Portugal resumes the recoveryas it emerges from lockdown

The pandemic dominated Q1 2021, but it is steadily losing its grip

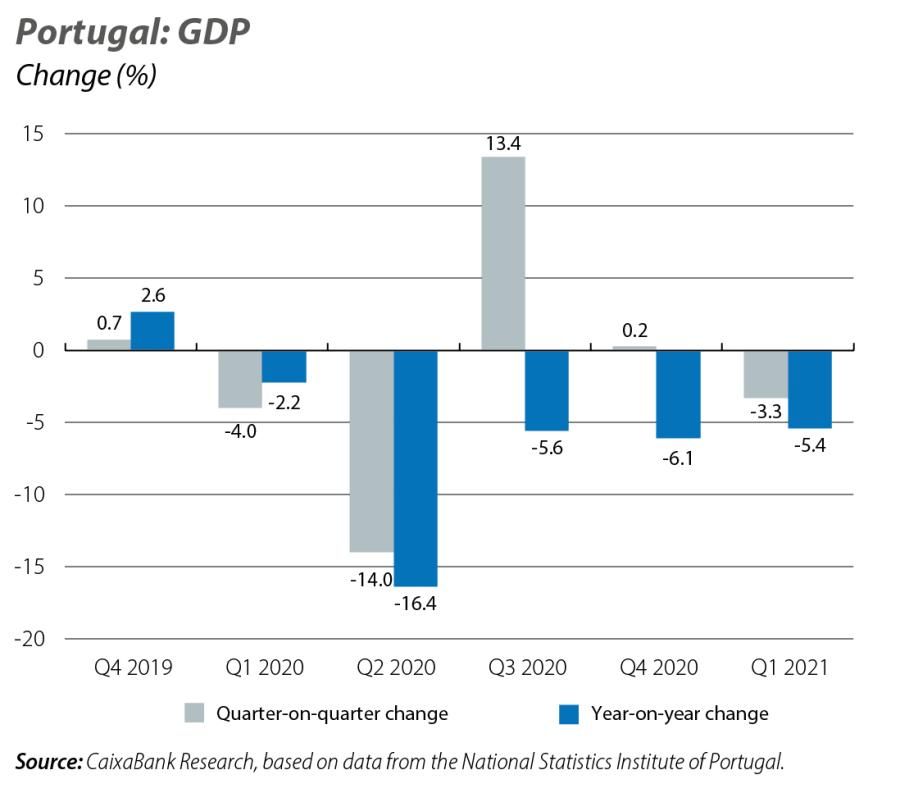

As detailed below, the strict lockdown imposed at the beginning of the year has caused GDP to shrink in Q1 2021 (–3.3% quarter-on-quarter and –5.4% year-on-year). However, in recent months, the COVID-19 figures have steadily improved, both in relation to new infections and in terms of the pressure on hospitals and the vaccination process (by the end of April, around 25% of the population had received at least one dose, in line with most European countries and twice as many as a month ago). This has provided continuity to a gradual reopening of the economy, which has already included activities such as catering (albeit with capacity limits) and education at all levels.

The indicators point towards an improvement in economic activity following the contraction in GDP in Q1

With the heavy blow of the pandemic and the strict lockdown imposed at the start of the year, GDP shrank by 3.3% quarter-on-quarter (–5.4% year-on-year) in Q1 2021 and stood almost 10% below its pre-pandemic levels. Although the breakdown by component is not yet available, the indicators suggest that the contraction reflects the weakness in both domestic and foreign demand. Nevertheless, the initial data for March and April already suggest a significant recovery in Q2. For instance, by mid-April the Bank of Portugal’s daily economic activity indicator had recovered to the levels of December 2020, while other indicators available up to March, such as car sales, cement sales and card payments, also reflect a significant improvement. The vaccination roll-out is a crucial factor for the recovery, and the immunisation of risk groups is expected to allow for a more sustained economic recovery beginning in Q2. In addition, European funds under the NGEU programme will help stimulate growth in the coming years (Portugal was the first country to deliver its Recovery Plan to the European Commission in April, requesting some 14 billion euros in grants between 2021 and 2026, equivalent to around 6% of GDP). Thus, in April the IMF adjusted its growth forecast for Portugal in 2021 to 3.9% and anticipated growth of 4.8% in 2022.

Ambivalent signs in the labour market

In March, employment increased by 13,300 people compared to the previous month, while the unemployment rate fell to 6.5% (6.8% in February). However, the labour market is still far from recovering pre-pandemic levels. On the one hand, there are still 55,300 fewer people in employment than before the COVID-19 crisis, while around 6% of employees are affected by furlough schemes (according to our estimates). Also, the decline in unemployment may not fully reflect the reality, as it is driven by an increase in the non-working population (there are people available to work, but who cannot seek employment because of the mobility restrictions imposed to curb the pandemic). In fact, the absolute number of people registered as unemployed increased in March for the fourth consecutive month and reached a peak not seen since 2017. This increase in unemployment was mainly focused in retail and in accommodation and catering, two of the sectors hardest hit by the pandemic.

The pandemic drives the current account into deficit

The latest data show that the current account balance fell to –1.3% in February 2021 (versus a surplus of +0.6% in February 2020). This decline mostly reflects the weakness of tourism, which has dragged the surplus in the balance of services down to +3.7% of GDP, while on the upside the balance of goods has reduced its deficit to –5.4% of GDP, 2.4 pps less than a year ago. Nevertheless, a certain recovery in the current account balance is expected over the coming quarters, spurred by the start of the recovery in tourism.

Tourism remains weak

In the period between March 2020 and February 2021, the number of guests fell by 71% to 8 million and the number of overnight stays fell by 72% to 20 million relative to the year-on-year period. Non-resident tourists were the main factor behind these figures, with a decrease of 85% compared to 50% among residents. The total revenues of tourism establishments fell by 74%. In March 2021, 283,700 guests and 636,100 overnight stays were registered (–59% and –66%, respectively). While not as dire as the previous month, these figures are still a far cry from those of March 2019 (1.9 million guests and 4.6 million overnight stays). The sector’s situation is expected to begin to improve in the coming quarters (especially in the second half of the year) as control of the pandemic improves and the vaccination campaign accelerates.

The stock of credit granted to the non-financial private sector continues to improve

In March, the stock of loans to private individuals increased by 1.8% year-on-year, driven by housing credit, while that of consumer credit continued to fall as a result of the impact of the lockdowns on household consumption. As for corporate credit, the stock of loans grew by 11.1% year-on-year. The trend in both segments reflects the support provided by credit moratoria. On the other hand, according to the credit market survey of banks, more restrictive lending criteria were observed in Q1 2021, especially in the case of SMEs, consumer credit and credit for other purposes. Demand for credit, meanwhile, increased slightly among SMEs and individuals, while it decreased in the case of large corporations.