The Spanish agrifood sector gains momentum in 2025 after overcoming recent challenges

Spain’s agrifood sector is enjoying an expansion in 2025, favoured by improved weather conditions, the containment of production costs and increased demand. All this translates into a gradual increase in production and exports, which have already recovered to pre-pandemic levels, as well as a more dynamic labour market, with job creation and a reduction in temporary employment. The outlook for the coming quarters is encouraging, although significant challenges remain, including the US tariff hikes and the growing impact of extreme weather events such as floods, droughts and fires.

The primary sector enjoys an expansion in 2025

The primary sector consolidates its recovery. In the first half of 2025, the primary sector – comprising agriculture, forestry and fishing – grew by 2.7% year-on-year, a dynamic rate similar to that of the economy as a whole (2.8%), adding to the excellent performance recorded in 2024 (8.3%). With this advance, the sector’s gross value added (GVA) is practically at 2019 levels, although it still remains 5% below the peak reached in 2021. Therefore, the downturn of 2022-2023, linked to the spike in production costs triggered by the war in Ukraine as well as the severe drought that affected much of the country, cannot be considered fully behind us. In addition, despite the growth recorded in recent quarters, the greater dynamism of the Spanish economy as a whole means that the agriculture, forestry and fishing sector has not yet recovered its pre-pandemic share of the total. In the first half of the year, its relative weight in the Spanish economy remained at around 2.7%, compared to the pre-pandemic period when it was around 3.0%.

The gradual recovery of the Spanish agriculture, forestry and fishing sector continues

