Summer storms

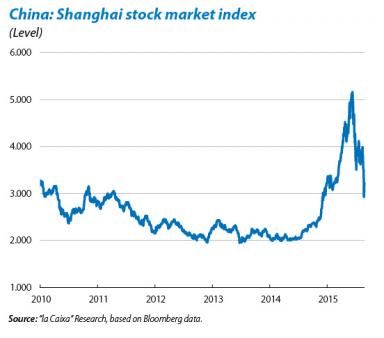

The source of tension shifts from Greece to China. The summer has been highly agitated in international markets although instability towards the end of June and early July due to fears of a Grexit gave way to a few weeks of calm for investors. Two major factors helped to soothe the tension. Firstly, the achievement, in mid-July, of an agreement between the Greek government and European institutions on the multiple reforms the country must undertake. This laid the foundations for the third bail-out programme to be approved, which is expected to provide a stable framework, at least for some time. Secondly, the solid economic figures published in the US and euro area (with Spain playing a leading role). However, tensions soon reappeared and virulently, this time originating in China. A series of growth figures weaker than expected, together with the announcement of a modest devaluation in the yuan, encouraged fears of a serious deterioration in the world's second economy. The Shanghai stock market tumbled, sending out shockwaves internationally, for the most part amplified by the reduced market liquidity characteristic of the summer months.

Investors turn their attention towards the Federal Reserve with a mixture of fear and hope. Concern for the situation of the Chinese economy and its global repercussions has heightened, if possible, the importance of the monetary normalisation plans of the Federal Reserve (Fed). For some months now the prospect of interest rate hikes in the US and the consequent upward trend in the dollar have exerted downward pressure on emerging markets (also heavily penalised by domestic weaknesses in some of them) and commodity prices (also affected in many cases by abundant supply). Recent events in China have complicated this situation even further and many investors believe the Fed should rethink its plans and delay raising interest rates. In fact, the money market now anticipates the hikes will begin at the end of 2015 or beginning of 2016 and this will most likely end up being the case (just two months ago they were expected for September). However, tackling normalisation gently but decisively is possibly the best contribution the Fed can make to world macroeconomic and financial stability in the medium term.

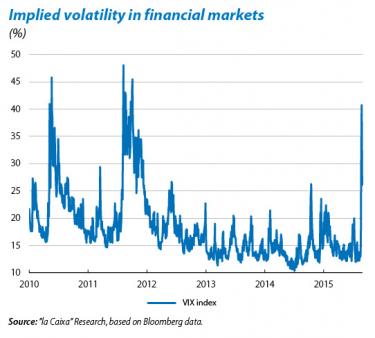

The highly volatile climate in asset markets does not provide the best scenario for the Fed to raise interest rates. This is the main reason why we now expect the first hike in the official interest rate to take place in December rather than September. By then equity and commodity markets are likely to have ended their current phase of extreme fluctuations. By way of reference, it is worth noting that, between mid-July and August, the price of a barrel of Brent oil underwent a cumulative drop of 30% and then rose by 25% in just three sessions. For its part the Ibex fell by 18% and subsequently rallied by almost 10%. In addition to the seasonal factor, such episodes once again highlight the fact that market liquidity has diminished with the imposition of restrictive regulations over the last few years on entities which had previously played a very active role as market makers.

China's slowdown is not a precursor to a recession and even less so a global one. Beyond the ups and downs in the short run, we believe that recent events in China form part of a long, tortuous process of structural change in the country's economic model which, by its very nature, entails a slowdown. We are still confident the Chinese authorities will achieve their aim while ensuring a soft landing for economic activity. Criticism due to their apparent inability to cut short the stock market crash, among others, is exaggerated because the harmful effects are modest (given the limited role played by the stock market in China's economy). However, critics seem to have underestimated the government's commitment to reforms aiming at amplifying the role played by free market forces, including the determination of the exchange rate, which helps to internationalise the yuan even further and gradually open up the country's capital account. Nonetheless, the Chinese economy still has grey areas, such as high leveraging in some business segments and local government as well as the state of bank balance sheets, suggesting that the weak tone (and mistrust) may continue for some time. The People's Bank of China (PBOC) cut its official rate in August and is very likely to do so again, as well as carrying out additional but controlled devaluations. This will exert downward pressure on inflation in the US and euro area, a slight effect but enough for the Fed and ECB to take it into consideration.

