The growth of disposable income strengthens Spanish household finances

Gross disposable income is growing well above household spending in Spain, with the consequent improvement in household finances. We explain this increase and explore where the savings are being allocated.

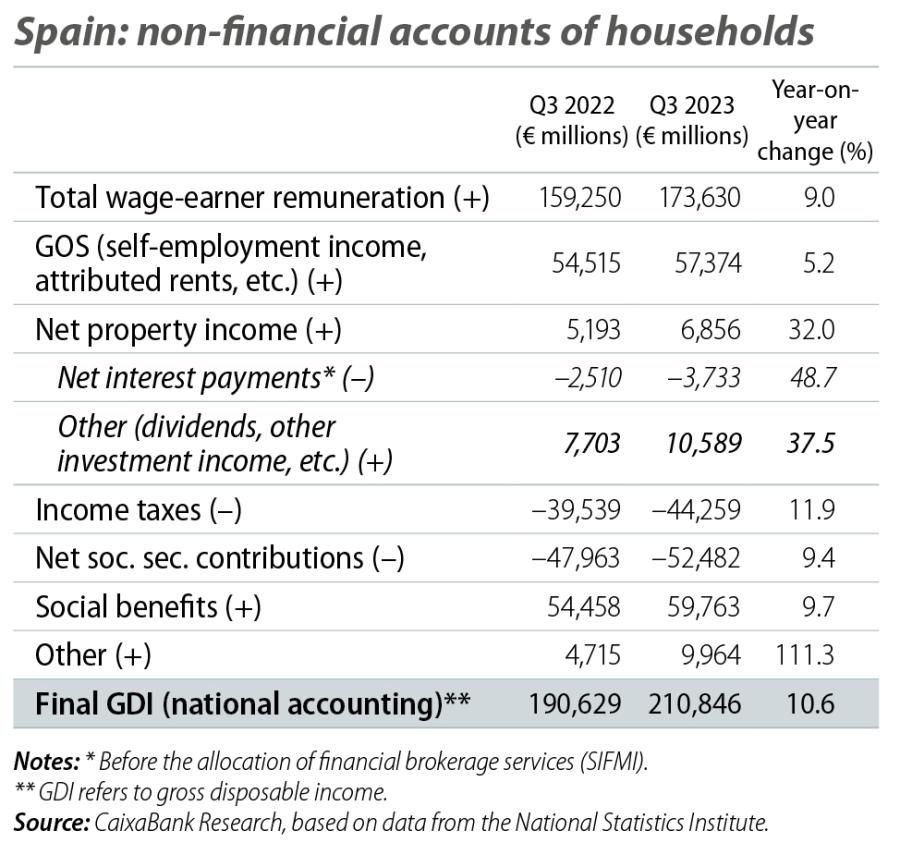

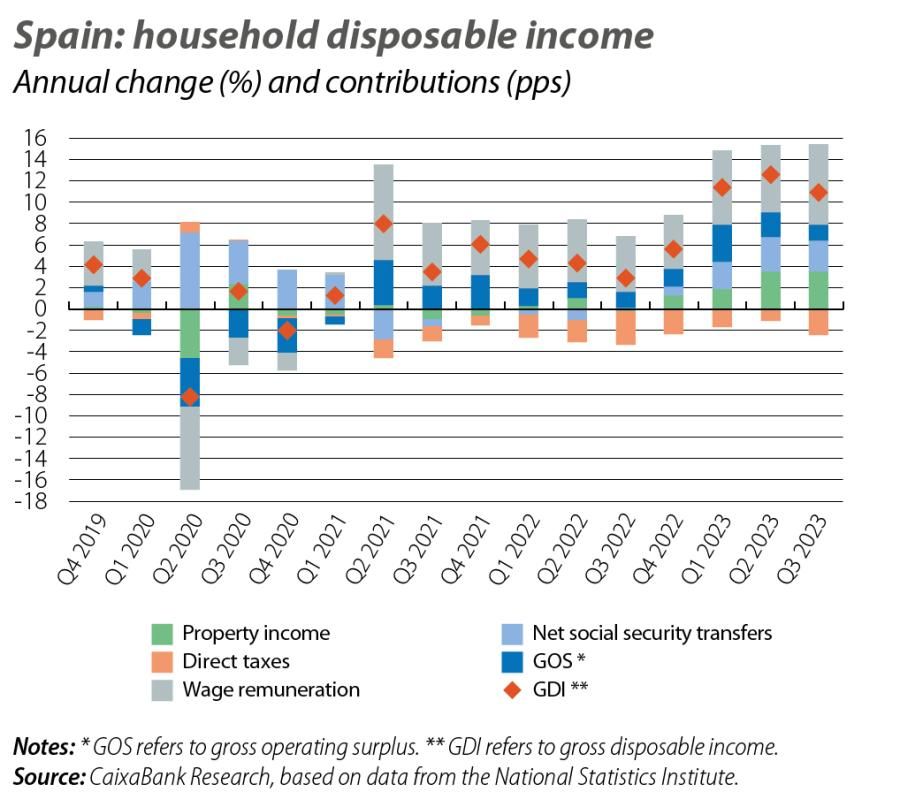

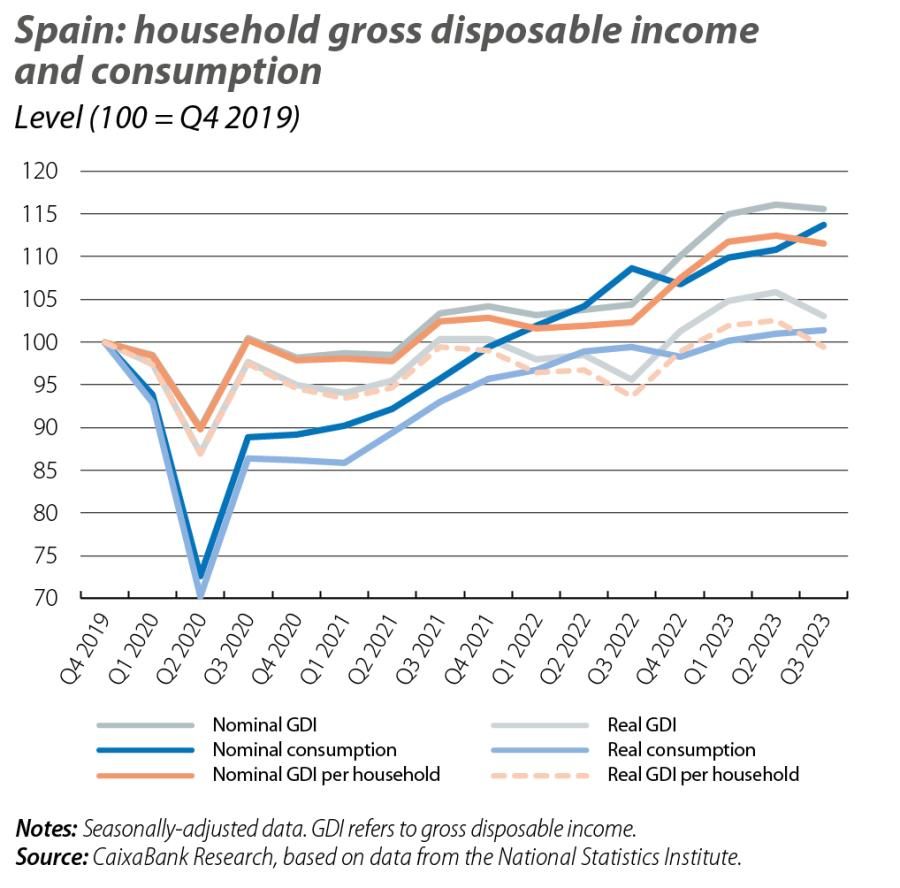

The total gross disposable income (GDI) of all households grew by an impressive 10.6% year-on-year in Q3 2023 (stagnant figure). This is well above both the rate of inflation in Q3 (2.8%) and the growth in the number of households (1.5%), allowing for a significant recovery of the purchasing power that had been lost due to the inflationary shock unleashed in 2022. Household income growth in Spain was much more buoyant than in the euro area as a whole (6.4%). In the first three quarters of 2023, disposable income grew by 11.4% year-on-year.

