Domestic demand, supporting the Spanish economy

The economy continues to enjoy strong growth, with domestic demand acquiring a more prominent role, largely supported by the buoyancy of the labour market. Electricity keeps inflation at around 3%, while house sales buck the upward trend for the first time since 2024.

Domestic demand takes on a more prominent role

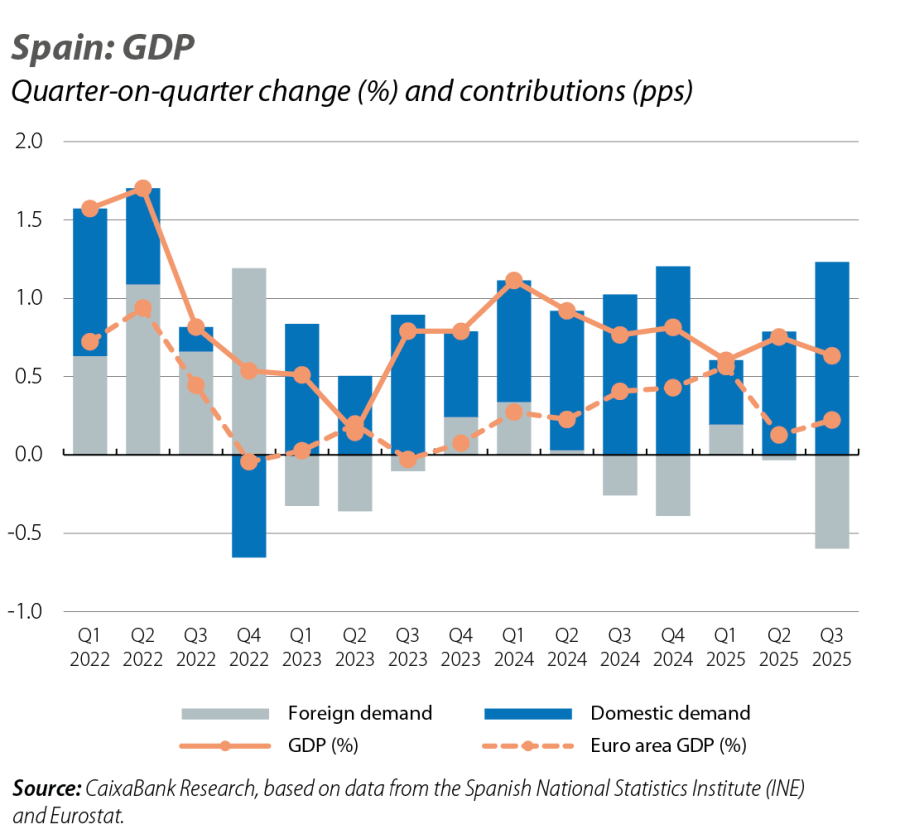

The Spanish economy continues to enjoy strong growth. GDP grew by 0.6% quarter-on-quarter in Q3 2025, far outpacing the euro area, at 0.2%, as has become the norm of late. The composition of the growth reveals a very favourable picture, albeit with some nuances. The economy is growing because households are spending more – private consumption grew by 1.2% quarter-on-quarter – and because companies are investing more – investment grew by 1.7% quarter-on-quarter. We have also seen a recent rebound in public consumption, which was up 1.1% quarter-on-quarter, although this has come after three quarters of practical stagnation, so in year-on-year terms public consumption has grown by a modest 1.3% in Q3.

Overall, domestic demand contributed 1.2 pps to quarter-on-quarter GDP growth. This is a very high figure and, with the exception of Q4 2024, we have not seen such levels since late 2021, at the height of the post-pandemic recovery. The negative contribution came from foreign demand, which subtracted 0.6 pps from GDP growth. This was due to a fall in exports, of 0.6% quarter-on-quarter, combined with a notable increase in imports, of 1.1% quarter-on-quarter. Thus, whereas the foreign sector was one of the main pillars of growth in 2023 and still managed to contribute slightly to GDP growth in 2024, in 2025 it is subtracting growth.

