Investment flows in times of Trump 2.0

The protectionist agenda and the withdrawal of multilateralism by the new US administration could benefit foreign investment in the euro area, thanks to its stable regulatory framework, confidence in the independence of the ECB and plans to boost spending on defence and infrastructure.

Trump continues to demonstrate a somewhat disruptive approach to legislating, marking a turning point compared to the stability and predictability of his predecessors. The new Trump administration has argued that the global economic order that has been in place almost since the end of World War II is harmful to US interests, so it must be changed («America First»). This shift, which is materialising primarily in the imposition of high and sweeping tariffs and the reduction of the country’s commitments on international security and cooperation, is leading many to wonder whether it could undermine the pillars that have sustained the dominant role of the dollar for the past 80 years.1 In this process of international geopolitical «adjustment», one of the main beneficiaries in terms of investment flows could be the euro area: it offers a stable regulatory framework, there are no doubts about the independence of the ECB, and plans to boost defence spending in Europe (the ReArm Europe plan) and infrastructure spending in Germany will provide major investment opportunities in the coming years.

- 1

See M. Obstfeld (June 2025). «The International Monetary and Financial System: A Fork in the Road». Andrew Crockett Memorial Lecture, Bank for International Settlements, 29 June.

The euro area as a destination for foreign investment

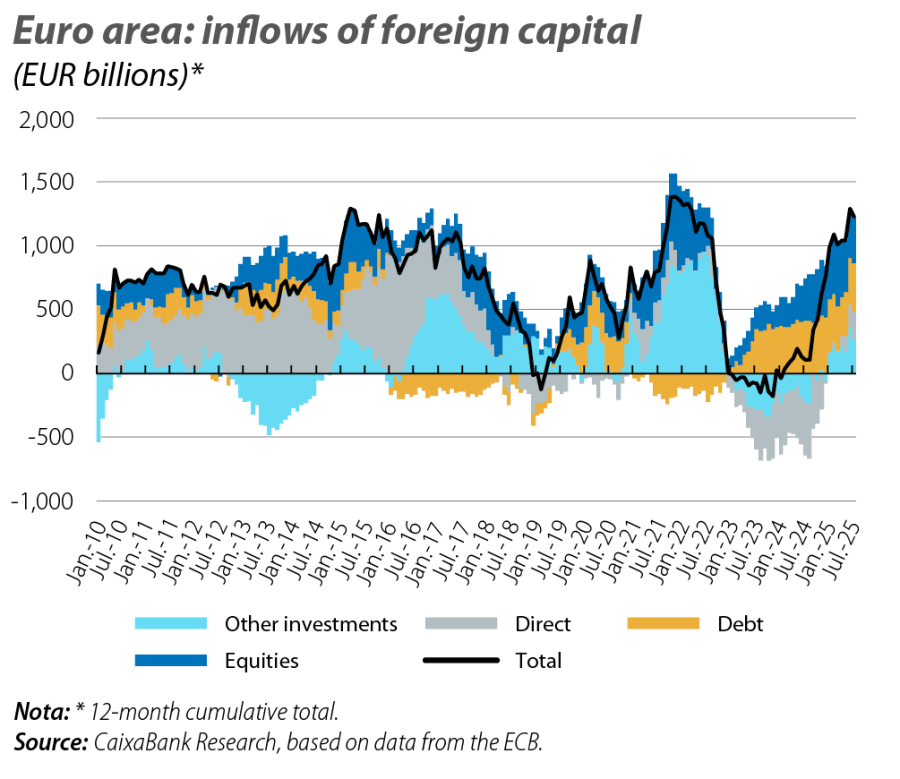

In the last two years, having overcome the halt in capital flows following the outbreak of the war in Ukraine in 2022, there has been renewed interest among foreign investors in the financial assets of the euro area, especially in 2025 and in certain asset classes, as can be seen in the balance of payments data published monthly by the ECB. In fact, in the past year up until July, inflows of foreign direct investment (FDI) and portfolio investment (fixed-income securities and equities) amount to over 560 billion euros (3.7% of GDP), which is 30% more than in the same period a year ago and the highest level since 2015. This result has been supported by the reactivation of capital inflows in the form of FDI, which in the year to July amounted to 147 billion euros, after divestments in this category reached 15 billion euros in 2024 as a whole and more than 350 billion euros in total in 2023.

