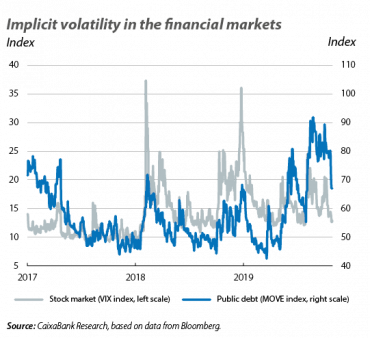

The risk appetite recovers. After a turbulent summer, since September the accommodative monetary stimulus adopted by the Fed and the ECB have kick-started the gradual improvement in investor sentiment. In addition, in October, the tone of the financial markets continued to gradually recover as investors welcomed the rapprochement between the US and China and the progress made on Brexit (see the section on International Economy). However, despite this improvement, the volatility of all financial assets (especially public debt securities) remained relatively high due to the absence of definitive solutions in both conflicts. All in all, in a market environment sensitive to political statements and messages from the central banks, in October the major global stock markets closed up and recovered part of the losses suffered over the summer. Furthermore, sovereign bond yields picked up on both sides of the Atlantic, while commodity prices rose.

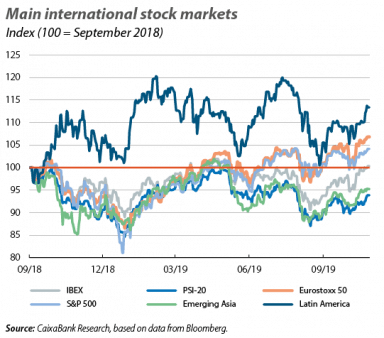

Widespread gains in the stock markets. In addition to the recovery in sentiment, October provided the equity markets another reason to be optimistic: the start of business profit announcements for Q3 2019. Most of the profit announcements made up until the closing date of this Monthly Report far exceeded analysts’ forecasts, especially in the US (although it should be remembered that, since the beginning of the year, analysts have lowered their forecasts due to the deterioration of the economic growth outlook). The stock market indices in developed economies registered gains in the month as a whole (the S&P 500 +2.0%, and the EuroStoxx 50 +1.0%). At the sector level, the recovery in investor sentiment was reflected in the higher valuations of financial corporations (favoured by the rise in sovereign yields), as well as of cyclical companies (those whose profits are more sensitive to the business cycle). Emerging economies stock market indices also experienced gains (MSCI Emerging Markets +4.1%), due to expectations of an improvement in the trade relations between Washington and Beijing.

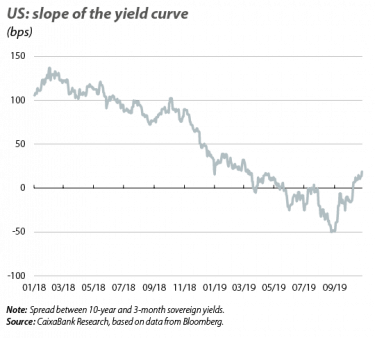

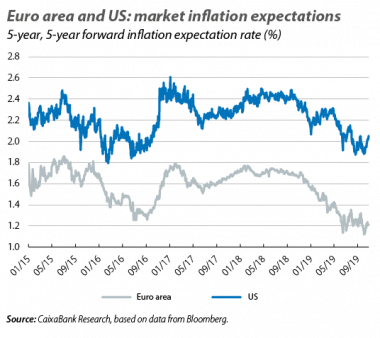

Sovereign debt yields continue to recover. Despite sovereign debt yields in the US and euro area falling once again due to the publication of weak economic activity data, over the course of the month they recovered thanks to the positive developments in the trade negotiations between the US and China and on Brexit. Furthermore, in the US the sovereign yield curve normalised for the first time since June, as the 10-year rate became higher than the 3-month rate (historically, an inverted curve has anticipated the onset of a recession a few quarters later). Furthermore, in Europe the improvement in risk appetite led to an increase in the yield of the German bund (approximately +20 bps), as well as a reduction in risk premiums in the euro area periphery down to their lowest levels this year.

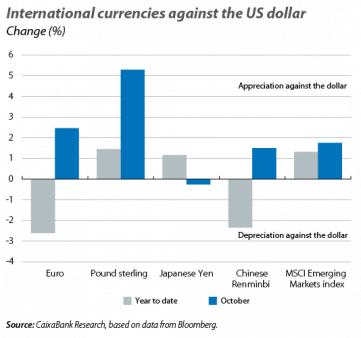

The pound sterling is strengthened by the agreements reached on Brexit. Investor optimism surrounding Brexit also extended to the currency market by affecting the exchange rate of the pound, which appreciated by more than 4% (against the dollar and the euro) following the publication of the withdrawal agreement between the United Kingdom and the EU. In addition, and reflecting lower risk aversion, the US dollar depreciated against most currencies of both advanced and emerging economies (the Argentine peso was one of the exceptions, depreciating by just over 3% at the prospect of a change of government after the general elections held on 24 October).

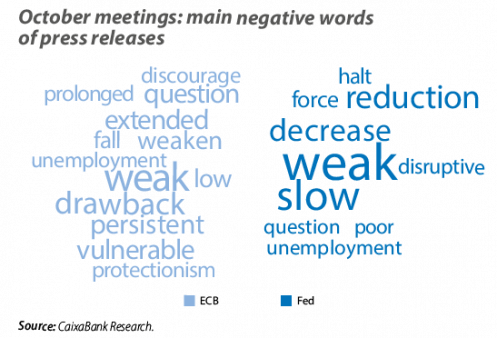

The ECB defends its September stimulus as Draghi bids farewell. After the significant measures announced in September (especially the repo rate cut down to –0.50% and the resumption of net asset purchases at a rate of 20 billion euros per month), there were no new developments at the ECB’s October meeting. The members of the Governing Council stressed the persistence of the low-growth scenario, the weak inflation and the high uncertainty to support the decisions taken in September and to reiterate the need for a more expansive fiscal policy. They also called for unity and for the disagreement of the previous month to be left behind. On the other hand, this was Mario Draghi’s last meeting as president of the ECB (Christine Lagarde will take over in November), and much of the post-meeting press conference was devoted to highlighting his legacy. Draghi defended the policy of negative interest rates and the other unconventional monetary policy measures, while he was also reminded of the words Whatever it takes, with which he will be remembered for putting an end to fears of a break-up of the euro area in 2012.

The Fed lowers rates for the third time this year. Once again justifying its decision with the persistence of risks affecting the economic outlook and moderate inflationary pressures, the Federal Reserve cut interest rates by 25 bps down to the 1.50%-1.75% range. At the press conference after the meeting, the chairman Jerome Powell noted that this level of interest rates was appropriate for the Fed’s economic scenario, which projects modest growth, a robust labour market and a rapprochement of inflation towards its target rate. Powell also suggested that, in the absence of material alterations to the scenario, there will be no changes to interest rates over the coming months. Although this reference applies equally to potential rate hikes and cuts, Powell’s comments pointed towards a lesser predisposition to raise rates, hence the Federal Reserve is likely to maintain an accommodative bias over the coming quarters. On the other hand, at the beginning of October (at an emergency meeting) the Fed decided to recommence purchases of short-term government debt at a rate of 60 billion dollars per month, in order to shore up bank reserves and boost liquidity in the interbank markets. The members of the Fed were keen to reiterate that this decision does not constitute another round of QE, since, unlike the asset purchases carried out following the Great Recession (which focused on assets with longer-term maturities), the intention this time round is not to decrease the sovereign debt term premium.