The Spanish economy makes steady progress in a context of uncertainty

The Spanish economy continues to perform well despite a context of high uncertainty

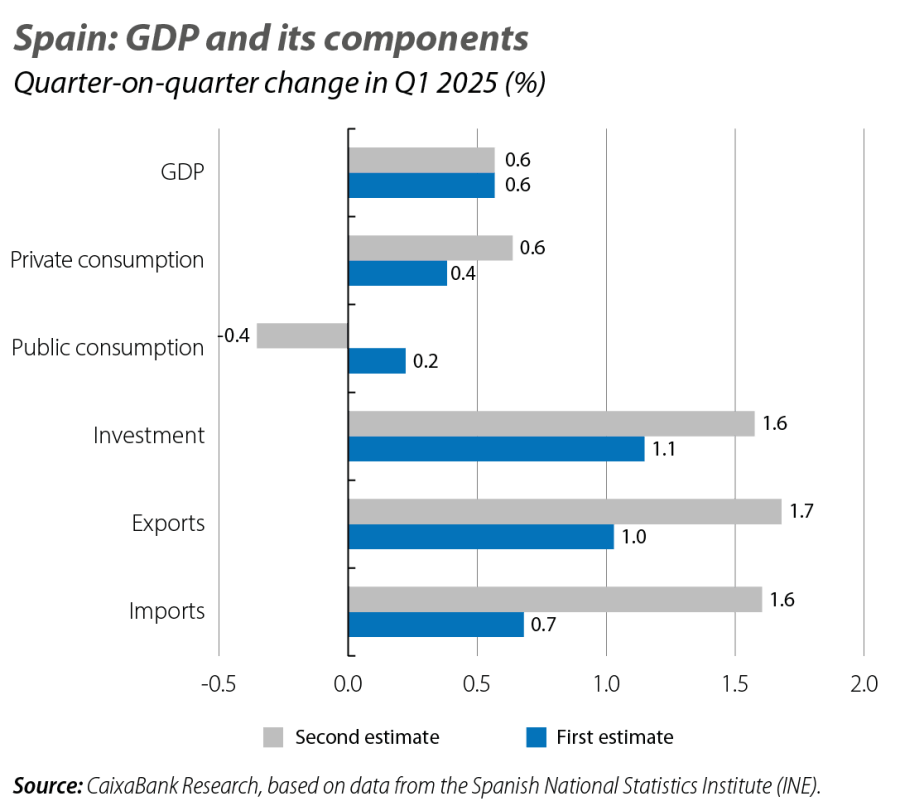

Despite the trade tensions stemming from the US’ tariff policy and the geopolitical conflict between Israel and Iran, the economic activity indicators have shown significant buoyancy, suggesting a solid performance in Q2. In addition, the revision of the GDP figure for Q1 did not change the good aggregate result (0.6% quarter-on-quarter), but it did lead to significant revisions in the components, reflecting a robust composition of this growth. Specifically, the revised figures reveal that it was sustained by private consumption (0.6% quarter-on-quarter growth), investment (1.6% quarter-on-quarter) and the foreign sector, with exports growing by 1.6% quarter-on-quarter (very similar to the growth of imports), driven by the strength of non-tourism services.

Domestic demand is showing particular strength, although pockets of uncertainty persist

Looking ahead to the coming quarters, we expect domestic demand to play a predominant role in economic growth, driven by the reduction of interest rates, a certain recovery of purchasing power, the traction of European Next Generation funds and the strength of the labour market on the back of population growth. In this scenario, the two main sources of uncertainty are the trade tensions linked to tariffs and developments in the conflict between Israel and Iran. While our current scenario, which forecasts GDP growth of 2.4% in 2025, already incorporates a certain dose of uncertainty linked to the trade tensions, this may well end up having a bigger impact, depending on how these two pockets of uncertainty evolve over the coming months. With regards to the escalation of the conflict between Israel and Iran, the uncertainty is high, but at the close of this report, all the indicators are pointing to a gradual de-escalation of the conflict. The probability of the Strait of Hormuz being closed has been reduced, and this has contributed to a slight correction in the oil price, which is not unfavourable for our economy: Spain has to import almost all the oil it consumes. Consequently, cheap oil is a clearly positive factor for the Spanish economy.

