The international economy holds up over the summer

The international economy has returned from the summer with signs of resilience, less uncertainty, but more tariffs. There are indications of an improvement in European activity in Q3, signs of a less robust labour market in the United States, and divergent inflation between the two sides of the Atlantic.

A resilient global economy, with less uncertainty but higher tariffs

The economy returned from the summer break with resilient activity indicators (global composite PMI of 52.9 points in August, a 15-month high) and a reduction in uncertainty surrounding trade relations in the short term. The US and the EU reached an agreement establishing a general 15% tariff on exports of goods from the EU to the US, including cars, semiconductors and pharmaceuticals, as well as preferential treatment for a number of strategic products and a European commitment to make purchases and investments in key US industries. Japan also agreed on a 15% tariff with the US, while the US and China extended their truce and continue to negotiate, with a new deadline set for November. Other economies received more severe US tariffs, especially Brazil and India (50%), as well as Switzerland (39%). In addition, the US eliminated the de minimis exemption (products with a value of less than 800 dollars) for all countries and set a 50% tariff on copper. All this leaves an effective average US tariff of close to 17% (the highest level since 1934, and a far cry from the rate of 3% or lower that had prevailed in the last 50 years).

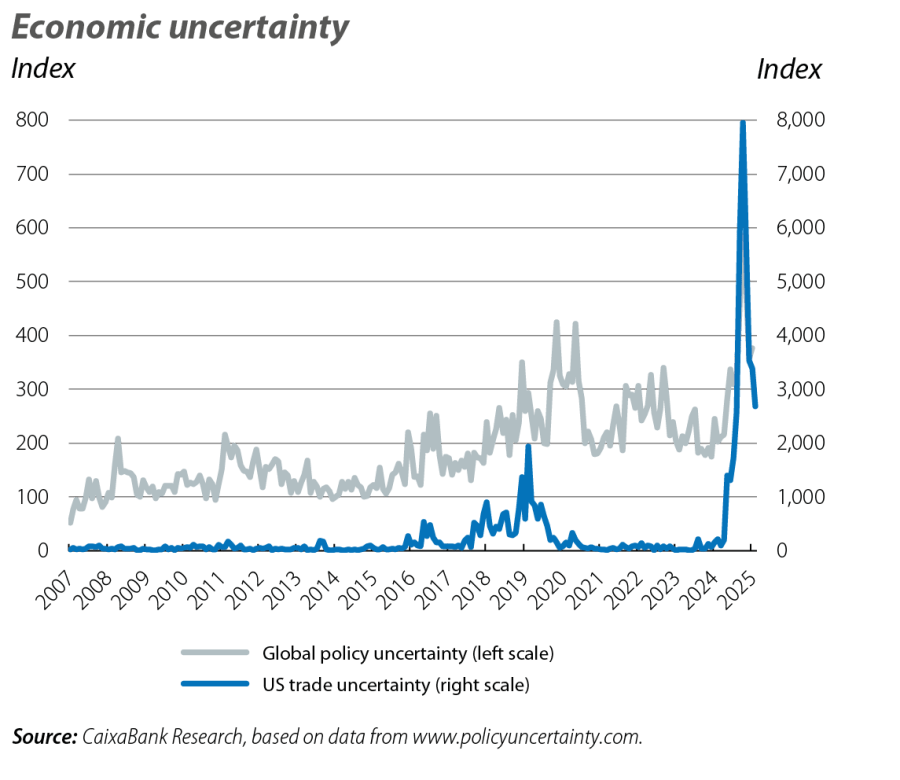

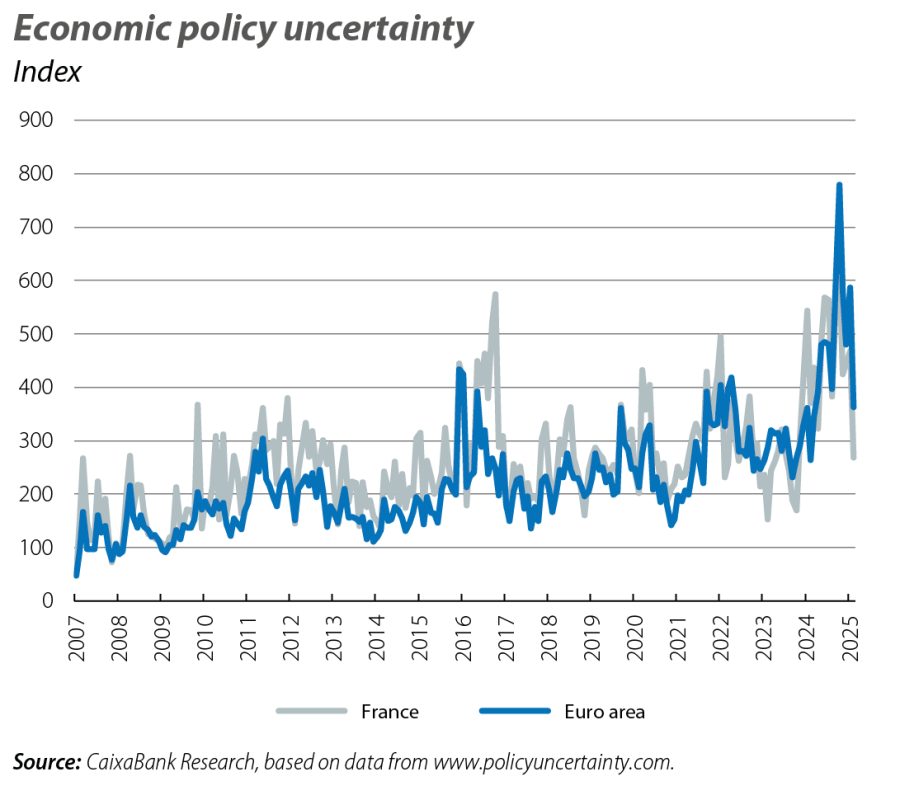

The sources of uncertainty persist

Not only are important trade negotiations still pending, but uncertainty also persists over how long the agreements already reached will last, as well as legal uncertainties (the US Court of Appeals has declared the general bilateral tariffs established under the IEEPA to be illegal), although they remain in force until at least 14 October and the case is likely to be brought before the Supreme Court. There is also uncertainty regarding the macroeconomic impact of the tariffs, ranging from their transmission throughout global and domestic production chains and price formation to possible global reconfigurations of trade flows. On the other hand, politics is harbouring more sources of uncertainty in Europe. In recent weeks, France has suffered a tensioning of its risk premium in the face of a possible fall of François Bayrou’s government and a slower correction of its public accounts: in 2024, the budget deficit was 5.8%, the highest in the euro area; public debt, at 113%, is the third highest in the euro area (behind Greece and Italy) and it lies at practically the same level as that of 2020 and 15 pps above that of 2019.

