The Spanish economy is sailing in more favourable waters

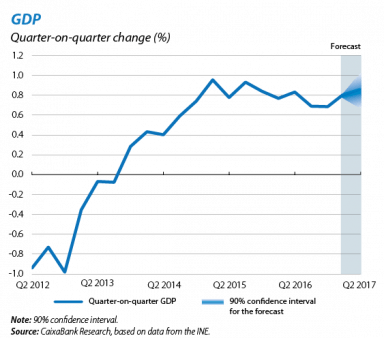

Growth is surprisingly high in the first six months. The information available for the April-June period, still very incomplete, shows that economic growth remained high in Q2. The CaixaBank Research leading indicator predicts 0.8% quarter-on-quarter growth, very similar to Q1’s figure. This year’s strong growth rate is largely due to improvements in the external environment. The high political uncertainty hovering over the main euro area countries has gradually diminished, especially after the French elections with President Macron’s party, La République en Marche, winning an absolute majority in the parliament. The outcome of the UK general election has also made a «soft» Brexit more likely, ensuring an orderly transition with the UK keeping reasonable access to Europe’s single market. The trend in oil prices has also been surprisingly downward. Prices were expected to rise after the OPEC agreement to prolong its oil production caps until March 2018 but this has not happened so far. In fact, the Brent barrel price in euros fell by 8.7% in June. Given its high dependence on oil imports, Spain’s economy particularly benefits from this new scenario of a more moderate increase in oil prices than previously expected.

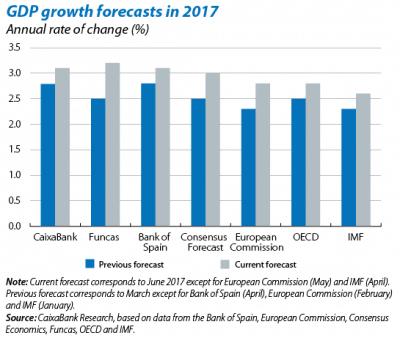

Growth forecasts are revised upwards - again. Strong economic activity figures for the first six months and a more favourable international environment have encouraged another wave of upward revisions in growth forecasts for the Spanish economy this year. The average of the forecasts by various analysts and institutions, such as the OECD, IMF and Bank of Spain, has increased to 3.0% for 2017, 0.4 pp higher than three months earlier. However, CaixaBank Research has kept its forecast unchanged at 3.1% as this was already revised upwards by 0.3 pp the previous month. This will therefore be the third consecutive year that Spain’s GDP has grown by more than 3%. Given this positive situation, it would be advisable to continue implementing an ambitious agenda of structural reforms to underpin the Spanish economy’s capacity to withstand any future storms.

Private consumption picks up again after slowing down in Q1. Private consumption indicators have recovered after looking relatively weak at the beginning of the year. Retail sales grew by 1.6% year-on-year in April, clearly higher than the Q1 average of 0.8%, while consumer confidence reached 2.2 points in May, up on Q1 (–2.2 points). Owing to continued improvements in financing conditions and gross disposable household income, private consumption increased by 2.2% year-on-year in Q1. The savings rate therefore reached 7.0% of gross disposable income in Q1, somewhat below its historical average of 9.6%.

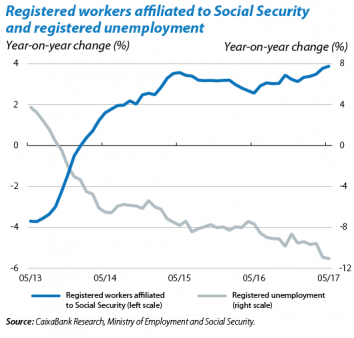

Job creation is very dynamic. In May, the number of registered workers affiliated to Social Security speeded up its growth rate to a high year-on-year figure of 3.9%. Although a lot of jobs tend to be created in May as it coincides with the start of the tourist season, the seasonally adjusted series, corrected for this seasonal factor, was also very positive with 60,608 additional people, a larger increase than the same month the previous three years. Registered unemployment fell by 111,908 people (not seasonally adjusted) while the rate of decline in registered unemployment is still high (–11.1% year-on-year).

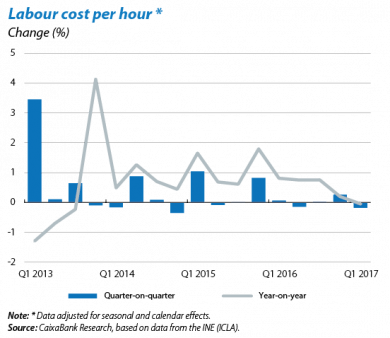

Wages remain contained. The harmonised labour cost index, which measures labour cost per hour worked while keeping the structure by activity branches constant, remained flat in quarterly terms between Q1 2017 and Q4 2016 (–0.1% in year-on-year terms). The wage rises contained in agreements reached in May were 1.3% on average. These data confirm that wage rises are still moderate, in a context in which the collective bargaining agreement for this year have yet to be reached between employers and trade unions.