Divergence: the balance of trade in goods deteriorates, while that of services improves

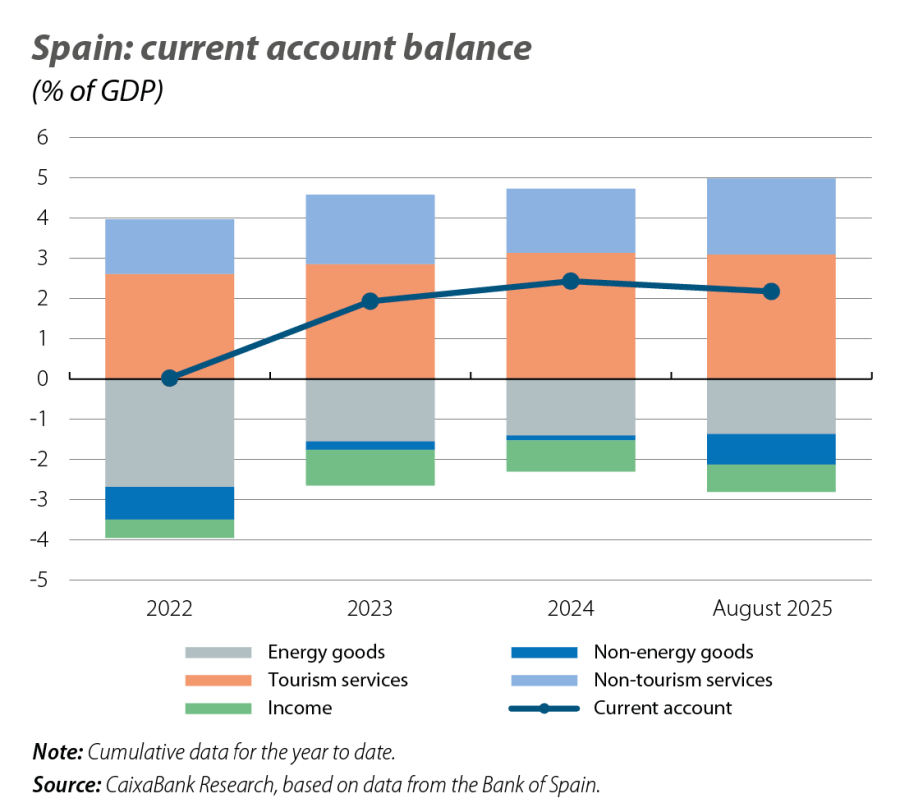

The poor performance of exports in Q3 was due to exports of goods. Customs data up to August confirm that the balance of trade in goods continued to deteriorate, and this is entirely due to non-energy goods. Thus, in the current year up until August, the balance of trade in non-energy goods showed a deficit of 0.8% of GDP, compared to a deficit of just 0.1% of GDP in the same period last year. Much of this 0.7-pp of GDP we have lost is down to the lower growth of exports, which are no doubt feeling the impact of the US’ protectionist shift. The data for services, in contrast, remain very positive, albeit not enough to fully offset the deterioration on the goods side. In particular, tourism services are progressing in line with the performance of the previous year, while non-tourism services are exceeding it: the cumulative surplus up until August stood at 1.9% of GDP, 0.3 pps more than in the same period in 2024. However, the current account surplus is not in danger: in the current year to August, the current account shows a surplus of 2.2%, just 0.3 pps lower than in the same period of the previous year.

