Which Spanish regions could be most affected by Trump’s tariffs?

Although around 80% of Spanish exports to the United States are concentrated in five autonomous communities, no region is facing significant systemic risks.

The Spanish export sector is facing a complex international environment, marked by the protectionist shift in US trade policy. After months of uncertainty and negotiations, tariffs have finally been set at 15% for European products, pending confirmation of which strategic products will be exempt. Although the Spanish economy’s exposure to the US is relatively limited1 and the impact appears moderate at the aggregate level,2 it varies significantly from region to region depending on their individual exposure to the US economy, as we outline below.

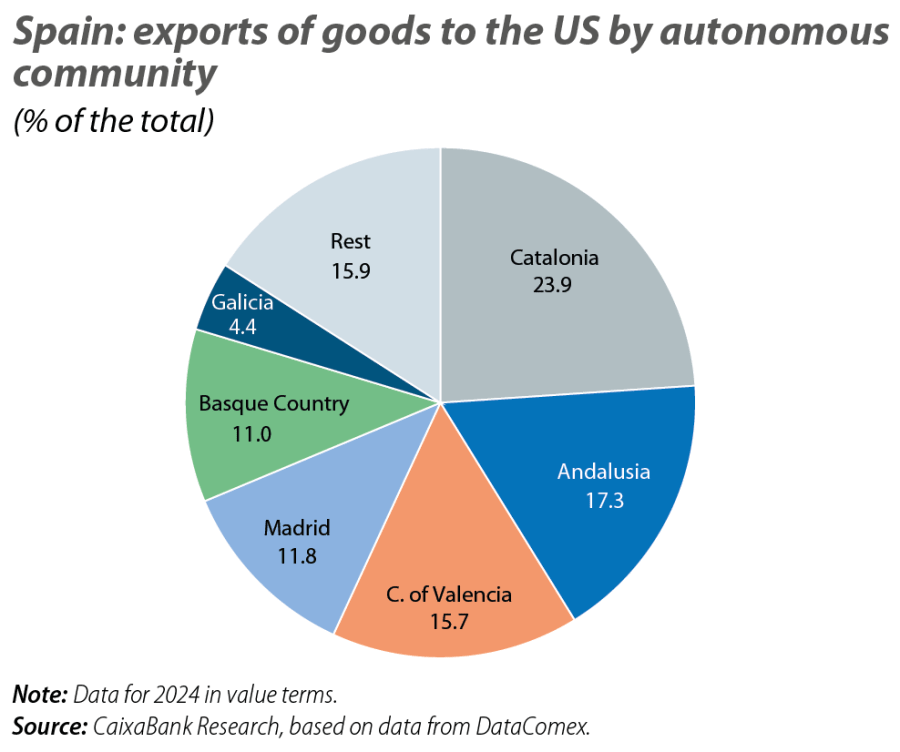

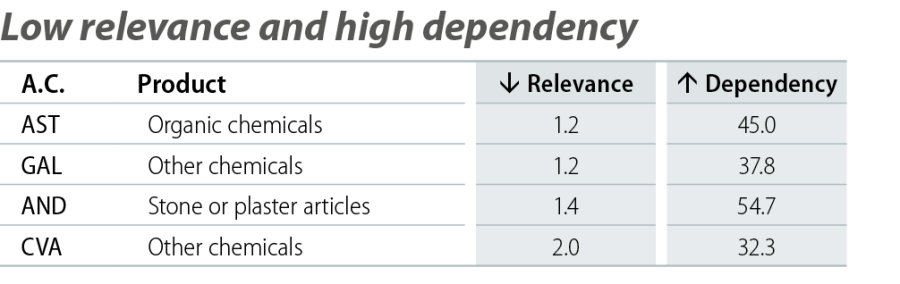

Spanish exports to the United States are concentrated in just a few autonomous communities. Specifically, as shown in the first chart, around 80% of these exports come from five regions: the Basque Country, Madrid, the Community of Valencia, Andalusia and, above all, Catalonia, which accounts for almost a quarter of the total. At the opposite end of the ranking we find La Rioja, Cantabria, Extremadura and the two island regions, with less than 1% each.

- 1

Based on data for 2024, exports of goods to the US account for 4.7% of total exports and 1.1% of GDP; on the other hand, 1.3% of the added value generated by the Spanish economy ends up being sold, either directly or indirectly (through the content of our products within other countries’ exports), to the United States.

- 2

The IMF estimates that, among the big EU economies, the Spanish economy is the one least affected by the trade war: for each 10-point increase in US tariffs imposed on the EU, Spain’s GDP growth in the short and medium term could be reduced by 0.1 pp; see IMF-Spain (2025), «2025 Consultations Article IV». The calculations performed by the Bank of Spain are similar: it estimates an impact of 0.11% after three years with a tariff of 10%; see Bank of Spain (2025), «Annual Report 2024».

