Global wage trends: will we get back to normal after the crisis?

The global trend in wages, and in particular the marked wage rise in certain countries, is leading to opposing positions regarding what has sometimes been called «the end of cheap labour» in the emerging countries. Are these opinions well-founded? In order to answer this question, this article will first compare the wage levels between countries and then analyse their trends during the period 2000-2011, paying particular attention to the effects of the recession in 2008-2009. Lastly, to complete this examination of global wage trends, we will review the link between growth in wages and in competitiveness.

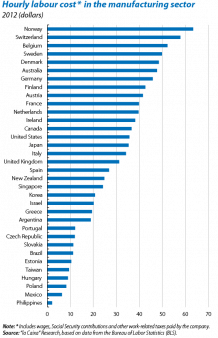

The US Bureau of Labor Statistics (BLS) provides data that help to analyse the issue of relative wage levels. According to these data, in 2012 the total hourly labour cost for manufacturing in countries such as the Philippines, Taiwan, Mexico, Poland and Hungary was below 10 dollars an hour, while in Spain this figure was 27 dollars, 36 in the United States and 46 in Germany. The BLS does not offer equivalent figures for China for 2012 but, in another study by the same institution, this country's hourly wage level was around 1.4 dollars in 2008. The distance between industrialised countries and many of the emerging countries is therefore very wide.

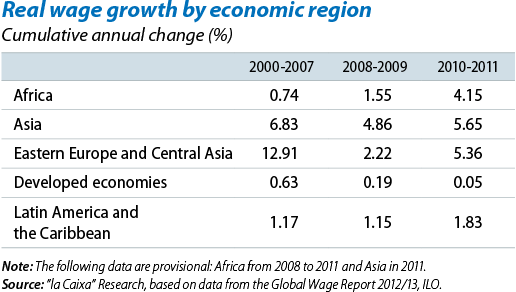

Nonetheless, these distances have tended to shrink, as a general rule, over the last decade. Between 2000 and 2007, the real average wage in emerging economies generally tended to rise, accumulating notable increases in some regions.1 According to the International Labour Organisation (ILO), during this period the emerging economies of Eastern Europe and Central Asia as a whole saw real average wages increase by 134%, and the emerging countries in the rest of Asia recorded an increase of 60%. Although other emerging zones saw smaller increases (8.5% in Latin America, 5.3% in Africa), the figures for the developed economies were even lower (4.5% increase).2 This being the general situation before the Great Recession, we should ask ourselves whether the convergence of emerging country wages towards advanced economy wages has continued after the crisis of 2008-2009.

The ILO data show that wages, as a global aggregate, were undoubtedly hit by the world economic shock in 2008. Before the crisis (2000-2007), the annual growth in global wages was 2.2%, whereas in the two years affected directly by the Great Recession (2008 and 2009) this rate slowed up to 1.2% year-on-year. After the crisis, in the period 2010-2011, annual growth stood at 1.6%. As a result of this situation, the average global wage in 2011 was 6% higher than in 2007. However, this general view must not ignore the fact that the rate of growth varies considerably between regions and in particular between the emerging economies and the group of advanced economies. Before, during and after the crisis, advanced economies have seen clearly lower growth rates in wages than the emerging regions. Wage convergence is therefore still continuing. Given its economic importance, one case that demands particular attention is China. Since the regional and global averages are calculated as a weighted average, the Asian giant affects our interpretation of the aforementioned trends. The data corroborate this intuition, although probably to a greater extent than expected. While wages in Asia were 22% higher in 2011 than in 2007, if we exclude China from this calculation the result is that the wage in 2011 in the region would have been 1% lower than the initial figure. The effect of China is not only significant at a regional level but is also truly global: the increase, between 2007 and 2011, of the average global wage goes from 6% when China is included to just 1.8% when it is excluded.

Given this situation, are the fears still valid that the emerging countries are gradually losing one of their competitive advantages, namely low wages, before they have fully completed their modernisation and achieve the levels of relative prosperity enjoyed in the advanced countries? First of all, we must remember that the trend in wages, by itself, does not help us to determine whether a country's competitiveness is being eroded or not: if its growth in productivity is greater than the growth in wages, a country's competitiveness will improve. The ILO data suggest that, between 2008 and 2011, this was indeed the case in quite a few economies in Asia, Latin America and Africa. Therefore, on numerous occasions we could say that their wage growth is «healthy». However, one of the most notable exceptions is China. In the period 2008-2011, still according to the ILO data, real wage growth was around 11% year-on-year. Given that China's growth in productivity during this period was in the order of 8%, the country's competitiveness has diminished when measured in unit labour costs.

In summary, from this review of the situation we can conclude three fundamental ideas. Firstly, the wage gap between the advanced and emerging countries is still wide. Nonetheless, and this the second conclusion we should bear in mind, wage convergence has been occurring for years and the Great Recession of 2008-2009 has not brought about any substantial change to this trend. Lastly, it should be noted that, on numerous occasions, the wage growth of the emerging countries is taking place within what we have called a «healthy» context, i.e. with productivity rising faster than wages.

Àlex Ruiz

International Unit, Research Department,

"la Caixa"

1. Global average calculated as the weighted total of six economic regions: Africa, Latin America and the Caribbean, Asia, developed countries, Eastern Europe and Central Asia and the Middle East.

2. To measure wages, the ILO uses the national monthly wage (without transfers or tax), measured in real terms and adjusted for purchasing power parity. The data in this article come from the Global Wage Report, 2012/13, ILO, 2013.