One of the drivers of disposable income has been the labour market; this is not surprising, as the total remuneration of wage earners grew by 9.0% year-on-year in Q3, reflecting both job growth (+3.9% year-on-year growth in the number of wage earners) and higher wages (+5% in the remuneration per worker). Other components of gross income which also contributed to this growth included social benefits (increase of +9.7% year-on-year, driven by the 8.4% rise in pensions in 2023), self-employment income and property income, due to the increase in the payment of dividends and other investment income. All this has more than offset the increase in net interest payments, which amounted to 3.7 billion euros (up 1.2 billion compared to the stagnant figure for Q3 2022).

This increase in aggregate gross income occurred in the context of a rise in household creation. Indeed, Spain’s population increased in Q3 2023 by 525,000 people versus Q3 2022, driven by a rise in migratory flows. Thus, in the last year, 285,000 households have been created in net terms. Consequently, the increase in disposable income per household in Q3 was slightly below that of aggregate income, although it still registered rapid growth: an impressive 9.0% in nominal terms and 6.1% in real terms.

In contrast, household consumption expenditure has grown at a lower rate than household income. Specifically, in the cumulative period of the first three quarters of 2023, household disposable income rose well above household expenditure (10.6% vs. 5.7% year-on-year, respectively).

In 2023 as a whole, following these very positive statistics, we predict that the growth of GDI will exceed 9.0%, and this should allow aggregate household consumption in real terms to close the year well above the level of 2022, despite the rise in interest rates and the still high inflation.

By 2024, we expect that disposable income could grow by around 5.0%, driven by the resilience of the labour market, the gradual reversal of the recent increase in gross interest payments, and a rise in social benefits that could be around 5% (contributory pensions have risen by 3.8% year-on-year in 2024, but total expenditure on pensions will be greater taking into account the entry of new pensioners and the bigger increases in non-contributory and minimum pensions). Thus, with the buoyancy of disposable income and the moderation of inflation, purchasing power should continue to recover.

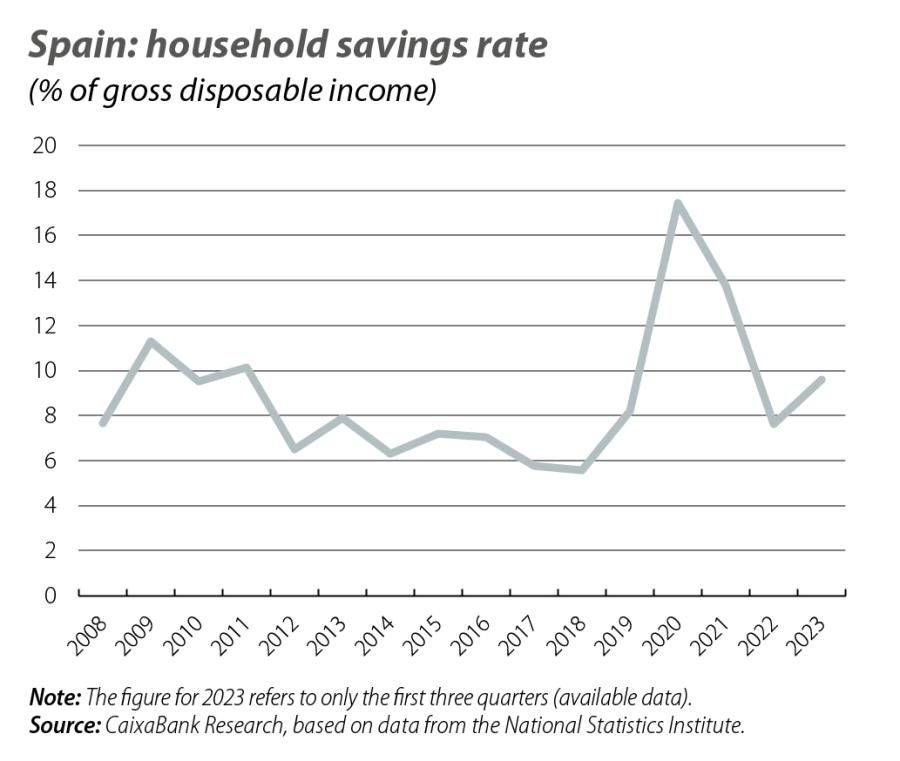

As a result of the wide gap in growth between income and consumption, the savings rate increased to 9.6% in the first nine months of 2023, representing a 2-pp increase compared to the figure for 2022 as a whole. In addition, this figure is well above the average recorded between 2015 and 2019 (6.8%).

