Spain’s economic growth holds steady in an adverse external environment

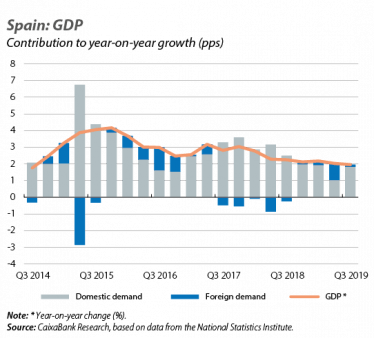

GDP grew in Q3 by 0.4% quarter-on-quarter (2.0% year-on-year), the same rate as in the previous quarter. This confirmation of GDP growth from the National Statistics Institute means that, in Q3, the Spanish economy was growing at a rate well above that of the euro area (0.2% quarter-on-quarter). All in all, the Spanish economy is in a deceleration phase, with lower growth than that registered in recent years, more moderate domestic demand and a more demanding external environment. As for the composition of the year-on-year growth rate, Q3 growth was very different from that of Q2 2019: domestic demand increased its contribution by 0.8 pps up to 1.8 pps, while foreign demand reduced its contribution by 0.8 pps down to 0.2 pps. Meanwhile, private consumption recovered from a poor first half and grew 1.1% quarter-on-quarter (1.5% year-on-year), and investment rebounded following the slump of the previous quarter to grow by 1.3% quarter-on-quarter (2.0% year-on-year, with a rebound of 5.6% in investment in capital goods). All this bodes well for the outlook for aggregate demand over the coming quarters. On the other hand, foreign demand registered a mixed performance, with greater growth in imports (1.3% quarter-on-quarter, 0.4 pps more than in Q2) and a contraction in exports (–0.8% quarter-on-quarter), which were affected by the trade war and the economic slowdown in Spain’s main trading partners.

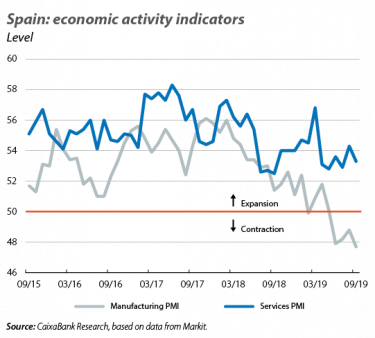

The indicators suggest that the expansion will continue at a moderate pace. The industrial sector is going through a difficult period, penalised by the deterioration in the external environment: its turnover fell in August by 0.3% year-on-year (three-month moving average), continuing the gradual deterioration seen in previous months. Then, in September, the manufacturing PMI index fell to 47.4 points, in contractionary territory (below 50 points). In contrast, the services sector continues to perform well, although its latest indicators reflect some erosion due to the weakness of the industrial sector. Services sector turnover grew by 3.4% in August, a healthy pace, albeit below the monthly average experienced between January and July (4.7%). In September, the services PMI index dropped to 53.3 points, 1 point below the figure for the previous month. Overall, these indicators point towards a gradual moderation in the pace of economic activity.

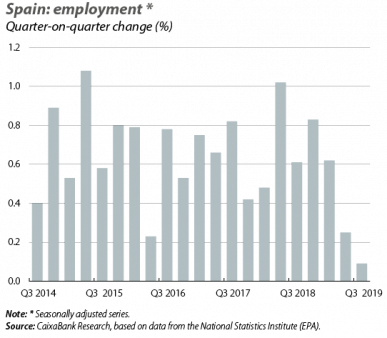

The economic slowdown becomes more noticeable in the labour market in Q3 2019. According to the Labour Force Survey, the pace of job creation slowed to 0.1% quarter-on-quarter (in seasonally adjusted terms), well below the rate experienced over the past four quarters (0.6% on average). In year-on-year terms, although job growth (1.8%) was lower than in Q2 2019 (+2.4%), employment increased by 346,000 people, reaching 19.9 million people in work. The reduction in unemployment, meanwhile, has also slowed down: the number of unemployed people fell in the past four quarters by 111,600, a figure well below the average of the third quarters of the past five years (–294,000). This is due to both the lower creation of jobs and the greater increase in the total labour force. In the end, the unemployment rate stood at 13.9% (14.6% in Q3 2018), which is very much in line with the previous quarter (14.0%) but also represents the best figure in a third quarter since Q3 2008.

