Risk aversion takes hold among investors

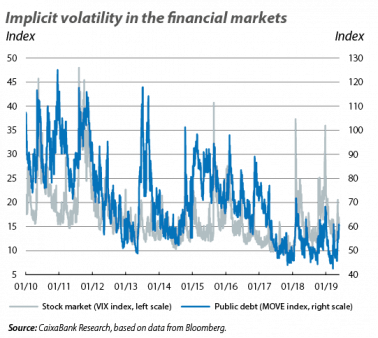

Trade tensions destabilise the financial markets. Breaking with the relative calm that had dominated the financial scenario during the first few months of the year, in May risk aversion took hold in the global markets. The optimism among investors seen in the previous months – supported by the trade tensions being steered in the right direction, the easing off on the tightening of monetary policy by the major central banks and favourable economic data – made an about turn when the US Administration announced a tariff hike on Chinese imports. This announcement, which surprised the market, led investors to reassess their expectations and aroused fears that the trade tensions will have a higher price in terms of economic growth. Thus, it resulted in a surge in volatility and risk aversion, which increased the preference for safe haven assets (such as US and German sovereign debt, the dollar and gold). On the other hand, in this context of greater uncertainty the central banks maintained their messages of patience, reiterated their intention not to tighten monetary policy in the near future and offered a relatively positive view of the macroeconomic environment in the medium term, noting, however, that the risks continue to be biased to the downside.

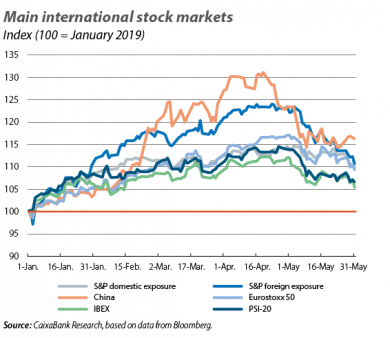

The stock market staggers. During the first four months of the year, investor optimism had resulted in substantial gains in the stock markets (+15.6% in the MSCI global index). In May, however, the tables turned. The rebound in trade tensions between the US and China, coupled with the publication of economic activity data confirming that the global economy is growing at a more moderate pace, diminished investor sentiment. Such was the importance assigned to these aspects by investors that little attention was paid to the positive surprises of the Q1 business profits season in the major economies (led by the consumption and technology sectors). Thus, in an environment of greater uncertainty and volatility, the losses were spread across the global equity markets and the S&P 500, the EuroStoxx 50 and the MSCI index for the emerging markets bloc fell by around 7%. By region, the losses were particularly significant in the Asian stock markets, and the MSCI index for emerging Asia fell by around 9%. In Latin America, meanwhile, the stock markets moved more to the sound of factors specific to the region and the MSCI index for Latin America fell by less than 2.5%.

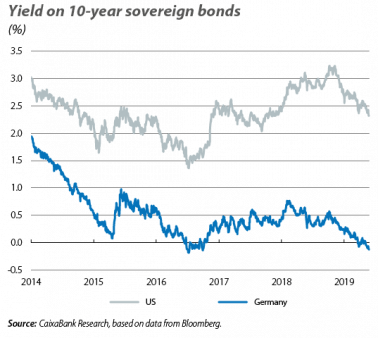

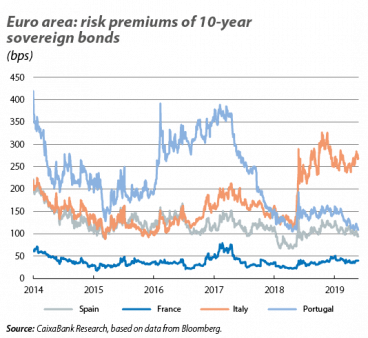

Sovereign yields reach a low point. In the fixed income markets, the heightened risk aversion resulted in a shift in the preferences of investors, who opted for safer assets such as US and German sovereign debt. This drove down both economies’ 10-year sovereign debt yields, which reached a two-year low in the case of US treasury and a three-year low in that of the bund (which once again fell into negative territory). In addition, the US sovereign yield curve inverted once again, with the 10-year yield falling below that of 3 months (which has traditionally been an early signal of recession, although there is reason to believe that this time may be different, as we have analysed in previous publications). On the other hand, risk premiums in Spain and Portugal reduced, albeit to a lesser extent than in April, bringing the yield on 10-year bonds to an all-time low and ending the month below 0.80% and 0.90%, respectively. In Italy, in contrast, the rise in tensions surrounding the government’s fiscal policy and the contradictory statements in this regard drove the country’s risk premium upwards.

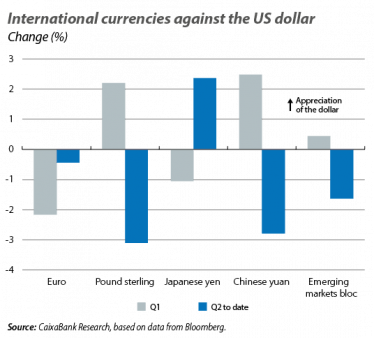

The dollar remains strong and the oil price recedes. The increase in fears among investors and their preference for safer assets supported the appreciation of the US dollar against the rest of the major currencies and against the Chinese yuan in particular, in a movement that contrasted with the gradual depreciation of the dollar seen in previous months. Bucking this trend was the Japanese yen, acting as a safe haven in the financial turbulence and appreciating against the dollar, while the pound sterling weakened due to the heightened uncertainty over the future of the British Government and Brexit. In the commodity markets, the price of industrial metals, highly correlated with the business cycle, fell to levels of two years ago due to fears over the effects that the trade dispute could have on global growth. The Brent oil price, meanwhile, was more volatile than in previous months, squeezed between the upward pressures of supply factors (the sanctions imposed by the US on Iran, tensions in the Middle East and the expectation that OPEC could extend its production cuts at its meeting on 25 and 26 June) and the downward pressures of demand (related to the pessimistic shift in investor sentiment in May). In the end, it was the latter that prevailed and dragged the Brent oil price towards 65 dollars per barrel at the end of the month.

While we await their meetings in June, the central banks reiterate their messages of patience. In the face of the month’s financial turbulence, members of the major central banks (which had no monetary policy meetings in May) continued to reiterate, through their various public communications, their intention not to tighten monetary policy in the coming months. Thus, as shown in the minutes of the latest meetings of the ECB (10 April) and the Fed (1 May), the major central banks remain cautious due to the presence of downside risks, although they maintain a positive view of the economic scenario in the medium term. On the other hand, both institutions point out that inflationary pressures remain moderate, which supports a patient attitude over the next few months. However, various members of the Fed argued that the factors that have held back US inflation are temporary and will fade over the next few months, while in Europe, the members of the ECB stressed that the signs of greater buoyancy in wages boost confidence in the recovery of inflation over the medium term.