The first available indicators suggest that domestic demand remains strong

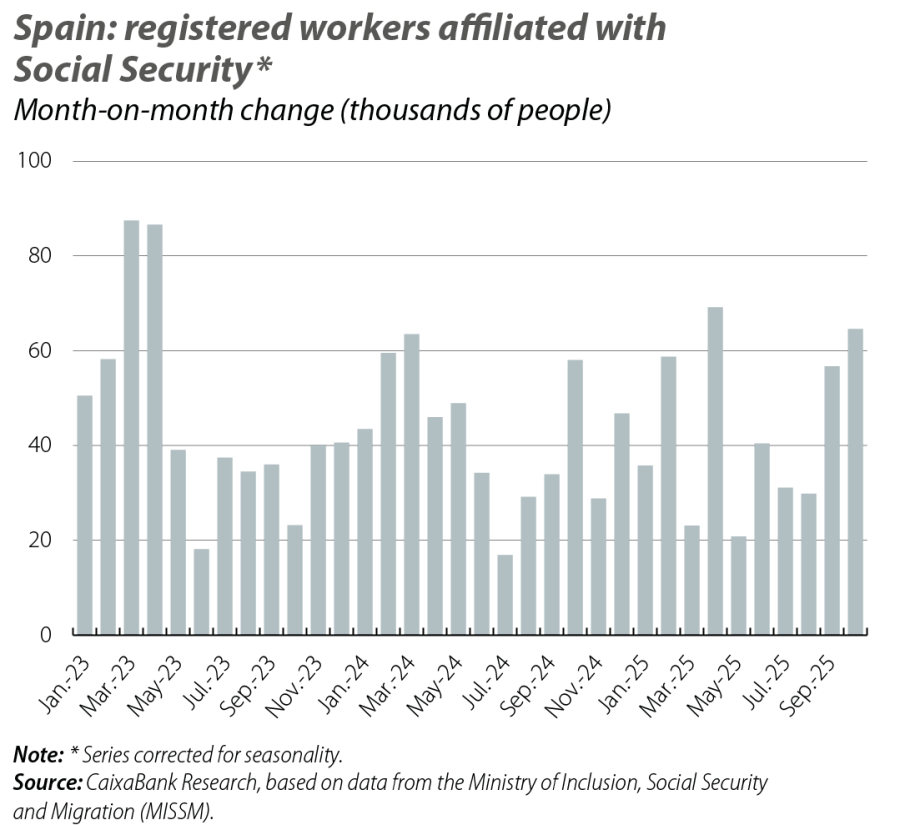

The strength of domestic demand is largely supported by the buoyancy of the labour market. According to the Labour Force Survey (LFS), employment grew by 0.4% quarter-on-quarter in Q3 – a rapid pace. As for the Social Security affiliation data for October, the first available month of Q4, they continue to exceed expectations, with an increase of around 142,000 workers; this is the biggest advance in a month of October, with the exception of 2021. With this figure, the number of registered workers in October stands 0.52% above the average figure for Q3, so it looks likely that in Q4 we will see an acceleration of the quarter-on-quarter growth rate (which in Q3 was 0.48%).

