The USA: acceleration in 2014 depends on investment

The USA's GDP posted 2.8% annualized quarter-on-quarter growth in Q3. First impressions are positive: this figure greatly exceeds the 2.0% predicted by the consensus of analysts and seems to confirm a scenario of acceleration. Optimism has been further boosted by various partial indicators for Q4 that show little impact from the shutdown at the beginning of October. However, a detailed examination of the breakdown by GDP component invites caution regarding our forecast that growth will reach 2.8% for 2014 as a whole: some of the pieces required to promote sustained growth are still missing and the risks continue to be downwards.

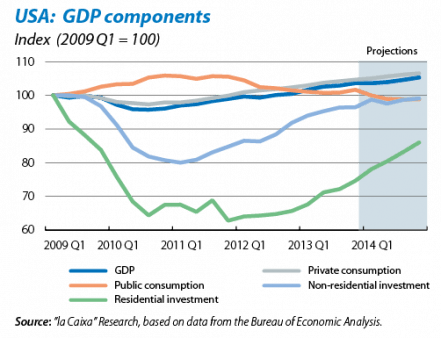

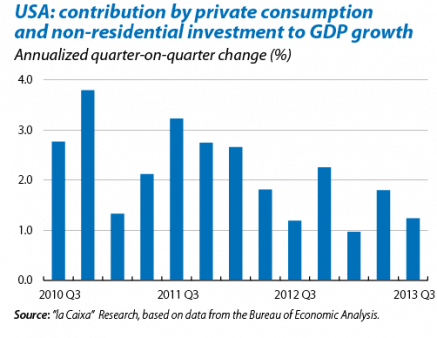

This surprising rise in Q3 growth was due to the high contribution by stock variations (0.8 points of the total of 2.8) and public consumption, which did not fall as much as expected. However, the two main components of private domestic demand were disappointing: private consumption and non-residential investment. Their joint contribution to GDP growth was just 1.2 percentage points, barely half the average during the period of 2000-2007. This lethargy in consumption and investment (which account for 80% of GDP) shows that, for the time being, the private sector is finding it hard to react to the monetary stimuli being applied.

Our forecast of higher growth for 2014 is based on an improvement in private consumption and investment. We expect three factors to help private consumption. Firstly, the fiscal adjustment in 2014 is likely to be slightly less than in 2013. Secondly, household wealth should continue to improve: house prices are growing steadily and household debt is falling. However, the third factor, namely recovery in the labour market, is more tepid. We expect employment to improve but slowly and modestly. This will lead to very slight wage rises (household income), making it difficult for private consumption to grow by more than 2.5%.

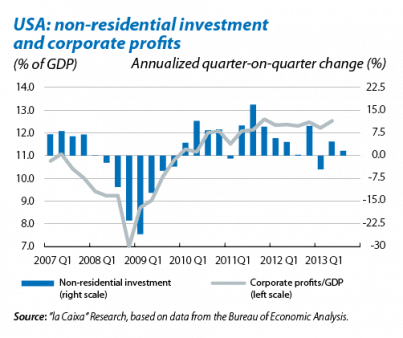

But the biggest risk to our growth forecast for 2014 is non-residential investment. Q3 figures were poor, especially with regard to capital goods (accounting for half of non-residential investment), down by 3.7% annualized quarter-on-quarter and, to a lesser extent, with regard to spending on intellectual copyright (one third of non-residential investment), rising by a modest 2.2%. Our forecast is that investment will pick up steam in 2014. This projection is based on the already observed improvement in business confidence (ISM indices), on corporate earnings that continue to perform solidly and on the fact that, unlike consumption, non-residential investment is still below its 2007 level in real terms. There are therefore reasons to expect investment to pick up, although this has also been the case on previous occasions.