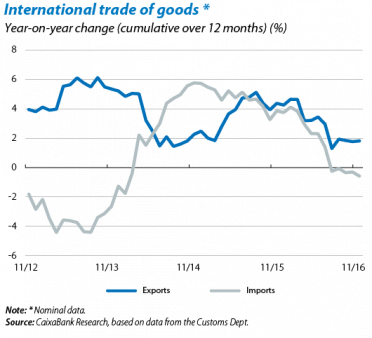

The foreign sector, an underlying factor that continues to underpin growth. In November the trade deficit fell to 18,101 million euros (cumulative over 12 months) due to a 1.8% rise in exports year-on-year and a 0.6% reduction in imports (cumulative over 12 months). Over the coming months, the upward trend in oil prices is likely to stop boosting the current account, although we expect it will remain in surplus. This will help the net international investment position, which stood at –88.7% of GDP in Q3, to gradually approach the benchmark threshold set by the European Commission (namely –35% of GDP). It is therefore vital to continue improving competitiveness and optimise the geographical composition of exports towards destinations with higher growth, as explained in the Focus «Spanish exports and world trade slowdown» in this Monthly Report.

Public finances are on the right track. Given the high public debt, approaching 100% of GDP, and the fact that interest rates will no longer provide a tailwind, as explained in the Focus «Public debt: the elephant in the room» in this Monthly Report, fiscal consolidation efforts need to continue. The European Commission, in its report evaluating the 2017 Budget, predicts that Spain will slightly fall short of the budget deficit target of 3.1% of GDP. However, it has concluded that, in general, the Stability and Growth Pact has been fulfilled. It estimates that the structural effort carried out is equivalent to 0.7% of GDP, more than the 0.5% of GDP required. It also suggests the Spanish authorities should be prepared to adopt further measures if necessary and to reinforce the budgetary framework. Regarding 2016, the data available so far indicate that the fiscal deficit in Q3 (cumulative over four quarters) stood at 4.8% of GDP, close to the target for the whole year (4.6%), indicating that the deficit target for 2016 was probably achieved.