In terms of inflows into debt securities and the stock market, which are much more sensitive in the short term to changes in investor sentiment, there were significant outflows of investment in April following the announcements of reciprocal tariffs on «Liberation Day», although interest in euro area assets subsequently recovered. It appears that inflows of capital into debt are the preferred option among investors, despite a rather modest start to the year, given that up until July inflows into this category from foreign investors amounted to 255 billion euros, around 20% less than those registered in the same period of 2024. As for inflows into equities, which have been highly volatile this year, in the year to July they stood at 162 billion euros, 20% less than in the same period last year.

The US and its historical need for foreign savings

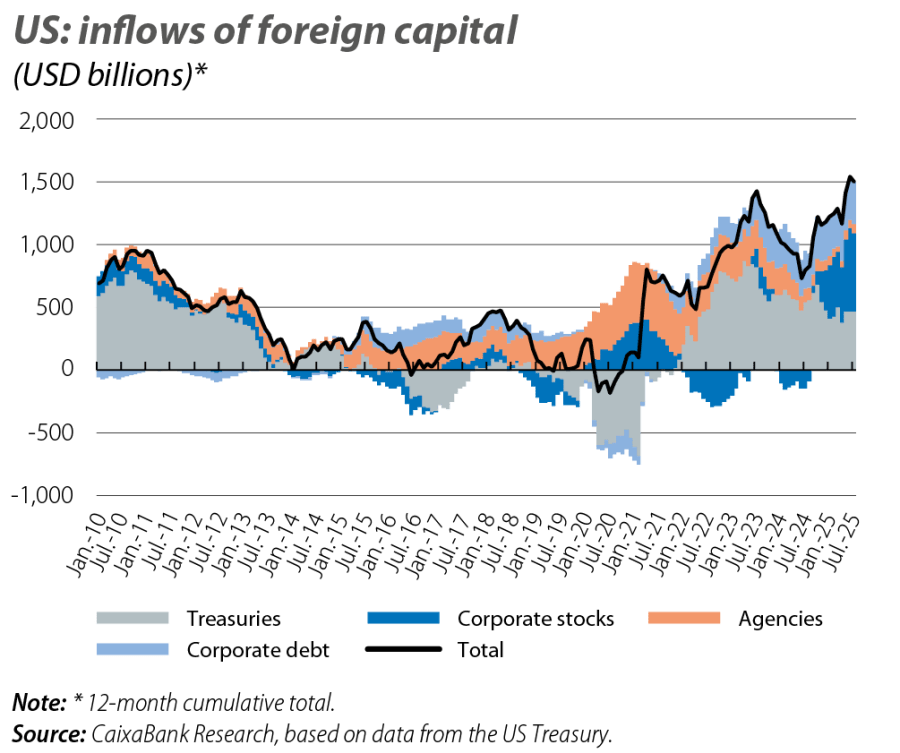

The US has traditionally maintained a deficit in its current account balance (above 3.0% of GDP, on average for the last two decades), as a result of its savings being insufficient to meet its funding needs (especially in the public sector). However, it has been able to finance this deficit thanks to a significant inflow of foreign capital. Although the tariffs seek to reduce these imbalances, the outlook suggests that, at least for the next two years, the current account deficit will remain at close to 3.0% of GDP. Therefore, it remains vital that foreign capital continues to flow into the US economy in order to finance this deficit.

In order to analyse the evolution of capital flows into/out of the US, we use the monthly statistics on international capital flows published by the US Treasury. The breakdown by investment instrument offered by the Treasury statistics is not exactly the same as that offered by the ECB (there is no data for FDI), but this does not prevent us from making a comparison of the investment flows entering both economies.

The Treasury data reveal that, while the increase in uncertainty does cause significant capital outflows (such as in April, following the announcements on «Liberation Day»), US financial assets have not lost their appeal among foreign investors. In fact, so far this year up until July, foreign investors acquired US financial assets amounting to 878 billion dollars, up from 558 billion in the same period last year. Most of this improvement rests on the significant inflow of capital into equities: 272 billion dollars, compared to outflows exceeding 37 billion suffered in the same period a year earlier. Meanwhile, treasuries continue to maintain their appeal and up until July they registered inflows of 376 billion dollars, just 4.0% below what was invested in the previous year. It should be noted that this greater appetite for US financial assets is driven by private investors (who account for almost 80% of all positions), as governments and central banks are significantly reducing their holdings of assets in dollars: up to July, the balance of inflows from institutional investors is practically zero, compared to inflows of around 50 billion in the previous year. This pattern is part of a trend observed in recent years and responds to the strategy being pursued by many central banks (especially in emerging economies) to reduce their dependency on the dollar, while increasing positions in other currencies, thus strengthening their strategic security.