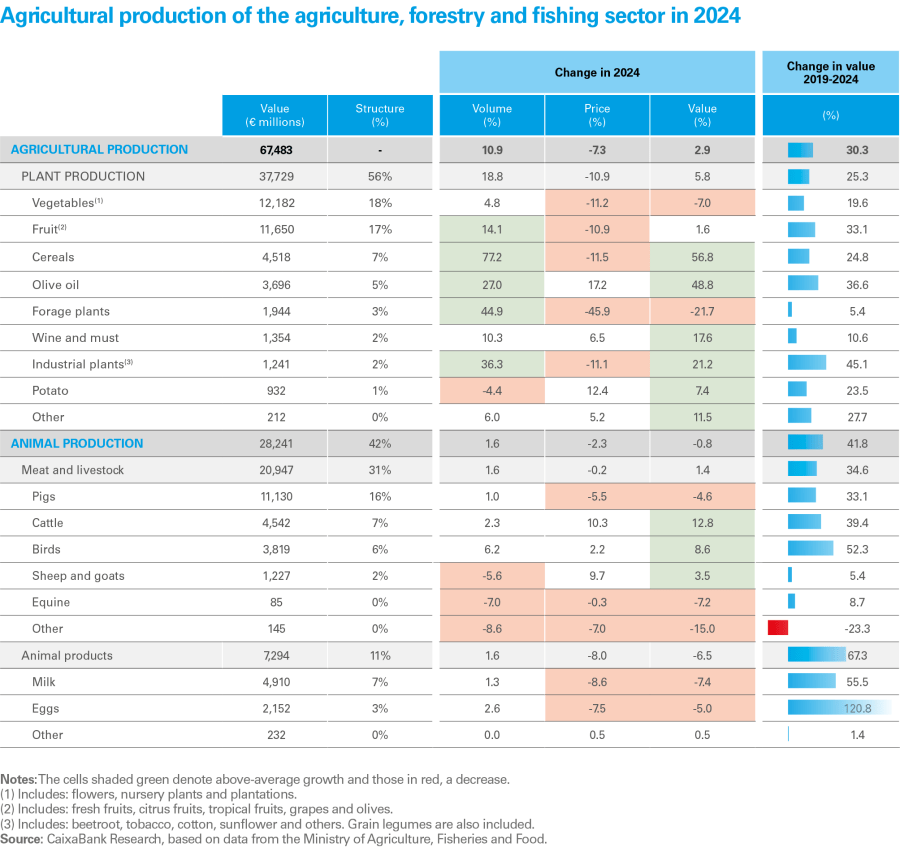

Plant and animal production: an uneven recovery. Plant production recorded very dynamic growth (+18.8% in volume, leaving behind the downturns of 2022 and 2023), and across most crop types, according to the agricultural accounts of the Ministry of Agriculture, Fisheries and Food (MAPA) for 2024, which provide an insight into the specific evolution of the different agricultural productions. Of particular note was the strong recovery in cereal and olive oil production (which were particularly affected in previous years by the persistent drought). However, the reduction in prices has limited the improvements in terms of value, especially in the case of vegetables (–7.0% in value) and, to a lesser extent, in fruits (1.6%), the two largest agricultural productions in the Spanish sector (accounting for 35% of the total). As for animal production, the increase in beef and poultry meat production stands out, both in quantity and, above all, in value. On the other hand, the decline in the price of pork – Spain's primary animal product – has caused the value of animal production in 2024 to decline slightly (–0.8%).

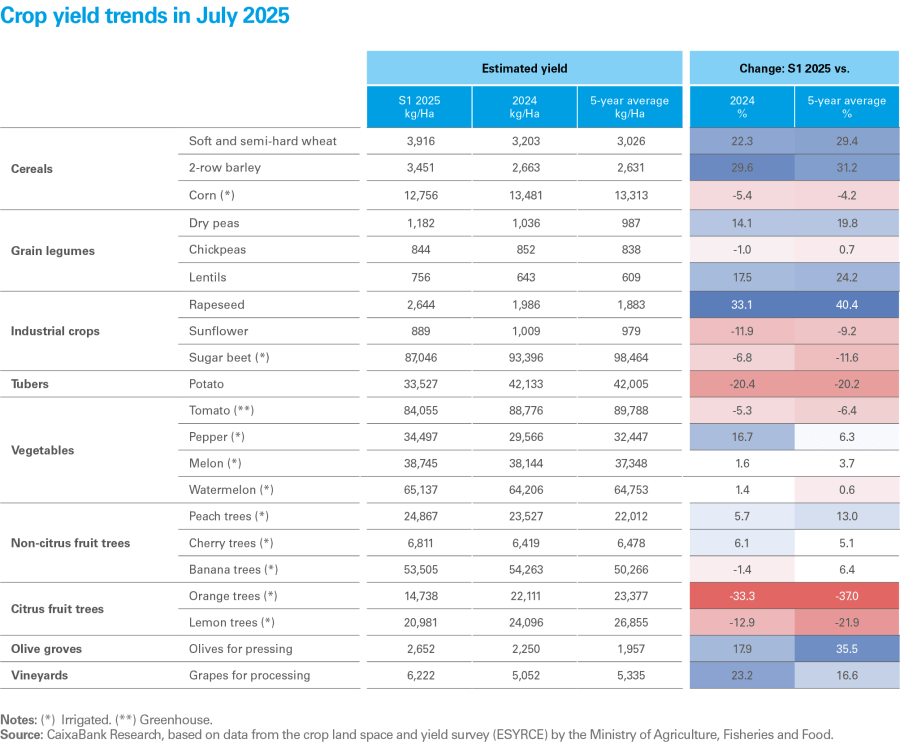

Higher yields, except for citrus fruits, thanks to improved weather conditions. According to the crop land space and yield survey (ESYRCE) conducted by the Ministry of Agriculture, Fisheries and Food (MAPA), agricultural production is expected to maintain a positive trend in 2025, albeit with significant discrepancies between crops. Rain-fed cereals (except corn), grain legumes, olives for pressing and grapes for processing are performing particularly well, since the expectation is for higher yields than last year and above the average of the last five years. This higher expected yield is driven by the better weather conditions and represents a revival following the poor harvests of 2022-2023. On the other hand, lower yields are expected for citrus fruits, including both oranges and lemons, as well as for vegetables. These yields are no doubt affected by the consequences of the floods endured by the Community of Valencia and Murcia in late 2024, since these regions account for 65% of the area dedicated to the cultivation of citrus fruits in the entire country.

As has already been pointed out, the improvement in agricultural output is largely explained by the more favourable weather conditions. According to the data available from the Ministry for the Ecological Transition and the Demographic Challenge (MITECO), the persistent drought that the country endured in 2022 and 2023 can almost be declared as behind us. In the first half of 2025, only 0.5% of the country was in a state of prolonged drought, compared to 25% in 2023.