The good economic activity data for Q2 and a thriving labour market point to another highly dynamic quarter

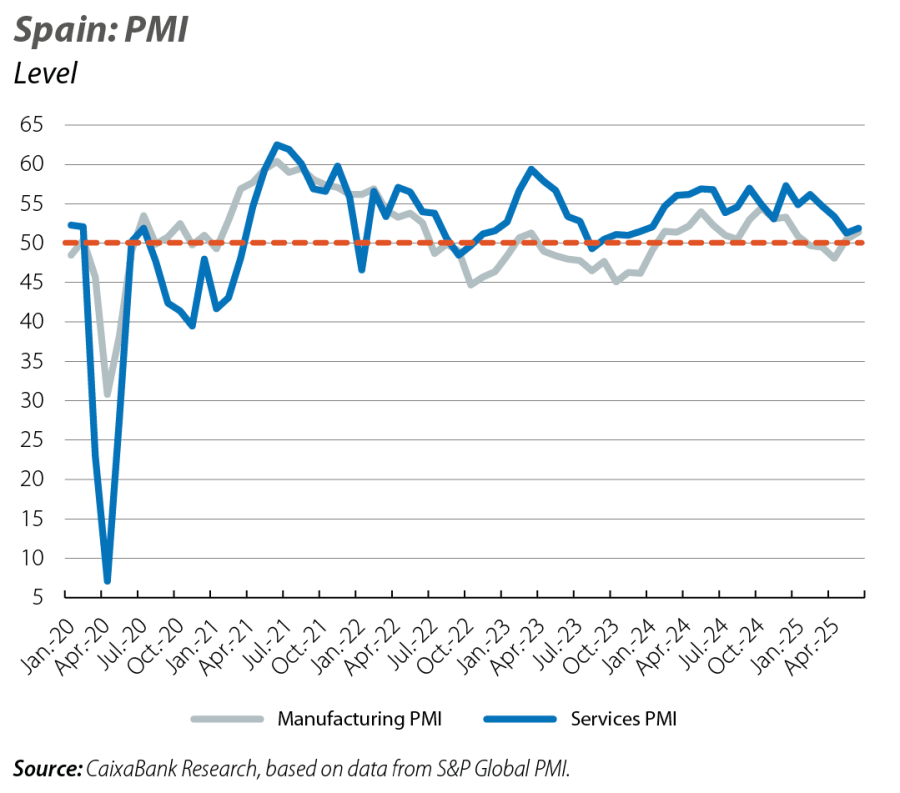

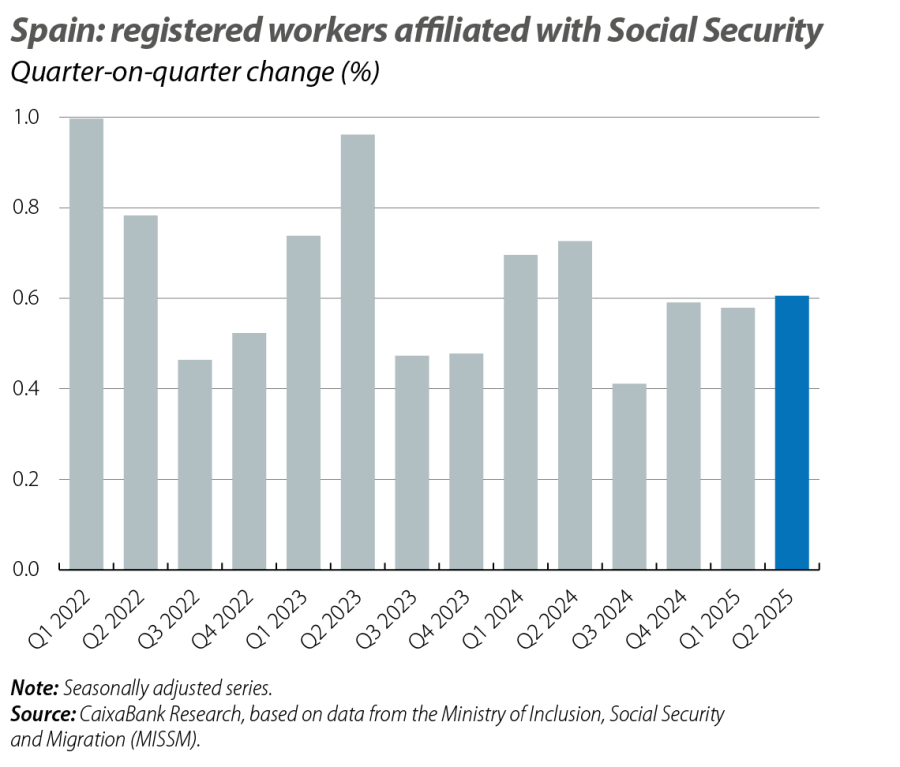

The indicators related to employment and consumption have been positive in Q2. Employment growth, measured by the number of registered workers affiliated with Social Security, remained robust and increased in Q2 by 0.6% quarter-on-quarter (corrected for seasonality), matching the rate of the previous quarter. In addition, the total number of affiliates reached 21,861,095 workers, marking a new record and standing 468,206 above the level of a year ago. On the other hand, the CaixaBank Research Monitor’s domestic consumption indicator has shown higher year-on-year growth rates in Q2 than in Q1. As for the business sentiment indices, June was a good month: the manufacturing PMI once again stood in expansive territory (above 50 points) for the second consecutive month, specifically at 51.4 points, exceeding the 50.5 points recorded in May. The services PMI, meanwhile, stood at 51.9 points in June, slightly above the 51.3 points recorded in May. Considering the available data as a whole, quarter-on-quarter GDP growth in Q2 could be around 0.5%. The first estimate for Q2 GDP will be published on 29 July, after the close of this edition.