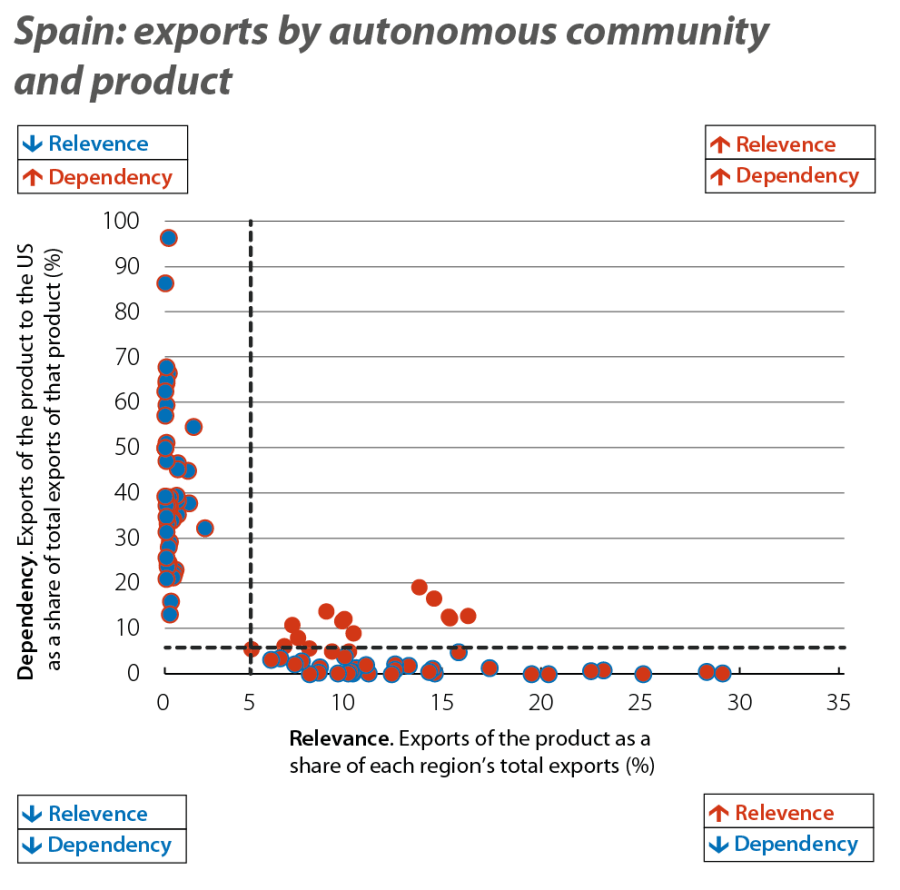

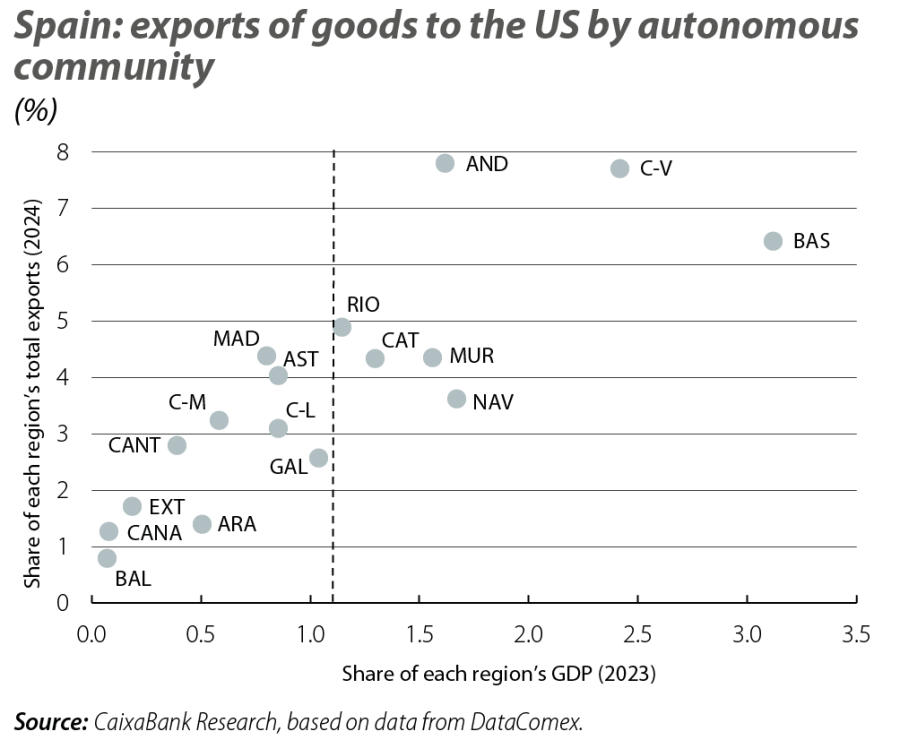

In order to identify which are the most vulnerable products in each region, we have calculated two indicators: the relevance ratio, which we define as the exports of each product expressed as a share to the total exports of the autonomous community in question, and the dependency ratio, which is the exports of each product destined for the US market expressed as a share of the autonomous community’s total exports of that product.3 The results of combining these two variables – relevance and dependency – can be seen in the second chart, in which for each autonomous community we have selected the three products with the greatest share of the region’s exports (i.e. those with the greatest relevance) and the three with the highest percentage of their exports destined for the US (i.e. with the highest dependency ratio).

