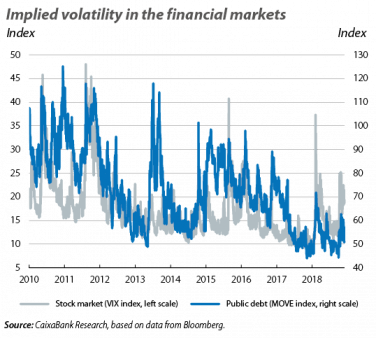

The financial markets experience volatility in the final stretch of the year. Following an October marked by losses in the stock markets, above all in the US, in November the markets continued to behave erratically. Trade tensions between the US and China, coupled with political tensions in Europe (concentrated in Italy and in the Brexit negotiations), continue to determine the performance of most financial assets. In addition to these factors, there is the fear among investors that in 2019 the world economy could slow down more than expected (an issue that has particularly affected oil prices). Faced with these concerns in the financial markets, both the Fed and the European Central Bank maintain a positive view of the macroeconomic scenario for their respective regions and are continuing with their strategies of monetary policy normalisation.

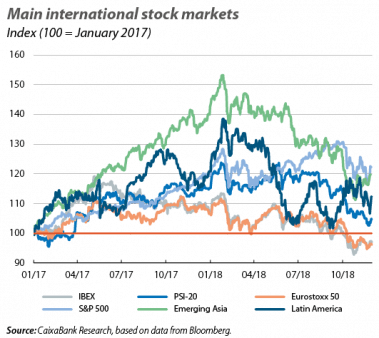

The main international stock markets struggle to shake off the negative tone of October. The trade tensions between China and the US, and the fear that they could undermine growth in global demand, led to declines in the main international stock markets. In addition, in Europe, the indices were weighed down by somewhat disappointing economic growth data, especially in Germany, and by the tensions between Italy and the European Commission regarding Italy’s fiscal policy. Nevertheless, towards the end of the month, trading floors in the US and Europe recovered some of the ground lost over the previous weeks (some even managed to close the month in the black). These recoveries were mostly driven by hope among investors that the trade tensions between China and the US, on the one hand, and the political tensions in Italy, on the other hand, could dissipate. In the emerging economies, meanwhile, the MSCI index for the region as a whole showed highly volatile behaviour and managed to close the month with gains, although the performance was disparate between continents (the Asian indices experienced growth, while the Latin American indices, led by Mexico, registered losses).

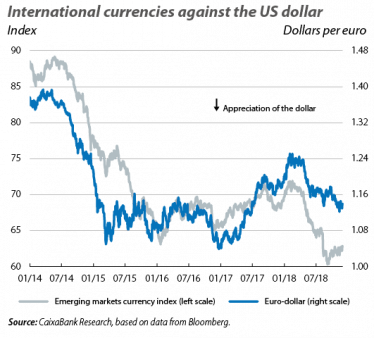

The euro remains weak against the dollar. The political tensions surrounding Italy and the disappointment of the economic activity indicators in the euro area also impacted the foreign exchange market, where the euro depreciated down to nearly 1.12 dollars, its lowest so far this year. On the other hand, the various developments in the Brexit negotiations led to the British pound depreciating against most international currencies. In particular, despite the Commission and the United Kingdom reaching an agreement on the divorce terms that minimises disruption, the financial markets were more swayed by fears that this agreement may not be approved by the United Kingdom’s Parliament, which would lead to an impasse and further uncertainty. In the emerging economies, meanwhile, there was a generalised depreciation among the Latin American currencies, led by the Argentine peso and the Brazilian real, whereas most of the Asian currencies gained ground against the dollar.

The major central banks stick to their roadmaps. In the US, at its meeting held on 8 November, the Fed kept interest rates unchanged in the 2.00%-2.25% range. In addition, the press release issued after the meeting reiterated a positive view regarding the growth in economic activity and stressed that the strength of the labour market, together with an inflation rate lying close to the 2% target, reinforces the strategy of gradual interest rate rises. The ECB, meanwhile, published the minutes of its last meeting (held on 25 October), at which the members of the Governing Council reiterated their positive view of the macroeconomic scenario. That said, some of them expressed concern regarding the external risks to economic growth, which have shifted to the downside. All in all, based on the strength of domestic demand, the members of the Governing Council insisted on their intention to gradually begin to realign monetary policy, with the net purchases of assets being brought to an end in December.

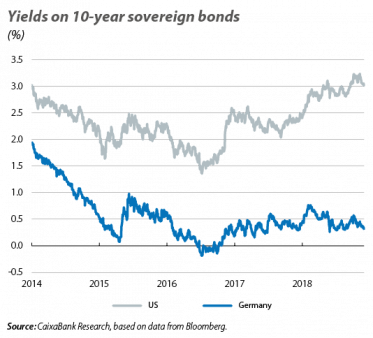

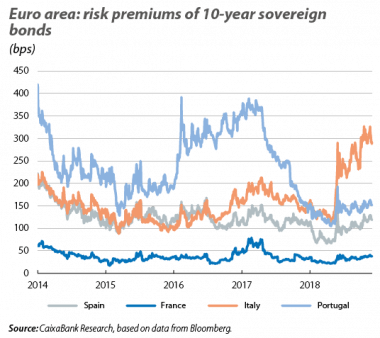

Yields on safe-haven assets fall. The turmoil in the international stock markets and the uncertainty surrounding Italy’s fiscal policy led to an increase in the demand for bonds that are considered safer. As a result, the yield on the 10-year US sovereign bond contracted by over 20 bps, falling below 3%, while the yield on the German bund fell by 15 bps, ending the month below 0.33%. The risk premiums of the euro area periphery, meanwhile, remained at their highest levels in recent months. Italy’s risk premium reached over 325 points, a level not seen since 2013, while the Spanish and Portuguese premiums fluctuated slightly above 120 and 150 points, respectively. Nevertheless, at the end of the month, Italy’s premium fell back to around 290 points following news that suggested the possibility of the Italian Government moderating its fiscal deficit target for 2019.

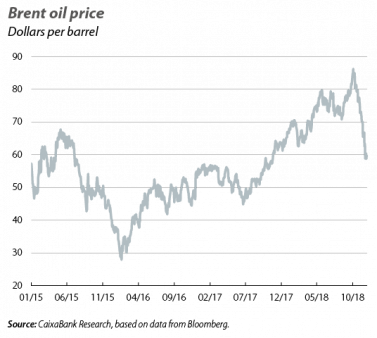

The oil price collapses in November. Following the surge seen in the summer, when the price of a barrel of Brent reached over 85 dollars, in November it dropped below 60 dollars (its lowest this year). This decline was due to greater production of crude oil both in the US and among the members of OPEC, which had previously cut supply by more than what had been agreed at its latest meetings. In addition, the US announced exemptions for the sanctions on Iranian exports, making it easier for eight countries (including China, India and Japan) to continue to import Iranian oil temporarily. Finally, expectations of a slowdown in the growth of the global demand for oil over the coming quarters also contributed to driving down the price of a barrel of Brent (for more details, see the Focus «Oil: reflections and outlook for 2019» in this same Monthly Report). With all these factors on the table, on 6 December, OPEC will hold a meeting at which it will decide whether to extend production cuts into 2019.