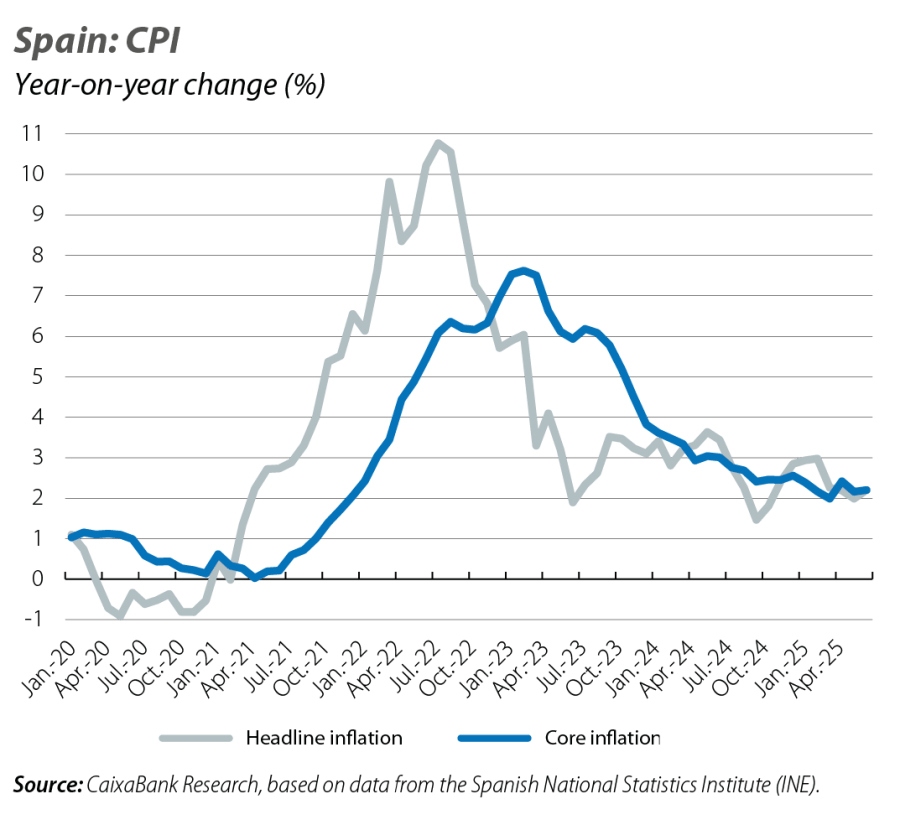

Slight upturn in inflation in Spain, marked by the increase in fuel prices

Headline inflation rose 0.2 pps in June, to 2.2%. This increase was mainly due to the rise in fuel prices observed following the escalation of the conflict between Iran and Israel – although prices have moderated following the signing of a cease fire – and, to a lesser extent, the rise in food and soft drink prices. Thus, headline inflation has picked up again after three months of declines, although core inflation has remained stable at 2.2%. There are some upside risks to the inflation forecast of 2.4% for 2025, due to this rise in fuel prices and a steeper than expected increase in food prices, especially unprocessed food.

Households’ gross disposable income remains buoyant in the opening months of 2025, although it is slowing, while the savings rate is declining slightly due to stronger consumption

Households’ nominal gross disposable income grew by 5.1% year-on-year in Q1. This is a significant growth rate, thanks largely to the strength of the labour market, but it is more contained than that of 2024 (8.7% for that year as a whole). This growth was lower than that of households’ final consumption expenditure (7.1% year-on-year), resulting in a 0.6-pp reduction in the savings rate (static and seasonally adjusted figure), which stood at 12.8% of gross disposable income.

The rally in the real estate market takes hold

Between January and April, there were 237,458 home sales, representing year-on-year growth of 15.9% and the best start to the year since 2007. This strong demand is being felt in increasing pressure on prices. Thus, the appraisal value of housing published by the Ministry of Housing and Urban Agenda increased by 9.0% year-on-year in Q1 2025, accelerating from the 7.0% registered at the end of 2024. At the regional level, this growth rate varies widely. Andalusia was the only region to register a price correction (–0.5% year-on-year), while the highest price increases occurred in Galicia, the Valencian Community and Castilla-La Mancha (increases in the range of 11%-14% year-on-year).