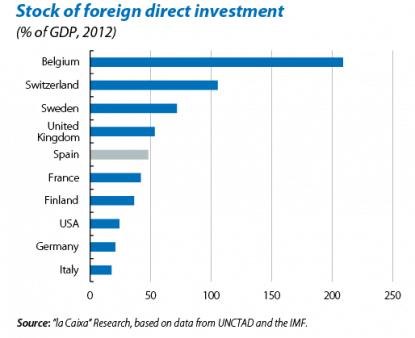

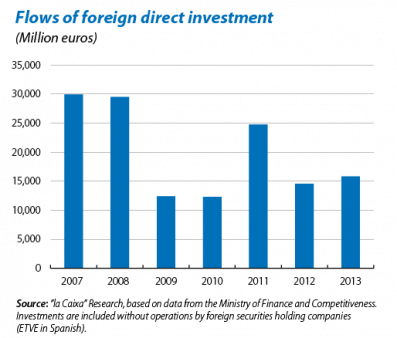

In Spain, the long-term investment in productive capital carried out by foreign firms (foreign direct investment or FDI) plays a vital role. In 2012, the stock of FDI accounted for 47.9% of GDP and, for some years now, Spain has ranked among the developed economies that receive most FDI, ahead of the USA and the main countries in the euro area and slightly behind the United Kingdom. On a global scale, although having increased by 11% in 2013, flows of foreign direct investment have yet to achieve the all-time highs of 2007. Given this context of less activity and continued uncertainty regarding the recovery of the periphery countries, it is important to note Spain's achievement by remaining in the top ten developed countries in terms of FDI received. To understand the solidity and scope of this position, we will analyse the performance of foreign investment in Spain, focusing particularly on productive foreign investment. In other words, we will exclude from our analysis operations that lack direct economic effects on the country such as the tax optimisation strategies of corporate groups.

Foreign investment increased by 8.8% in 2013 after falling substantially in 2012. Looking at the origin of these investments we can see that the euro area continues to be the main source (72.8% in 2013) and that, moreover, it contributed positively to the increase in total investment. Outside the euro area, of note is the larger role played by Latin American countries, representing 7.1% of the total in 2013, boosted by investment from Mexico. If we analyse the data by sector we can see that three industries attracted almost half of all investment: finance (19.9%), manufacturing (16.7%) and real estate (11.3%). Although investment in manufacturing decreased, this reduction can be interpreted as a temporary break after the huge influxes of 2011 and 2012. Banking investments grew but these can be explained as necessary consolidations that were postponed during the crisis and are being carried out now. It is also worth noting the positive trend in real estate investment which, in 2013, reached absolute maximums (more than double the figure in 2007).

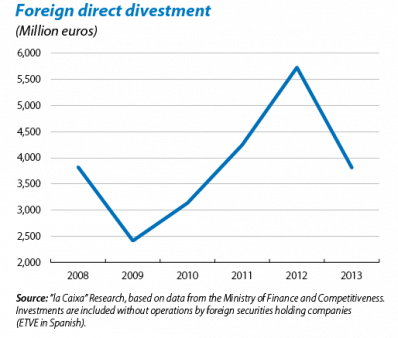

Lastly, an analysis of divestments also reveals the improved confidence of foreign firms in Spain. Divestments increased during the crisis but, in 2013, this trend reversed and they fell by 33.4%. In other words, the increase in gross foreign direct investment (8.8%) understates the rise in net foreign investment (36.3%). In short, the data confirm the good health of the Spanish economy as a receiver of foreign investment.