How have the savings generated been channelled? The financial accounts of the Bank of Spain provide a detailed picture in this regard. The main conclusion is that households’ lending capacity was partly directed towards acquiring financial assets, amounting to 10,600 million in the first nine months of 2023, and partly to deleveraging (household debt fell by 14,480 million euros compared to the end of 2022).

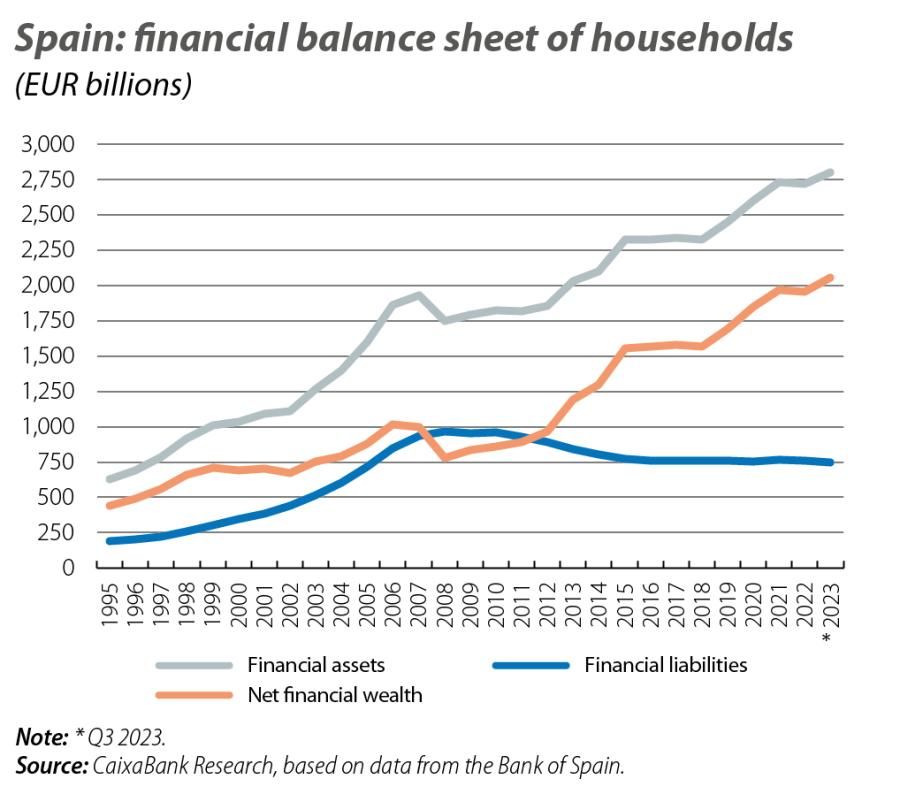

On the asset side, of particular note is the fact that the stock of gross financial assets increased by 82,300 million euros between Q4 2022 and Q3 2023, reflecting a rise in value of 71,700 million euros and the aforementioned net acquisition of financial assets of 10,600 million euros in the last three quarters.

When we analyse the breakdown of this net acquisition of assets, we observe a restructuring of financial assets since the end of 2022, moving away from deposits in favour of instruments offering a higher return, such as Treasury bills and investment funds. In particular, households invested in public debt securities worth 19,800 million euros and in equities and investment funds amounting to 18,440 million euros. In contrast, they reduced their cash and deposits by 28,200 million euros.

On the liabilities side, households continued to deleverage in the first three quarters of 2023, reducing their debt by 14,480 million euros compared to the end of 2022 (–2.1%) to 689,000 million. This new level represents 48% of GDP, 4.3 points less than at the close of the previous year and the best level since 2002.

As a result of these trends, aggregate household net financial wealth has grown by 97,300 million euros compared to Q4 2022, to slightly exceed 2.05 trillion euros; this represents 142.9% of GDP, a ratio 2.4 pps

lower than at the end of 2022, due to the increase in nominal GDP.

In short, the improvement in household finances at the aggregate level gives us some cause for optimism. Thanks to this buffer, household consumption will be able to continue to grow in the coming quarters and will remain an important supporting factor for the Spanish economy as a whole.