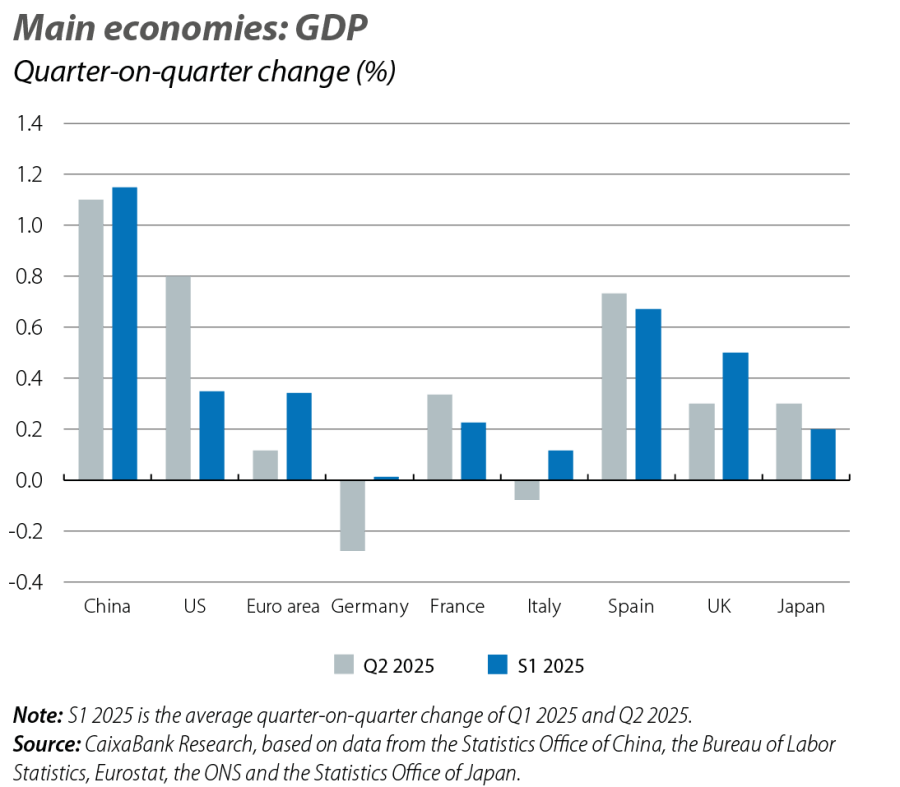

Reversal effects on GDP

The Q2 data show the reversal of the «anticipation effects» due to the entry into force of the US tariffs. After the import boom in Q1 in anticipation of the tariffs caused a drop in US GDP and boosted exports from the other major economies, in Q2 US GDP rebounded 0.8% quarter-on-quarter. This was driven by a significant positive contribution from the foreign sector, albeit one with a mixed composition: a marked fall in imports, a slight decline in exports and slower than usual growth in private consumption and investment. These swings in international trade with the US weighed on Chinese exports in Q2, although the economy compensated for it with higher exports to ASEAN countries and other economies, and China’s GDP continued to record solid growth in Q2 (+1.1% quarter-on-quarter, +5.2% year-on-year). In the euro area, GDP slowed to 0.1% quarter-on-quarter (vs. +0.6% in Q1 or +0.3% excluding Ireland), weighed down by the foreign sector, although the resilience of domestic demand reveals some positive underlying dynamics (in a context in which the unemployment rate fell to a low of 6.2% in July). By country, Germany and Italy contracted (–0.3% and –0.1%, respectively, in Q2 vs. +0.3% in Q1 in both cases) and France accelerated due to the accumulation of inventories (+0.3% in Q2 vs. +0.1% in Q1).

