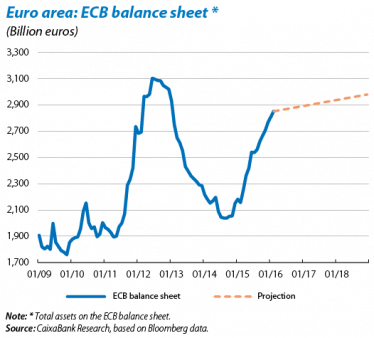

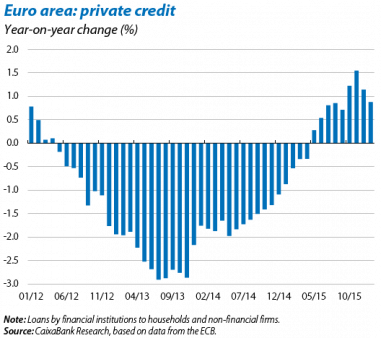

The ECB makes a surprisingly extensive move. On 10 March the ECB announced a new package of measures: interest rate cuts (lowering the Refi rate to 0.00% and the deposit facility rate to –0.40%), enlarging the bond purchase programme (by an extra 20 billion euros a month, up to 80 billion, which would place the ECB's balance sheet at around 3 trillion euros in 2017), including corporate bonds in the purchase programme and holding four new TLTROs which, if certain conditions are met, will be at a negative interest rate. As a whole these actions, more accommodative than expected, intensify incentives to grant loans and reinforce expectations of very low interest rates for a long time to come. Given this situation it is essential to look at the reason for this further accommodation of monetary conditions in the euro area and ultimately their potential economic impact.

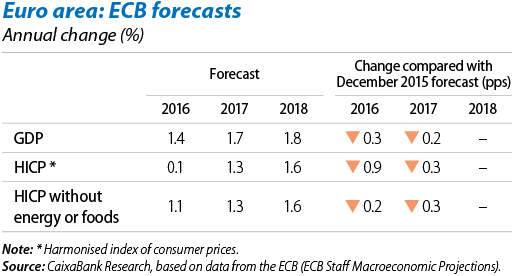

The ECB justifies this package of measures as a response to the euro area's worsening macroeconomic situation. When current forecasts are compared with those previously used by the ECB we can see a notable downward revision of the forecast for inflation and, to a lesser extent, for growth, particularly in 2016. The main reasons given by the institution for this downward adjustment are more acute risks faced by the world economy, higher volatility in financial markets and the euro's appreciation against the currencies of its trading partners as a whole. But is this scenario enough to warrant such ambitious measures of monetary accommodation? First of all we should note that, taking the medium-term view which should also be taken monetary policy, if the ECB's forecasts are accurate, in 2017-2018 the economy will grow at a rate slightly above its potential and growth in inflation will approach more normal rates (1.3% in 2017 and 1.6% in 2018). We must also remember that the ECB's scenario is sensitive to alternative hypotheses concerning oil prices. The forecasts of CaixaBank Research, for example, predict slightly higher growth in 2016 (1.6% compared with 1.4% by the ECB) and a clear recovery in inflation that could reach 2% in 2017 Q1 (partly due to a more dynamic recovery in oil prices).

The effects of the new measures will be noted in the long term. The ECB's forward guidance means that the first reference interest rate hike is unlikely to come before March 2018, a different timescale for the recovery throughout the interest rate curve compared with expectations before the announcement in March 2016. Nevertheless, as interbank rates and public debt cannot fall much further, this is likely to limit the effect of the measures on growth and inflation in the short and medium term, both via credit and also the fiscal savings entailed for countries with large borrowing requirements. The consequences of these measures will be more relevant for corporate debt, although this is a relatively small market with little capacity to grow in the short and medium term, as well as for certain aspects of the financial markets such as price changes for some assets, and also in reinforcing investor confidence. In summary we expect the ultimate impact on growth and inflation in the euro area to be relatively subdued and not to materialise until 2018-2019.

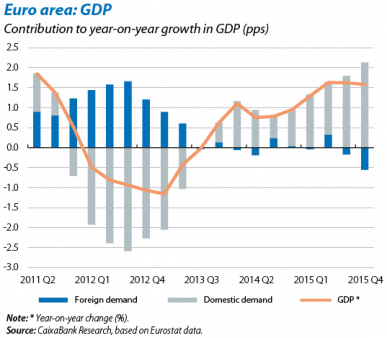

Domestic demand is driving the economic expansion of the euro area. When we move from the medium term, the timescale over which the ECB's measures will take effect, to short-term factors, it can be seen that domestic demand is still the fundamental support for the euro area's recovery. The figures of 0.3% growth quarter-on-quarter and 1.6% year-on-year for 2015 Q4 had already been published, similar to those posted in previous quarters, but the breakdown by component, published recently, confirms that the latest trends are consolidating. In year-on-year terms the contribution made by domestic demand increased (2.1 pps compared with 1.8 pps for Q3), particularly due to the acceleration in investment and public consumption (although private consumption slowed up moderately). This increasing contribution from domestic demand offset the growing negative contribution by the foreign sector (deducting 0.6 pps compared with –0.2 pps in the previous quarter) as a result of larger imports.