Conclusions

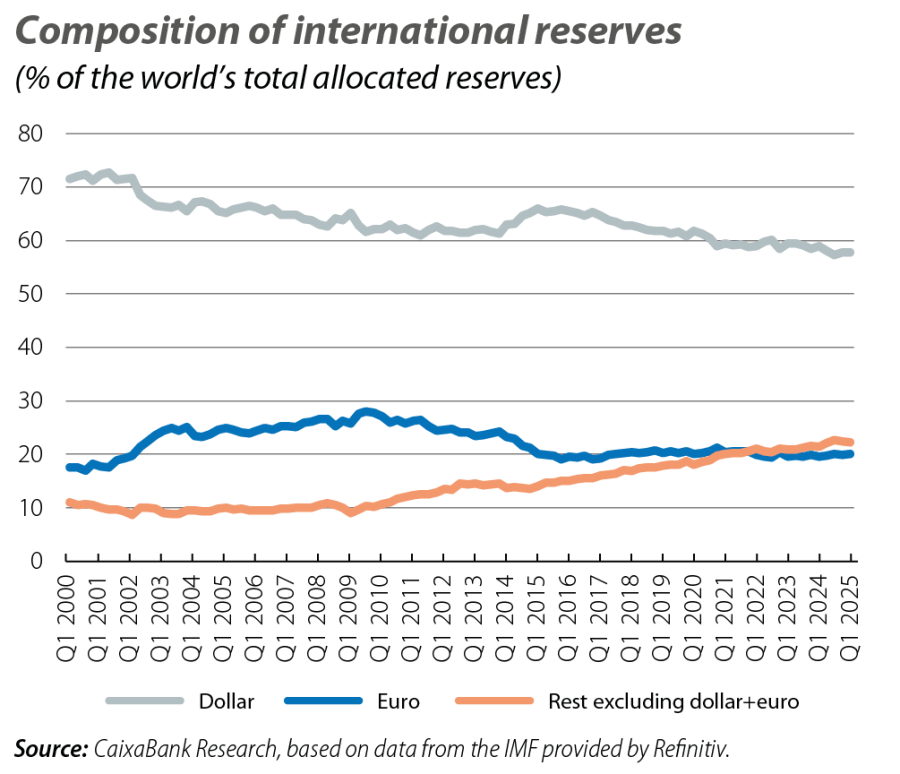

The data show the high sensitivity of capital flows to increased uncertainty, and this requires us to be particularly cautious to ensure these short-term movements do not cause us to lose sight of the bigger picture. Analysing the cumulative picture for the past 12 months, which offers a more balanced view of the underlying trends, we note a substantial revival of inflows of foreign capital into euro area assets since their lows at the end of 2023. This helps to explain the sharp appreciation registered by the euro: of around 20% against the dollar and more than 12% in nominal effective terms. However, this greater preference for euro area assets has not come at the expense of lower demand for US financial assets, which are at almost all-time highs, thanks to private investors. In fact, over the past two decades, governments and central banks, particularly in emerging economies, have been reducing their exposure to the dollar in a bid to reduce their dependency on the US currency, thereby strengthening their strategic security and financial sovereignty. So much so that the dollar, despite still being the predominant currency, has steadily seen its share of global reserves wane over the last two decades: today, it represents 58% of the total, compared to around 72% in the year 2000. In this repositioning of portfolios in favour of other assets, gold is emerging as the major beneficiary: in 2024, central banks’ purchases of gold more than doubled the annual average of the previous decade. As a result, and in a context in which the gold price continues to break records, this asset now represents almost 20% of the official reserves at market prices, almost matching the euro, which represents around 20%, a level at which it has remained quite stable in the last decade.2

However, several studies show that increasing consideration is being given to geopolitical relations when it comes to investment decisions, and that rising geopolitical tensions lead to lower cross-border capital allocation. If this process of fragmentation continues, in the long term we could find ourselves in a multi-polar financial system, in which the dollar would have to coexist with other influential currencies. Nevertheless, any change in the dollar’s leading role would be a very gradual process, but it is worth keeping these risks in mind in the current context of a reconfiguration of relations and possible conflicts between the major powers.3