The Fed states it will take a very gradual approach but will not call off monetary normalisation. Before the Chinese tensions, at the meeting of the Federal Open Market Committee on 29 July, the Fed confirmed the good situation and outlook for the US economy, the solid labour market and improved real estate market. In fact, the communication stated that the first rise in the official interest rate would depend on the occurance of a few slight improvements in the employment figures. The projection for inflation was less decisive although tending towards a scenario of gradual increases as the effects of falling energy prices disappear. The shock provided by China and market volatility have amended the Fed's speech but not essentially changed it. Various Fed members have indicated that the date of the first rate rise could be delayed but not by much. Comments made by the Vice President, Stanley Fischer, at the end of August were particularly important, suggesting that interest rate hikes would begin in the next few months based on an optimist view of the economy and anticipating that inflation would tend to rise over the coming months.

The internal rate of return (IRR) for two-year Treasury bonds reaches its highest figure since 2011 while the 10-year rate falls. The Fed's messages regarding the inexorable start of official interest rate hikes and strong business indicators have had an impact on the short-term part of the sovereign debt curve. The rate for two-year bonds is now above 0.7%, its highest level in four years. Nevertheless, the IRR for 10-year bonds has dropped to around 2.20% due to the decline in inflation expectations and strong demand for safe assets given the two episodes of instability occurring between June and August.

The emerging markets' environment will remain under pressure over the coming months. In addition to weaknesses observed at a macroeconomic level in most of the emerging region, one must also take into account the external factors previously mentioned. Secifically, the Fed's decisions regarding interest rates, growing doubts concerning China's growth and, largely related to this, falling commodity prices present important challenges for the emerging countries. Given this situation, outflows of capital are still occurring as currencies and stock markets have continued to weaken (and more sharply after the yuan's devaluation). Nonetheless this deterioration in the financial environment has not affected the region's sovereign debt markets and spreads have remained notably stable. Although we expect investor confidence in the emerging bloc to remain weak and volatility to remain high over the next few quarters, we do not predict any serious long-term turmoil, unlike the events in 2013.

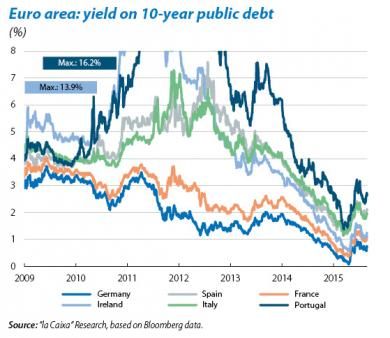

Meanwhile the euro area's sovereign debt markets are performing well. After the satisfactory outcome of the Greek issue, periphery IRR fell again and easily wiped off the upswings recorded in June and July. One powerful source of support has come from the promising growth figures in countries such as Spain and Italy, as well as messages from the ECB in favour of continuing and even increasing monetary stimuli. However, it is important not to forget the risks that still hover over the peripheral European countries. In particular those related to high levels of debt (domestic and external) and the elections in Greece, Spain and Portugal in the autumn. This last point will probably limit the extent to which spreads can narrow for Spanish risk premia compared with Italian or Portuguese, although the underlying tone for Spanish debt will remain relatively strong.

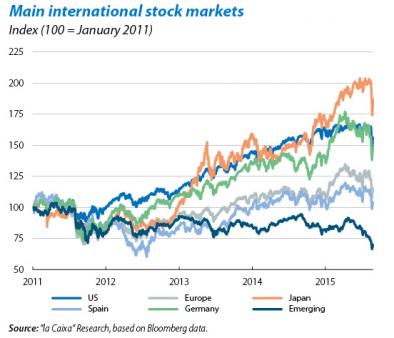

Developed stock markets are still immersed in a corrective phase with disparate volatility. The VIX index of implied volatility for S&P 500 options has reached similar levels to those seen during the crises of 2010 and 2011. In addition to the Chinese factor, the US stock market is now paying for the very high levels of over-buying and excessive optimism observed in the spring. In this respect, the outcome of the corporate earnings season for Q2 in the US was more a burden than a boost for share prices. The year-on-year rate of change in corporate earnings for S&P 500 companies was negative (–3%) and sales figures have yet to take off, although there were big differences between sectors. The energy industry saw a sharp deterioration in its financial records due to plummeting oil prices while banks and biotechnology performed solidly. The profile has been more positive in Europe: growth in earnings accelerated to 15% year-on-year and this can largely be attributed to the region's banking industry. The consolidation of this pattern is crucial to underpin the positive scenario we forecast for European stock markets and the Spanish market in particular, given the relatively high importance of the sector.