The third wave of the pandemic slowed the economic recovery in the opening months of the year

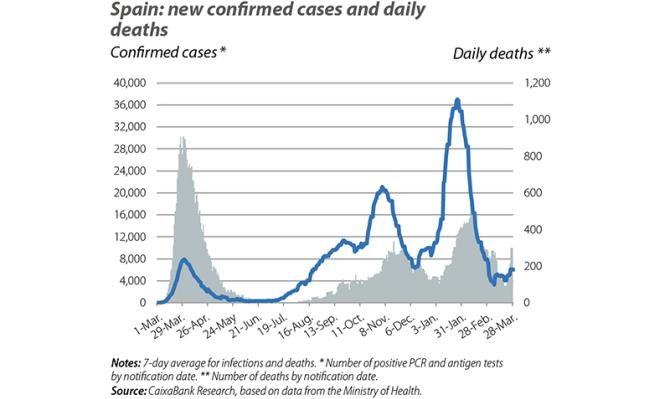

Nevertheless, in recent quarters the learning curve of how to manage and live with a pandemic has led to greater resilience in economic activity. Furthermore, although the restrictions continued to hold back the economy in Q1 2021 as a whole, in March the infection rate remained contained with new confirmed cases stabilising at around 5,000 (seven-day average), well below the average of 36,000 reached in January. The percentage of positive tests also fell in March, down to 5% (having reached almost 20% in January), while the vaccination rate improved despite the supply problems. The pandemic remains the major determining factor for the economic outlook, and although our forecasts contemplate the possibility of further outbreaks, over the coming months the immunisation of risk groups in Q2 is expected to help further contain the spread of the virus and relieve pressure on the health system, allowing for a more sustained revival of economic activity.

Economic activity is slowed by the COVID-19 pandemic in the early stages of 2021

The latest data from the National Statistics Institute show that GDP stagnated in Q4 2020 (+0.0% quarter-on-quarter), whereas a slight advance of +0.4% had been initially estimated. However, the institute’s new estimate indicates that the economy had rebounded in Q3 by more than originally estimated (specifically, by 0.7 pps more, reaching 17.1%) and all this placed the fall in GDP for 2020 as a whole at 10.8% (compared to an initial estimate of 11.0%). For Q1, most of the available economic activity indicators mark a slight decline versus the previous quarter. In particular, for the quarter on average, the composite Purchasing Managers’ Index (PMI), which measures business sentiment, stood below the 50-point threshold that separates contraction from expansion. This was despite Spain’s manufacturing activity improving again in March, at 56.9 points. In this environment, the Bank of Spain revised its macroeconomic forecasts for Spain slightly downwards, and expects GDP in 2021 to be 5.6% below the 2019 level, a view reasonably in line with that envisaged in CaixaBank Research’s forecast scenario. On the other hand, the public deficit in 2020 was 11.0% of GDP. This represents an increase of 8.1 pps of GDP over 2019, explained by a 5.0% drop in public revenues and a 10.1% increase in public expenditure in year-on-year terms, including interest charges. In addition, at the discretion of Eurostat, a figure of 0.9 pps has been included in the deficit to account for Sareb.

Control of the pandemic in March facilitated an improvement in economic activity

Following an 11% drop in CaixaBank’s consumption indicator in February (after declines of 5% and 7% in Q3 and Q4, respectively), in March the decline moderated to 6%. Overall, however, the weakness of January and February weighed down the figure for Q1 as a whole, and the indicator shows a slight decline compared to Q4 2020. On the other hand, cement consumption recovered in February, with a fall of 1.9% year-on-year (after a drop of 12.4% in January), and the figure for new vehicle registrations moderated its decline (–38.4% year-on-year in February compared to 51.5% in January).

The evolution of the labour market is key to the economy

Although the labour market showed encouraging performance in Q4 2020, the total number of workers under furlough (ERTE) schemes indicates less traction in the first quarter of the year, after an increase of 90,000 in February, largely concentrated in the service sectors most affected by the activity restrictions. On the other hand, the number of registered workers also shows a decline, with 30,000 fewer people in February than in the previous month (with seasonally adjusted data), representing the first month-on-month decline since May 2020. Finally, the number of unemployed people stood above 4 million, representing a 23.5% increase in year-on-year terms (21.8% in January). All this indicates that the temporary workforce reduction programmes will continue to play a key role over the coming months in order to avoid a major rebound in unemployment, ensure that household incomes are isolated from economic fluctuations and protect the business fabric in an environment marked by high uncertainty.

Spanish inflation rebounds in March

The CPI registered a year-on-year change of 1.3% in March, according to data advanced by the National Statistics Institute. This figure follows several months marked by high volatility (–0.5% in December, 0.5% in January and 0% in February), largely explained by fluctuations in electricity prices. All the indicators suggest that the trend in the CPI in March was also driven by energy prices, as core inflation remained at 0.3%. Looking ahead to the coming months, various base effects related to the pandemic (such as last year’s low oil prices) are expected to continue to generate volatility in the inflation data, which could increase slightly in the second half of the year.

The balance of services is slow to recover, but the balance of goods shows improvement

In January, both exports and imports fell at double-digit rates (−11.4% and −16.4% year-on-year, respectively), affected by the tighter activity restrictions imposed across Europe. The deficit in the balance of goods stood at 1% of GDP (12-month cumulative balance), representing an improvement of 1.5 pps compared to the figure of a year ago. Much of this improvement is due to the lower energy deficit, as a result of the collapse in oil prices and domestic demand in the last year, so it ought to be undone over the next few months. However, the balance of non-energy goods also showed improved performance, with a surplus of around 4 billion euros for the first time since 2015.