- 3

We disaggregate the exported products according to the TARIC classification.

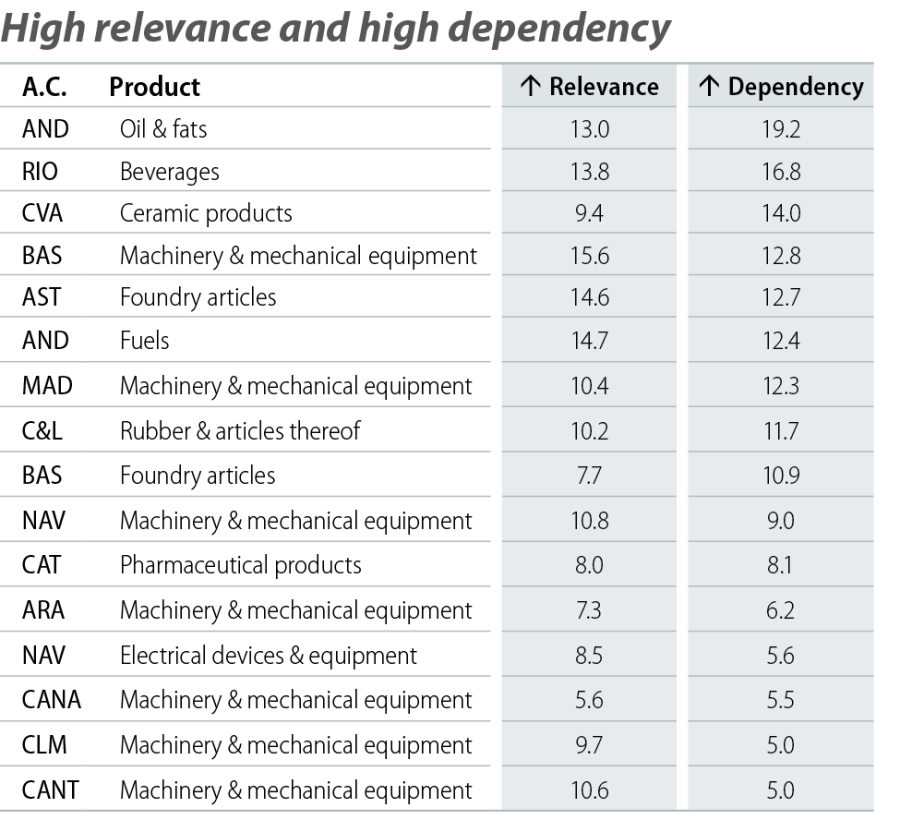

In the upper-right quadrant, we find the products of each autonomous community’s exports that have both a high relevance (greater than 5%) and a high dependency (greater than 5%). These are the products that present the greatest risks for their respective regions. This group consists of the products listed in the first table, including most notably Andalusian exports of oils and fats, which account for 13% of the region’s total exports and of which 19.2% go to the US, followed by exports of beverages from La Rioja and of ceramic products from the Community of Valencia.