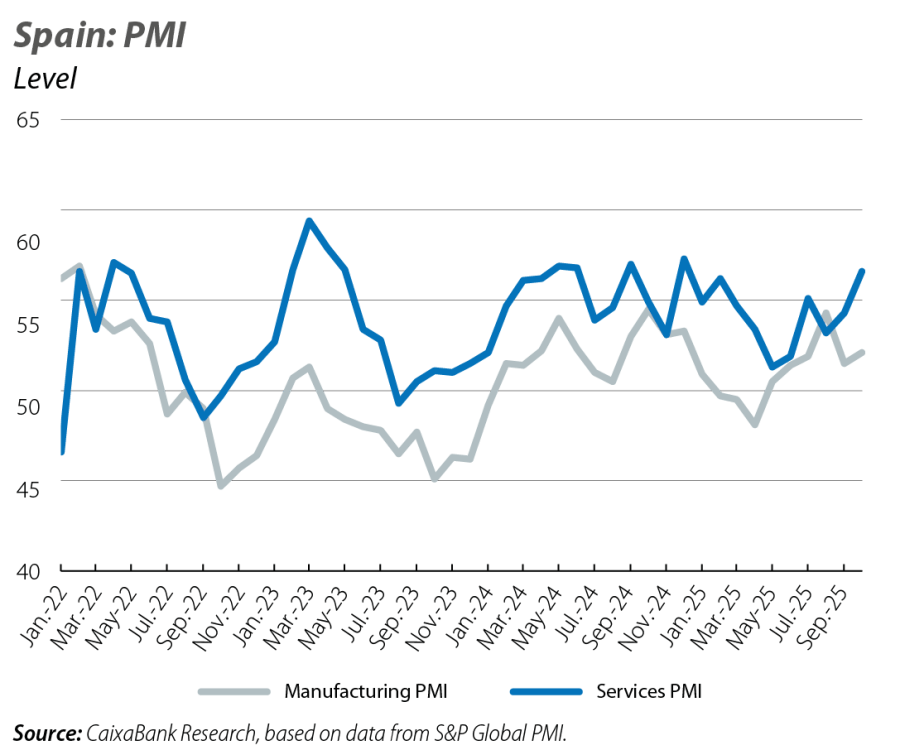

The Purchasing Managers’ Indices (PMIs), meanwhile, also suggest that economic activity is healthy. In October, the PMI for the manufacturing sector advanced 0.6 points to 52.1 points, well above the threshold that marks growth in the sector (50 points). Also, the PMI for the services sector gained 2.3 points and reached 56.6 points, the highest level in the last 10 months, indicating a significant growth rate in the sector. Finally, with data up to 21 October, the CaixaBank Research consumption indicator, which is based on duly anonymised data on card spending and cash withdrawals, shows a 0.4-pp acceleration in the year-on-year growth rate compared to the previous month, reaching 4.8% (3.2% on average in Q3). Overall, the good figures for employment and for the sentiment and consumption indicators suggest that domestic demand remains strong in the final quarter of the year.