Production costs: stabilisation with nuances. Production costs have stabilised at 20% above the levels prior to the war in Ukraine, while fertilizer and animal feed costs have even increased in 2025. The evolution of production costs was very favourable for the sector in 2024, although the improvement has been less pronounced in recent months. In particular, prices paid by farmers fell by 9.5% in 2024 and by an additional 1.6% year-on-year between January and April 2025, and they now lie 20.3% below the highs of mid-2022. Despite this significant improvement, it should be recalled that the increase between January 2021 and August 2022 was of around 50%, so these costs are still approximately 20% above the levels prior to the war in Ukraine (the headline CPI is 18% above mid-2021 levels).

In addition, if we look at the main components of the costs, we see some items that have even rebounded in price in recent months, such as fertilizers (3.5% year-on-year in April) and seeds (1.6%). However, feed prices have remained contained (–1.1% year-on-year), thanks to the recovery in cereal and fodder production, an input that accounts for half of the sector’s intermediate costs. Energy costs, on the other hand, have moderated significantly since the peaks of 2022 and are now back at similar levels to those of 2021. Finally, prices received by farmers have shown a notable recovery since August last year and are growing faster than prices paid, suggesting that producers in the sector will have seen an improvement in their gross margins.

Production costs have stabilised at 20% above the levels recorded prior to the war in Ukraine

The food industry continues to expand

Growth in food production and declines in beverages. The recovery in agricultural production is also reflected in higher output in the agrifood industry, which grew by 1.4% year-on-year in the first half of the year – an impressive figure in a context of stagnation in aggregate manufacturing output (see chart below). This progress is thus consolidating the revival that began in 2024, such that production in the agrifood industry is now back at pre-pandemic levels. This improvement in production is being reflected in an increase in turnover (3.0% year-on-year in S1 2025), despite the fact that industrial prices have declined recently (–2.9% year-on-year in the period January to July).

The performance of the beverage industry is different from that of food: beverage production decreased by 0.9% in S1 2025, moderating the –2.1% drop recorded in 2024. Turnover also fell in S1 2025 (–1.4%), despite the increase in industrial beverage prices in this period. This decline in beverage production, in a context of recovery in plant production, could be explained by the fall in demand: average beverage consumption per person was 131.9 litres in 2024, down 3.1% compared to 2023 (4.2 litres less per person in a year), and the average annual spending on beverages fell 1.3% to 132 euros per person.1 However, it should be noted that industrial beverage production exceeds the pre-pandemic records (+5.8% in June 2025 compared to December 2019), while food production only barely exceeds that level (+0.8%).

- 1

This reduction was widespread across all beverage categories, except cider. For a closer look at the behaviour of Spanish consumers, see the 2024 annual report on food consumption in Spain published by the Ministry of Agriculture, Fisheries and Food.

Macroeconomic indicators of the Spanish agrifood industry

The agrifood industry continues to create jobs and the temporary employment rate is declining

The number of registered workers in the agriculture, forestry and fishing sector has declined slightly in the first eight months of the year (–0.7% year-on-year) and its share of total employment has not yet reached pre-pandemic levels (4.8% of the current total, compared to 5.9% in 2019). In contrast, the agrifood industry continues to enjoy a more dynamic labour market, with the number of registered workers growing at a slightly higher rate than across the economy as a whole (2.8% year-on-year between January and August), reaching 486,000 in the trailing 12 months to August 2025 (45,000 more than in 2019).

Meanwhile, temporary hiring in the agrifood sector continues to decline: only 7.8% of all registered workers in the sector have a temporary contract (average of the last 12 months to August 2025), some 13 pps less than before the 2021 labour reform.

Drastic reduction in temporary employment in the Spanish agrifood sector

Food prices: moderation in processed food, rebound in fresh products

The first eight months of 2025 have seen a rebound in food inflation, following the significant containment in 2024, and in the month of August it stood at 2.6%. This recent increase is concentrated in fresh and unprocessed foods, which have shown a significant acceleration since late 2024, recording growth rates of close to 8% year-on-year during the central months of this year. In contrast, the growth of processed food prices has continued to moderate and was below 2.0% in the first half of the year.