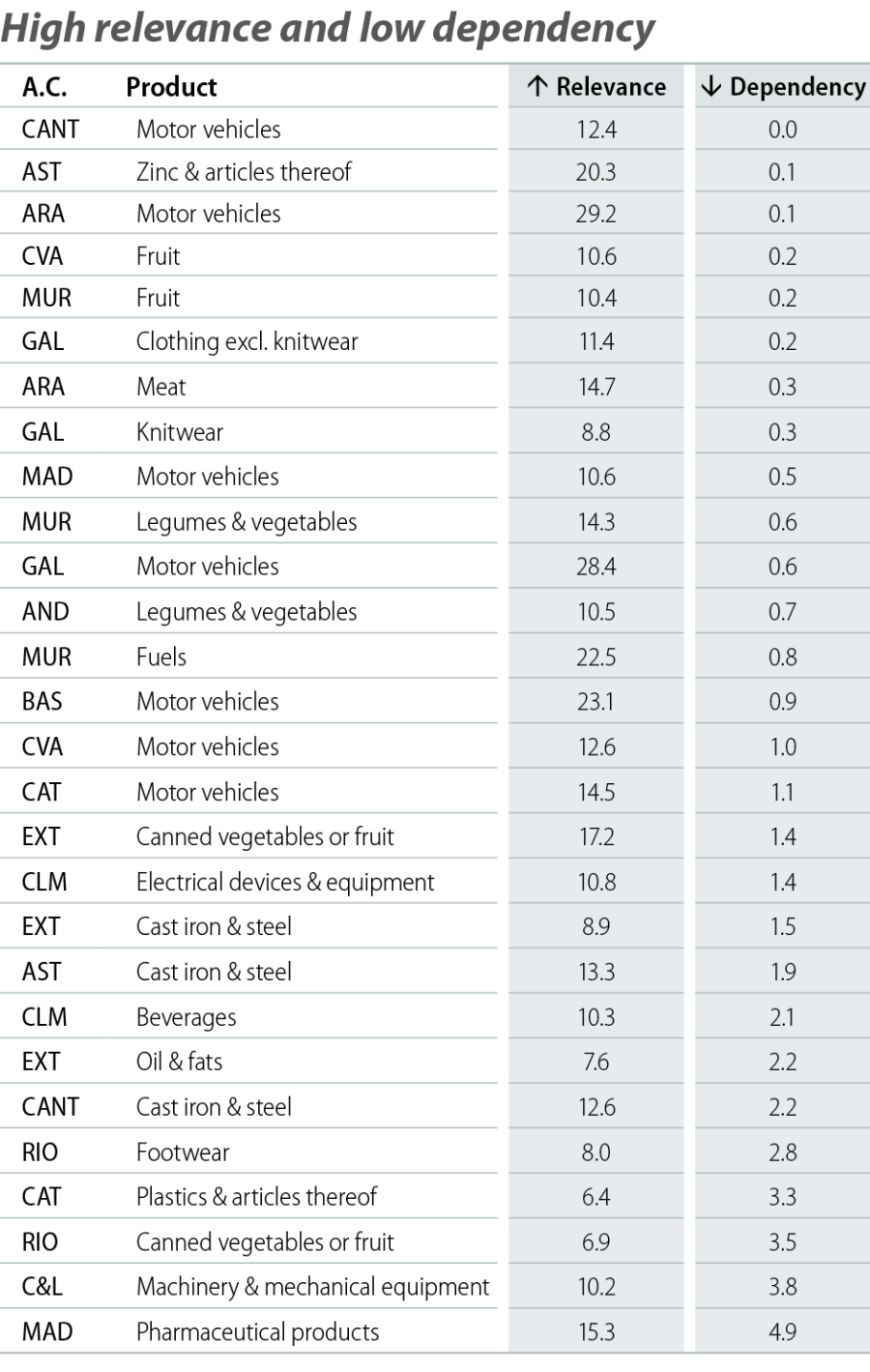

In the lower-right quadrant, we find the products with a high relevance but a low exposure to the US market. In this case, vehicle exports in several autonomous communities stand out.

As can be seen in the upper-left quadrant, the goods with the highest rates of dependency on exports to the US have a very low relevance in the total exports of each region. This is the case, for instance, for stone and plaster manufactured goods from Andalusia, which have a 54.7% rate of dependency on the US, but account for just 1.4% of all Andalusian exports.

Finally, it is worth asking what the potential impact of the tariffs is, not only on exports, but on the economy of each region as a whole, and this can be ascertained by looking at the value of exports to the US as a proportion of regional GDP (see last chart). In this respect, the region most exposed to the US relative to the size of its economy is the Basque Country, since its exports to this country account for 3.1% of its GDP, although this is still a moderate figure.

Despite the increase in US tariffs, the Spanish economy and its export sector are showing remarkable resilience. Spain’s overall exposure to the US is limited and, although there are differences between autonomous communities and sectors, no region is facing significant systemic risks. This geographical and sectoral diversification allows the aggregate impact to be moderate, which reinforces the capacity of Spanish firms to adapt to complex international scenarios. In addition, the strength and flexibility of the national export sector provide a solid foundation for further growth and diversification in global markets, even in contexts with greater protectionism.