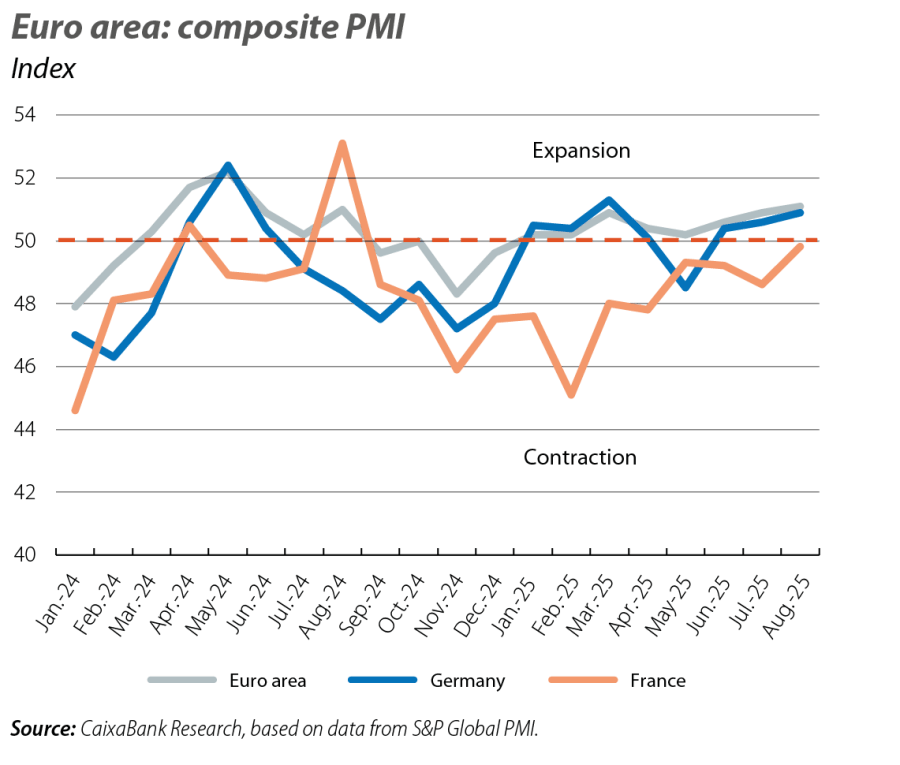

Signs of improvement in Europe’s economic activity in Q3

The euro area faces the challenge in the coming months of adapting to new trade conditions with the US which are clearly less favourable than those in place prior to 2025, although the fiscal stimulus due to be deployed in the coming years (ReArmEU plan and the infrastructure plan in Germany) could mitigate some of the impact of the new trade landscape. In this regard, the latest business confidence indicators show some improvement, within a scenario of modest expansion in economic activity. Specifically, the region’s composite PMI rose by around 0.5 points between July and August to reach 51.0 – while this indicates only modest growth, it nevertheless represents a peak since mid-2024. In addition, the improvement was widespread among the major economies and both in services and, especially, in manufacturing (in August, the manufacturing PMI [50.7] returned to expansive territory for the first time since June 2022). For July and August as a whole, the economic sentiment indicator also improved, although, like consumer confidence, it remained at somewhat meagre levels.