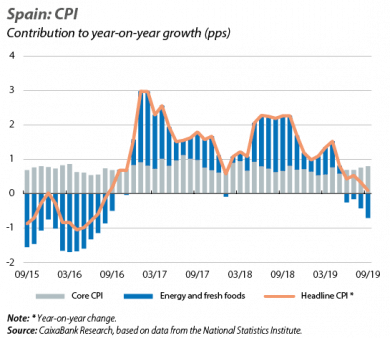

Inflation continues the trend of moderation of recent months. CPI growth in October remained at 0.1% year-on-year, the same figure as in the previous month. The low inflation of recent months is caused by the components with more volatile prices. Specifically, electricity amassed a price decline of 17.1% year-on-year in September, while the price of oil (in euros) in October registered a cumulative year-on-year decline of 23.7%, which will recede in November and December due to base effects. Looking ahead to the next few months, headline inflation will continue to be driven down by energy components and by the base effect of the oil price in particular (which, at around 60 dollars per barrel, lies well below the 80-dollar level reached in the autumn of 2018). Core inflation, meanwhile, will remain at around its current levels (1.0% in September).

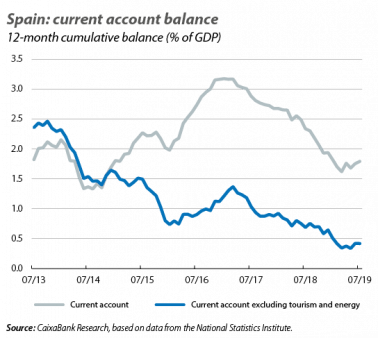

The current account balance remains stable in August. In the cumulative 12 months to August 2019, the current account balance stood at 21,883 million euros (1.78% of GDP), very similar to the figure for the previous month (1.79% of GDP). Thus, after deteriorating steadily between the end of 2016 until March 2019, the current account has finally stabilised. This largely reflects a stabilisation in the non-energy goods component since April, especially due to the slowdown in imports (in 12-month cumulative terms, they grew by 2.2% year-on-year in both July and August). However, the adverse international environment continues to manifest itself in the weakness of exports, which in August grew by a modest 0.6% year-on-year (1.3% in July, 4.3% in August 2018).

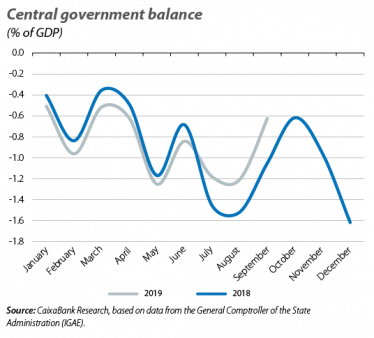

The budget execution shows few signs of progress in the consolidation of the public accounts. In August 2019, the general government deficit (excluding local corporations) was slightly higher than the figure for August 2018, standing at 2.1% of GDP (+0.1 pp). This result was mainly due to the deterioration of the Social Security and autonomous communities’ accounts, which experienced deficits of 0.5% and 0.2% of GDP, respectively. Meanwhile, the central government deficit, for which data are already available up to September, stood at 0.6% of GDP, below the 1.1% registered in September 2018. This points towards a slight improvement in the budget execution in the closing stages of the year. That said, this reduction would be insufficient to offset the shortfall from Social Security and the autonomous communities in order to achieve the general government’s overall deficit target for 2019 (2.0%). This target is once again included in the update of the public accounts submitted by the government to Brussels in October. This Budget Plan includes an inertial scenario for 2020, without additional revenue measures envisaged and with only the increase in pensions (+0.9%) and public sector salaries (+2.0%) as additional spending measures included in 2020. For that year, the government forecasts a deficit of 1.7%, 3 decimal points below the figure anticipated by CaixaBank Research.