Limited impact from the upswing in political uncertainty

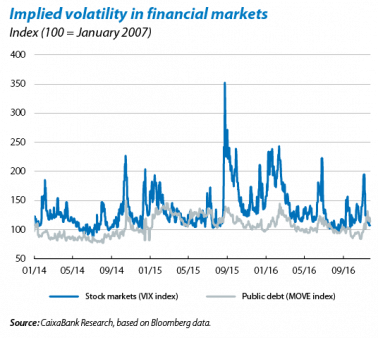

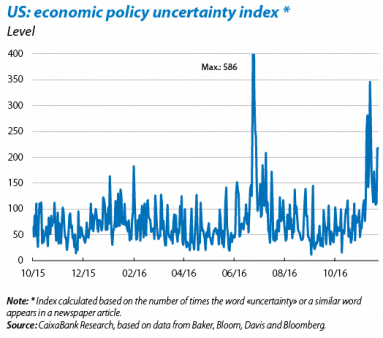

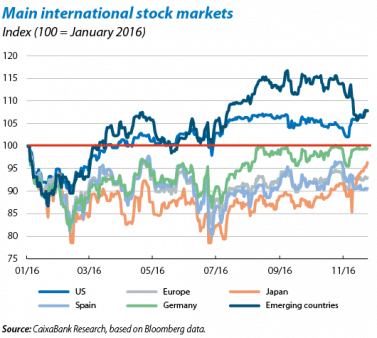

Global markets handle the second shock of uncertainty for the year to date with relative success. Political events have once again surprised a large proportion of the international community. Donald Trump’s victory in the US elections, against all predictions, has once again highlighted the growing importance of the political factor as a prime source of risk. As expected, the Republican candidate’s election has triggered quite large fluctuations in the main types of assets, although the direction of some of these movements has also come as a surprise ex post. The climate of high risk aversion and volatility has faded quickly; stock markets have managed to make up their huge losses and yields on long-term sovereign debt have reversed their initial falls. This risk-on dynamic, characterised by a sharp upswing in risk-free interest rates, gains in developed stock markets and the appreciation of the dollar, has remained in the weeks after the electoral outcome but it is not sure whether this pattern will continue for long.

Post-electoral uncertainty will not disappear and will remain high, especially in areas related to economic policy. Once D. Trump moves into the White House, several questions will emerge which, in the short and medium term, investors will have to live with. These concern almost all public policies, from immigration, trade, foreign policy and regulation to economic policy. But market attention is focussing particularly on the last area, economic policy, at least in the short term. As of today it seems very likely that the new Administration will carry out a moderately expansionary fiscal policy involving tax cuts and more spending on infrastructures and defence and we expect this fiscal impulse to bring about slightly higher rates of GDP growth and inflation in the US than previously expected, both in 2017 and 2018 (see the section on the International Economy in this Monthly Report for more details). Nevertheless, the high uncertainty will continue until the new Administration actually takes over and starts to specify its measures.

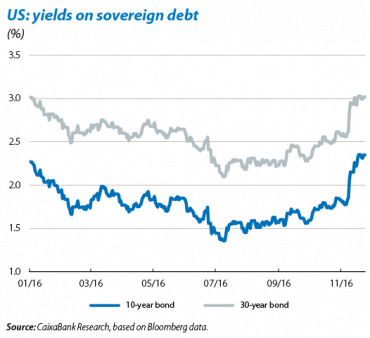

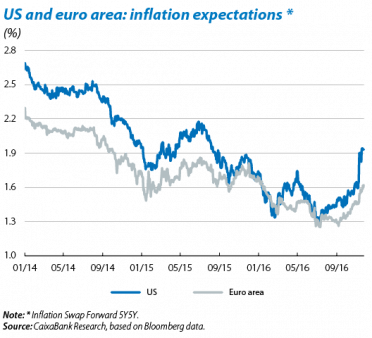

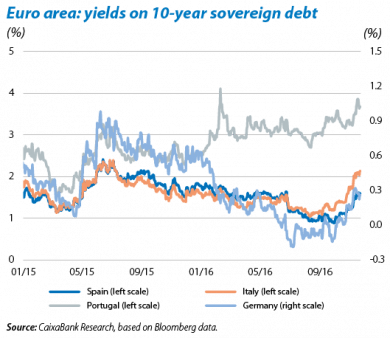

Expectations concerning a change in direction for fiscal policy trigger sharp upswings in sovereign bond yields. The rise in long-term sovereign yields has been substantial. In the US, the yield on the 10-year bond has increased by 50 bps since the Presidential election, up to 2.35%, while the yield on the 30-year bond has risen by 40 bps to 3%. Although sovereign debt in Europe and Japan has been less affected, it has not remained on the margins of this dynamic. The IRR for the bund has risen to 0.25% and the rate for Japan’s 10-year bond to 0.05%. This readjustment in sovereign yields is largely due to increased expectations of growth and inflation, in turn because of the outlook for fiscal stimuli. Particularly important is the correction recorded in long-term inflation expectations in the US, close to 30 bps.