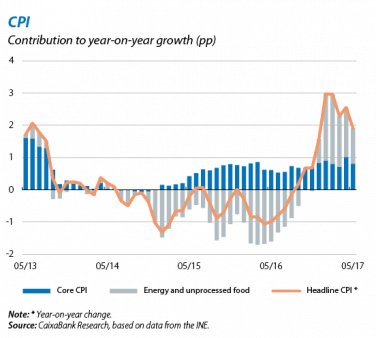

Inflation eases due to the trend in oil prices. Headline CPI increased by 1.5% year-on-year in June (1.9% in May), slowing down considerably after posting 3.0% rises at the beginning of the year. This is largely due to the slowdown in fuel prices in year-on-year terms. Weak oil prices over the coming months will continue to push down headline inflation, so it is likely to end the year below 1%. Core inflation (headline inflation without unprocessed food or energy products) fell to 1.0% in May, 0.2 pp below its April figure. It is expected to remain at this level in the second half of the year. The high level of underutilised production resources is the reason for this absence of inflationary pressures in spite of dynamic economic activity.

The more moderate rise in oil prices will also boost Spain’s current account. In April, the current account totalled EUR 19.1 billion in cumulative terms over 12 months (1.7% of GDP), higher than the figure of April 2016 (EUR 17.7 billion) owing to a larger services surplus. Regarding international trade, customs figures show a higher trade deficit in cumulative terms from January to April (EUR –8.4 billion) compared with the same period in 2016 (EUR –5.6 billion). This is entirely due to the worse performance by the energy component. We expect the current account to remain in surplus throughout the rest of the year. The lower growth expected in oil prices in year-on-year terms will keep any increases in the energy bill in check. Exports of non-energy goods will also continue to perform well (4.3% year-on-year growth in April, cumulative over 12 months). This good performance is due to higher growth in export markets, particularly the euro area, which receives 66% of Spain’s exports. International tourist arrivals continue to beat the records set in 2016 with 11.7% growth year-on-year in May.

House prices gain traction. The real estate sector, one of the industries hardest hit by the crisis, is recovering apace. Investment in residential housing picked up in Q1 and house sales looked very dynamic thanks to the effect of positive factors such as job creation, the consequent boost to household income and improved access to credit. House prices therefore grew by 5.3% in year-on-year terms in Q1 2017 (2.3% quarter-on-quarter). Land prices also rose by 6.2% year-on-year in Q1 2017. This positive trend in land prices, which tend to indicate the future trend in house prices, points to the upward trend continuing over the coming months.

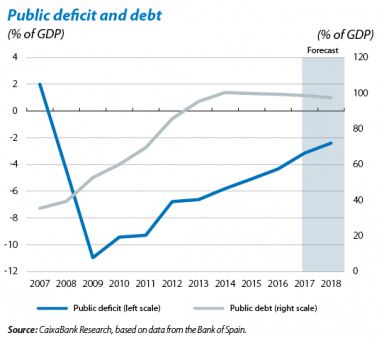

Solid economic growth helps to improve public finances. The consolidated general government deficit was 0.4% of GDP in Q1. In other words, compared with Q1 2016, the deficit fell by 0.4 pp out of the 1.2 pp required to achieve the target of 3.1% of GDP for 2017. General government debt reached 100.4% of GDP in Q1 2017. By sector, central government debt rose to 87.8% of GDP (87.0% in Q4 2016), autonomous communities debt remained almost unchanged at 24.8% of GDP, and local government corporation debt fell slightly to 2.8% of GDP. This high level of debt shows that it is important to continue fiscal consolidation efforts.

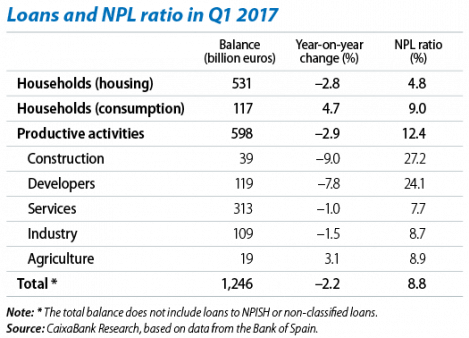

Bank credit improves further while bad debt shrinks. A breakdown of credit for Q1 2017 shows that consumer loans are still increasing apace while credit for the rest of the segments is still falling, albeit at an ever-slower rate. The NPL ratio continued to fall across all segments (except consumer loans). Nevertheless, the NPL ratios in construction and developer loans are still very high. In the medium term, improvements in economic activity and the labour market will help to reduce the NPL ratio further, as well as sales of portfolios with non-performing assets.