The IMF and European Commission assess favourably the reform programme

Every quarter, the International Monetary Fund (IMF) and European Commission (EC) analyse the progress made in implementing the Memorandum of Understanding (MoU) that accompanied the ESM loan to Spain in July 2012 to recapitalise banks. In their third report, published in July, both institutions gave an overall positive appraisal.

The IMF and EC agree that the vast majority of the measures specified in the MoU have already been applied. They highlight the recapitalisation carried out through Spain's bank recapitalisation fund (FROB) and the transfers of problematic assets to its external asset management company (Sareb). The bail-in has also been completed, sharing losses among holders of shares, preferred shares and subordinated debt. Thanks to all this, the solvency ratios of all banks identified as problematic in last year's stress tests, together with those of the rest of the banks, currently exceed the regulatory minimum.

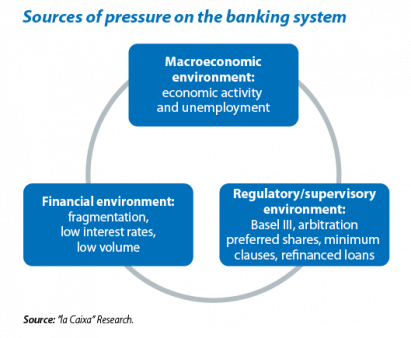

One of the challenges from now on is to maintain the levels of solvency achieved. In this respect, these international organisations underline the pressures that are still affecting Spanish banks: a weak macroeconomic environment which means a growing volume of provisions for non-performing loans; a further increase in reserves related to refinanced loans, in accordance with the Bank of Spain's new criteria; the entry into force of Basel III, which particularly penalises Spanish banks due to their high level of deferred tax assets (which will have to be deducted from their capital); and the potential costs resulting from the ruling regarding the elimination of non-transparent minimum mortgage rate clauses, as well as from arbitration underway regarding preferred shares and subordinated debt and some legislative initiatives affecting housing at the level of the autonomous communities.

The main strategies and recommendations to tackle these pressures include: strengthening the capacity of financial institutions to generate profits, involving significant cost adjustments given their limited capacity to generate new income; restricting the distribution of dividends, in line with the Bank of Spain's communication last June, limiting cash payments to 25% of earnings; and considering converting deferred tax assets into tax credits (for example, as Italy did recently).

In addition to maintaining an appropriate level of capital, other measures have also been proposed to stimulate credit: at the level of Spain, for example, more bank financing by the ICO for credit to SMEs and a continuation of the supplier payment programmes for public administrations, injecting liquidity and improving the solvency of a large number of firms. The IMF has also particularly stressed the need, at a European level, to accelerate and enhance the banking union in order to break the link between the banking and sovereign systems and thereby allow firms to attract financing according to their own merits, without being penalised by their country of origin.

These international institutions also highlight the need to continue restructuring the nationalised banks. More specifically, the IMF has urged Spain to specify the «exit strategy» in each case. In this respect, the government has announced that it plans to sell the FROB shares in NCG Banco and Catalunya Banc over the coming months.

With regard to Sareb, a significant challenge is posed by the implementation of its business plan. In this respect, the EC and the IMF recommend basing this plan on more conservative price forecasts for housing than the current forecasts being used.

Among the few measures pending full implementation, of note is the Bank Foundation Act. The bill that is currently going through parliament contains, as specified in the MoU, incentives for savings banks to reduce their positions as majority shareholders in the banks they control. This bill is expected to be passed before the end of the year.