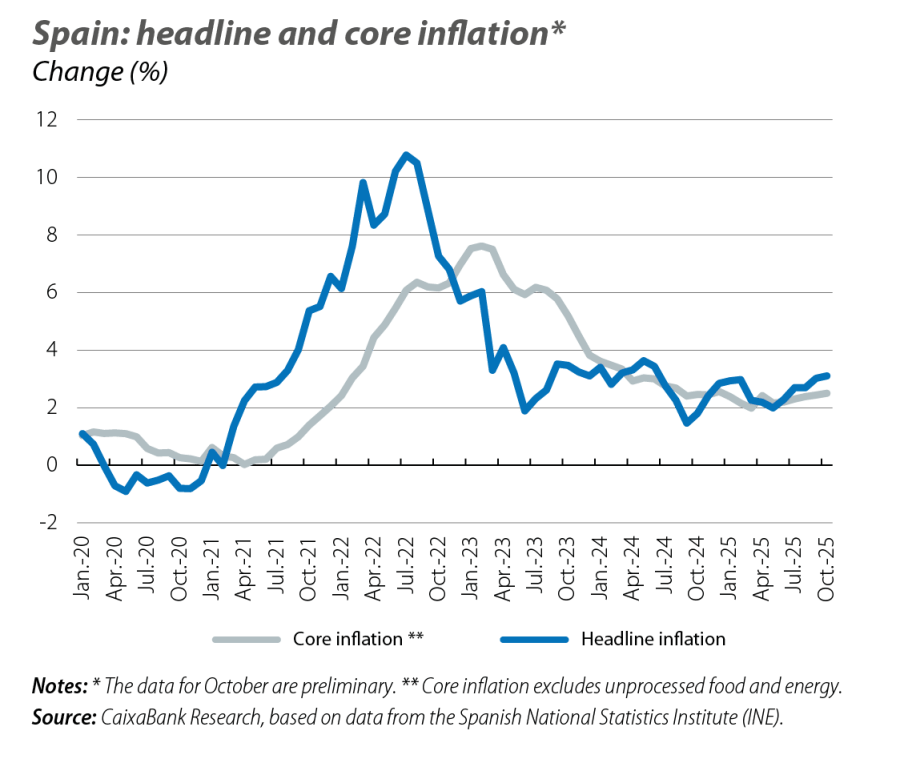

Electricity keeps inflation at around 3%

In October, inflation in Spain stood at 3.1%, 0.1 pp above the previous month and widening the gap with respect to the euro area, for which inflation has fallen 0.1 pp to 2.1%. This gap, which at first glance could be concerning, requires some qualification, since it is largely explained by the energy component. Core inflation, which excludes energy and food from the calculation, stood at 2.7% in Spain in September compared to 2.4% in the euro area – a much smaller difference. Despite this, a slight gap persists even in the core index, which is derived from the services component. Looking at this component in more detail, its evolution is increasingly marked by the dynamics of services that are periodically revalued. In their latest update, these services experienced a significant increase, and this has kept their year-on-year rate of change stable at relatively high levels. This is the case, for example, for health and car insurance services, for which the average inflation for the year to September – the last month for which we have data from the breakdown – stands at 10.3% and 9.5%, respectively. On the energy side, the contribution from this component to inflation ought to subside over the coming months, based on the outlook according to the futures markets – with oil and gas prices remaining contained – and the fact that, in January 2026, the impact of the VAT hike on electricity bills that occurred in January 2025 will fall outside of the inflation calculation.

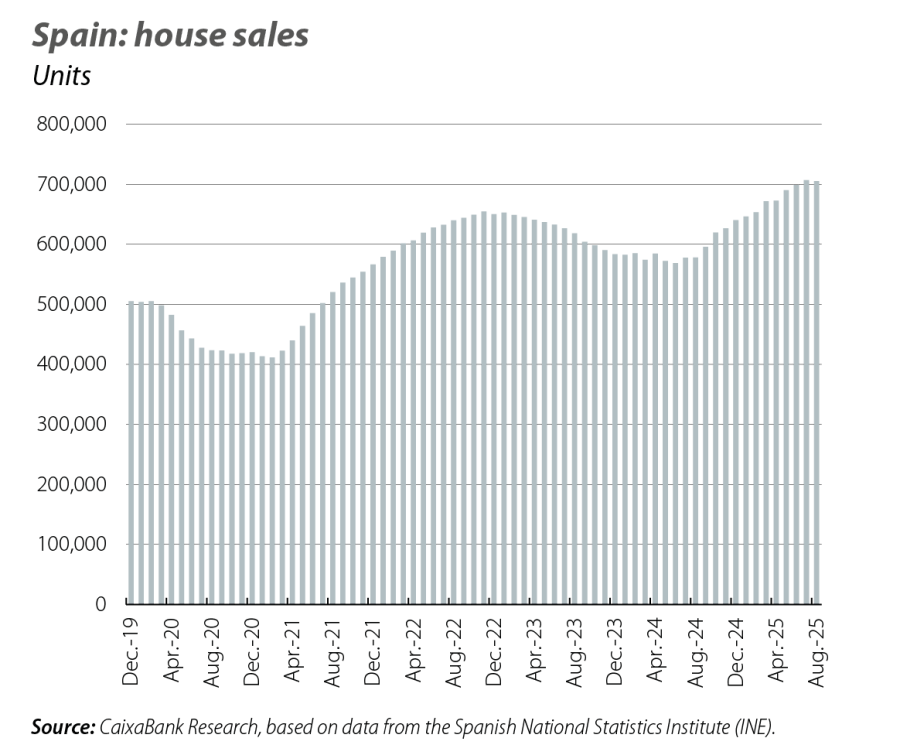

House sales in Spain buck the upward trend

Sales registered a year-on-year decline of 3.4% in August, the first setback since 2024. Although it is premature to draw definitive conclusions from a single data point, in a month which traditionally presents low residential activity, it is a first sign of moderation in the pace of growth in demand. In any case, activity in the sector remains high: so far this year, around 470,000 sales transactions have been completed, representing a 16% increase over the same period in 2024.