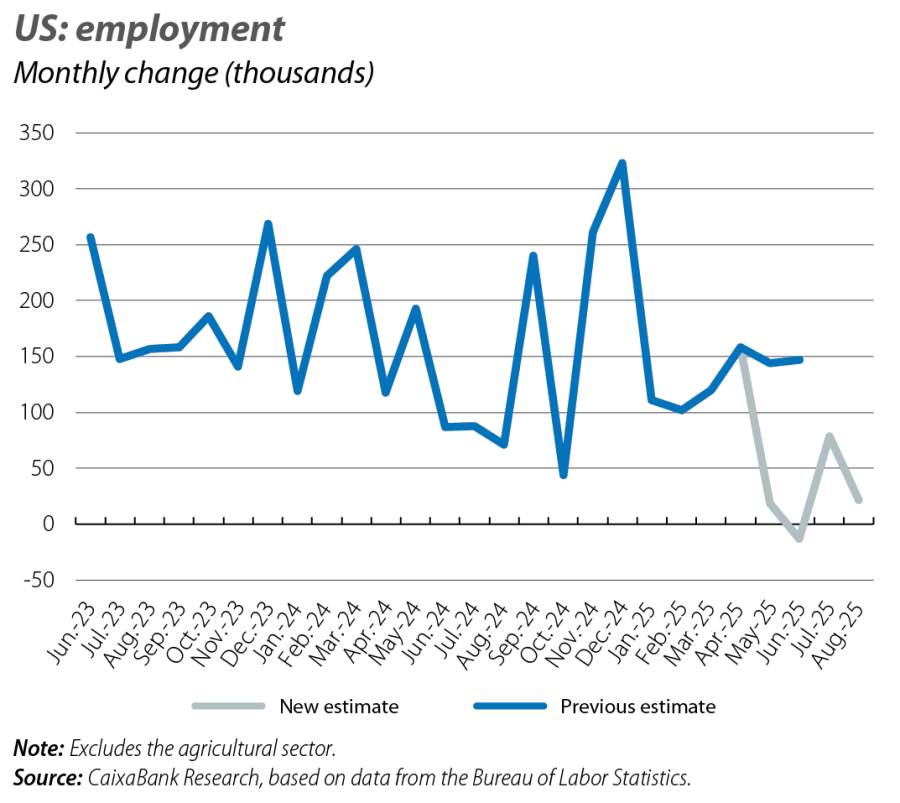

Signs of a not-so-robust US labour market

The bulk of activity indicators in the US point to a dynamic GDP in Q3 (the New York and Atlanta Feds’ trackers indicate growth of 0.6%-0.7% quarter-on-quarter), but the most relevant figure over the summer was job creation. Specifically, the labour market created 51,000 new jobs per month on average in July and August (vs. 127,000 on average over the previous 12 months). Moreover, the statistical revision of the series revealed that just 6,000 jobs were created in May and June in total (vs. 291,000 initially estimated). The contrast between the loss of dynamism in job creation and an unemployment rate that is relatively stable at 4% suggests that the labour market may be cooling on both the demand and the supply side. Indeed, this was the reflection made by Fed Chair Jerome Powell at the annual Jackson Hole symposium, after which he opened the door to a rate cut in September (see the Financial Markets Economic Outlook section).

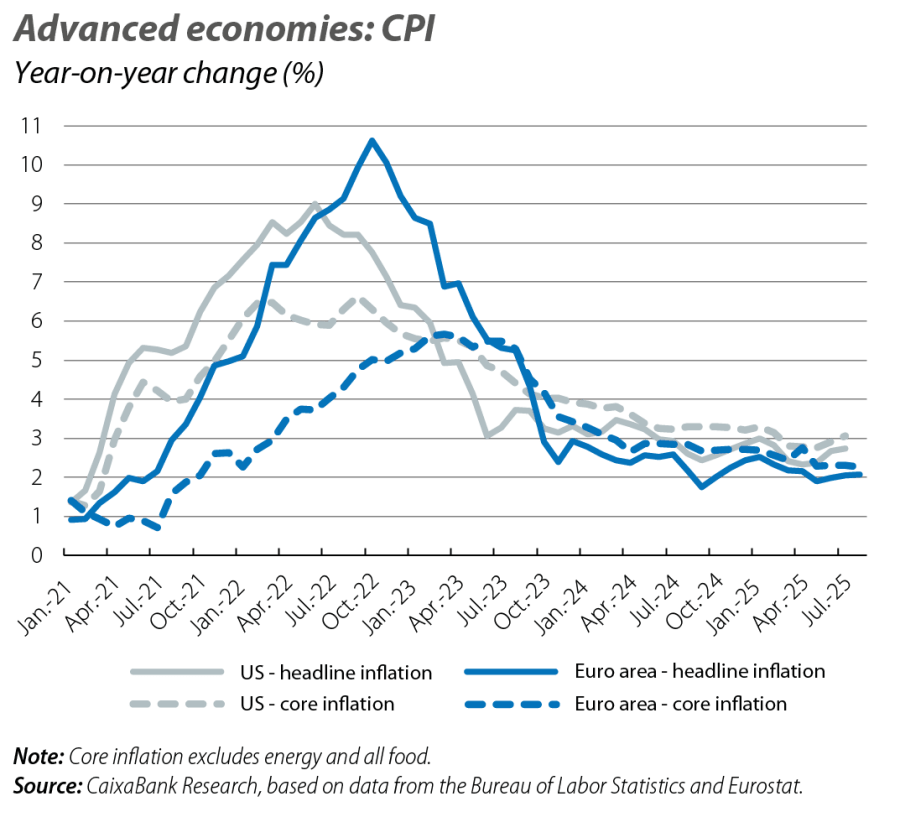

Inflation diverges between the two sides of the Atlantic

In the euro area, headline inflation was 2.1% year-on-year in August, virtually at the ECB’s 2% target. Although core inflation, which excludes energy and food, remained at 2.3% year-on-year, behind this stability lies a low inflation figure for non-energy industrial goods (0.8%) and a services inflation that is slowly but steadily moderating (3.1% in August, its lowest level since April 2022). In contrast, inflationary pressures in the US remain at close to 3%, with the headline CPI standing at 2.7% year-on-year in July and core inflation accelerating to 3.0% (the highest record since February). However, these figures suggest that the impact of the tariffs on final consumer prices has so far been modest, with limited pressures on the items that should be most affected (electronic equipment, textiles, etc.).