Within the subclasses of the food CPI, some major changes of trend can be seen. The most prominent example is olive oil, which after doubling its price in 2024 has registered double-digit declines in the first seven months of the year, thanks to the recovery of production in the latest harvest. In the opposite direction, products such as coffee, nuts and eggs have experienced significant increases, mainly due to external factors affecting global supply.2

- 2

The price of coffee and nuts has skyrocketed due to poor harvests in key international producers (Brazil and Vietnam in coffee, the US in nuts). In the case of nuts, the price is also influenced by the recent increase in their consumption at the national level. The increase in the price of eggs, meanwhile, could reflect a contagion of the production problems experienced in the US and the EU, prompted by cases of bird flu which affected their supply.

Food and beverage inflation increases slightly in 2025

In any case, food inflation is far from the inflationary episode of 2022-2023, and in turn this has allowed for a recovery in the demand for food and beverages. The following chart of retail sales in food reflects both the evolution of sales during the inflationary episode (strong growth in nominal sales, but stagnant in real terms) and the revival of consumption after this period. Between January and July, real sales grew by 4.2% year-on-year, a significant acceleration after growing by just 1.3% in 2024.

Exports are growing rapidly, but the momentum is contained amid the escalation in protectionism

Spain’s agrifood exports are enjoying a rapid expansion, with growth of 5.0% in volume and of 5.6% in value terms in the first half of 2025, far outpacing the growth in the total exports of all goods. This dynamism is supported by the recovery of production after several years of drought and is particularly noteworthy given the current complex international environment, marked by geopolitical tensions and a more protectionist trade environment. Given the important role of international trade flows in the agrifood sector for the Spanish economy as a whole, this report includes two specific articles: one focused on the recent behaviour of exports and the other on the potential impact of the current protectionist shift in international trade.

The outlook is favourable, but significant challenges remain: climate change and protectionism

The factors that have been driving the agrifood sector in recent months – favourable weather, high competitiveness in international markets and lower growth in production costs – will continue to be present in the current forecast horizon, so we expect the sector to maintain an expansive tone in the coming quarters.

One factor that could limit agricultural production over the coming months is the wave of fires that has affected the country this summer. Preliminary estimates by the Ministry of Agriculture, Fisheries and Food (MAPA) indicate that the fires have burned 362,472 hectares, including 35,421 for agricultural use (9% of the total affected, but representing just 0.15% of the total agricultural land area in Spain), which makes 2025 the worst year for fires since records began. Although the aggregate impact for the sector does not seem high, it could be significant for the hardest hit regions (Orense, Cáceres, León and Zamora) and for certain specific sectors (livestock, wine, olives and beekeeping, among others).

Finally, the Spanish agrifood sector is facing a steep protectionist spiral with the major international agrifood powers. The tariff threats from the new Trump administration have particularly caught the sector’s attention, as the US is the fifth largest destination for its exports, with some segments (notably, olive oil) and regions (some provinces of Andalusia, Eastern Spain and Catalonia) substantially affected. The final agreement has set the tariffs at 15% for European products, pending clarification of which strategic products will be exempt. In addition, the EU has committed to lowering tariffs on agrifood products from the US, which includes fruits and vegetables, fish, pork and a wide variety of dairy products. On the other hand, China is also introducing barriers to trade with the EU, in some cases in a bid to contain certain diseases3 or in retaliation for other trade-related measures.4 In this context of growing protectionism and a weakening of multilateralism, the sector is being forced to adapt, seeking alternative markets or, at the EU level, intensifying its strategy of bilateral agreements, such as the one signed with Mercosur. For a more detailed analysis, see the article in this same report «Agrifood exports in 2025: resisting the protectionist tsunami».

- 3

Since 7 August, China has prohibited the direct and indirect import of Spanish poultry products, including processed ones, thus suspending the agreement signed in April which opened up this market to domestic producers.

- 4

Since 11 September, China has imposed temporary tariffs of up to 62.4% on European pig-based products due to an anti-dumping investigation in retaliation for charges imposed on Chinese electric vehicles. In the case of Spain, the rates will range between 15.6% and 20% as a result of cooperation with the Chinese authorities.