Various factors suggest this upswing in yields will be more permanent than temporary. The shift in the Trump Administration’s policy mix towards more expansionary fiscal policies and increased risk due to its protectionist measures suggests a scenario of somewhat higher long-term interest rates. This has probably had an effect on the normalisation of the risk premium for longer-term Treasury bills, which has recently fallen to unusually low levels. In the medium term the pressure that may be exercised by expansionary fiscal policy on public finances will also be important. With public debt ending this year close to 110% of GDP, investors are increasingly concerned about such high levels.

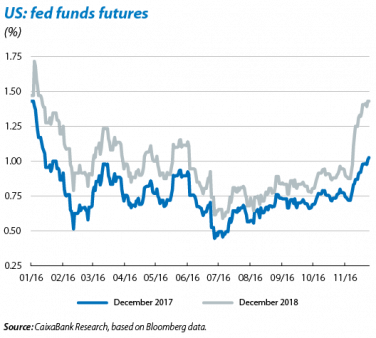

In this environment, the Federal Reserve (Fed) will not alter the next steps in its normalisation strategy. Given the large amount of uncertainty in the political sphere, the Fed will choose to provide some clarity through its messages and future actions. With a view to its December meeting, the CaixaBank Research scenario assumes that the central bank will raise the fed funds rate to 0.50%-0.75% at the same time as repeating the conditions for future hikes, namely the trend in business indicators, prices and wages. In this respect, given that a moderate acceleration in growth and inflation is expected for 2017 and 2018, monetary policy is also likely to take a less accommodative stance. The US money market has also followed the same lines, assuming one interest rate hike in 2017 and two in 2018 compared with none and one, respectively, before the US elections.

High expectations regarding the adjustments to be announced by the ECB in its asset purchase programme (QE). After its meeting in October, when no great changes were made, the bulk of the evidence suggests that the ECB’s Governing Council (GC) will announce significant modifications to QE in December. Attention will be focused on the likely extension of the asset purchase programme beyond March 2017, as well as on possible references to the start of tapering. In the last few weeks statements made by different GC members, at times conflicting, have not helped to make the ECB’s intentions any more certain. Nonetheless, the tone of the minutes to October’s meeting suggests Draghi will be cautious and focus his speech on reinforcing the ECB’s commitment to achieve its inflation target. Such caution seems appropriate given the political uncertainty, both at a global level and also in Europe. Events such as Italy’s referendum on 4 December and general elections in the Netherlands, France and Germany next year mean that political risk will not subside.

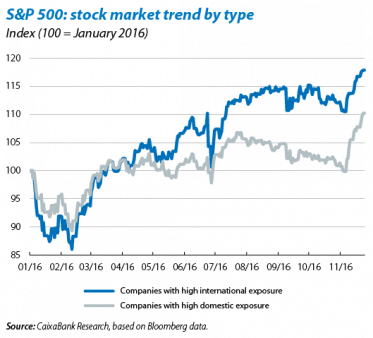

Equity takes advantage of the upswing in volatility in sovereign bond markets. One of the most visible consequences of the outcome of the US elections has been the shift in flows observed from fixed-income securities towards the equity of the advanced bloc. This is somewhat paradoxical if we remember that, in the eyes of most investors, a victory for Trump represented a notable risk. The S&P 500 is more than 2% above its pre-election level, the Nikkei is almost 7% higher while the Eurostoxx is only 0.5%. However, it is not sure whether this positive pattern will continue as it is vulnerable to changes in how investors perceive the factors that seem to support this solid performance by the US stock market. A closer look at the post-election rally shows it has been caused by gains in those sectors that could most benefit, a priori, from the decisions taken by a Trump Administration, such as finance, energy, industry and infrastructures while the gains made by US firms with a more domestic focus are also revealing. Beyond short-term movements, the truly important question is whether the policies adopted by the Trump Administration will be able to promote long-term growth without generating notable imbalances or whether, on the other hand, their effects will be temporary.

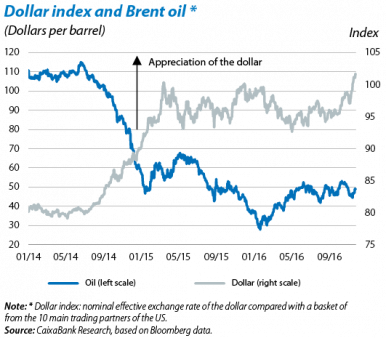

The emerging financial environment is faltering given the new political scenario in the US. The combination of expansionary fiscal measures and less accommodative monetary policy in the US does not help emerging assets to perform well. Emerging stock markets and currencies have been hit hard by this change in the US policy mix and there has been a sharp increase in capital outflows from the emerging stock and bond markets, albeit to a greater or lesser extent depending on the country concerned. The appreciation of the dollar, which in nominal effective terms exceeds 4% since Trump won the election, and the upward trend in yields on US sovereign debt are increasing the risks to financial stability for some countries. However, the emerging bloc as a whole is taking on this less favourable environment in a much stronger position than in previous episodes of instability. For example, today macroeconomic vulnerability is substantially lower thanks to many countries reducing their internal imbalances (see the Dossier article in this Monthly Report «Outlook for the emerging markets in 2017» for a more in-depth analysis of the strengths and weaknesses of the macroeconomic and financial situation of the emerging countries). Lastly, additional support could also come from rising oil prices. The agreement reached by OPEC members to reduce the production of crude should help in this respect, although its implementation will have to be credible and orderly for oil prices to become more stable.