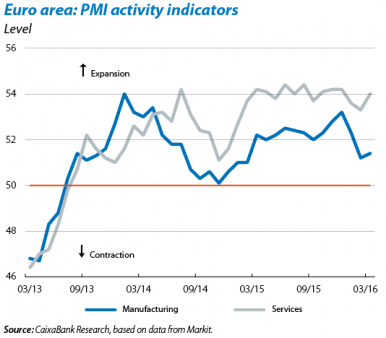

Activity rallies in 2016 Q1. The business indicators published throughout the first few months of the year point, on the whole, to growth being somewhat higher than the figure recorded at the end of 2015, a trend that is particularly reflected by supply indicators. The euro area's industrial production increased in January by 1.8% (average year- on-year change over the last three months), 0.2 pps above December's figure thanks to Germany joining the advances recorded in Spain, France and Italy after several months of a slowdown. The composite PMI activity indicator for the euro area also picked up to 53.7 points in March after two months of falls (probably reflecting the financial turbulence in January and February). By component, of note is the improvement in the PMI services indicator up to 54.0 points (53.3 in February) while manufacturing only rose by 0.2 pps to 51.4 points.

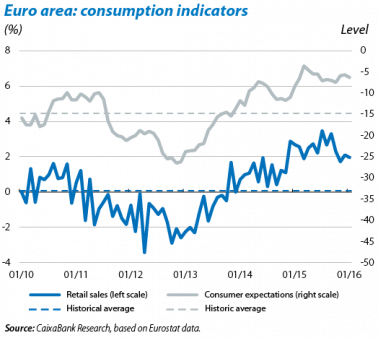

Demand indicators underline the recent tone seen in consumption. As we have already mentioned, private consumption ended 2015 with slightly less growth than in previous quarters and demand indicators are confirming a similar trend in the first few months of 2016. Retail sales, although still growing at a faster rate than their historical average, increased by around 2% year-on-year in December and January. We do not expect any major changes in the coming months although the expectations component of the consumer confidence indicator fell very slightly in March. In short, consumption is growing but not accelerating.

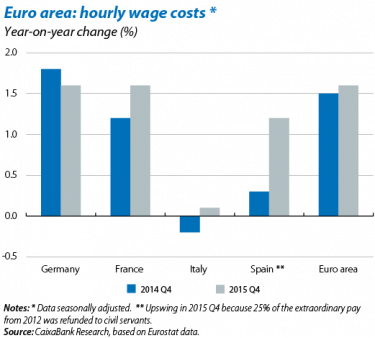

The euro area's economic recovery can be seen in its improved labour market. Employment rose by 0.3% in 2015 Q4, the same rate as in Q3, while unemployment fell to 10.3% in January, its lowest level since August 2011. Labour costs increased by 1.6% year-on-year in 2015 Q4, 0.1 pps more than the same period a year ago. The low inflation rate seems to be moderating wage increases, especially in Germany where wage costs rose by 1.6%, a slightly lower rate than in 2014 Q4 although its labour market is close to full employment.

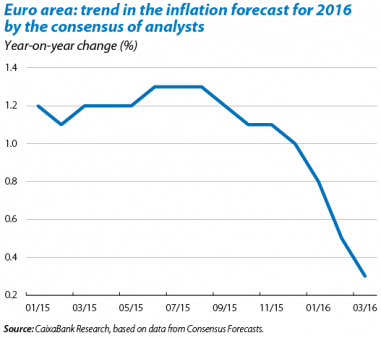

Inflation continues in negative terrain in March. The general HICP shrank by 0.1% year-on-year in March, somewhat less than the previous month (–0.2%). This decline in the general level of prices was particularly due to the larger drop in the energy component in response to falling oil prices. This factor has been the main reason why the consensus of analysts have lowered their inflation forecasts for 2016, reduced by more than 1 pps in less than six months down to 0.3% in spite of the stability observed in core inflation at around 1%. However, at CaixaBank Research we expect the price of oil to recover as from 2016 Q3, a little earlier than most institutions, and thereby push up inflation.

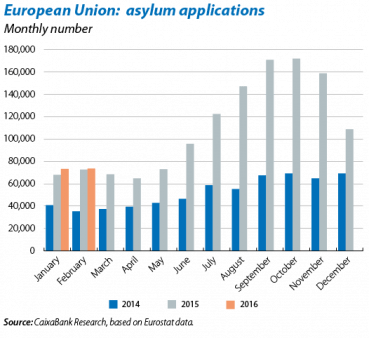

The extent of the refugee crisis and the UK's potential exit from the EU; internal risk factors over the coming months. The rate of asylum applications recorded by the EU in January and February was similar to last year (in 2015 more than 1.25 million applications were registered). In March the European Council reached an agreement with Turkey in an attempt to reduce the flow of illegal immigrants. The main measure consists of returning to Turkey all illegal immigrants arriving in Greece in exchange for accepting the same number of Syrian refugees who are currently in Turkey. This agreement, the first far-reaching decision taken by the EU in the crisis, is nevertheless complicated to implement, especially in Greece although also in some EU countries that do not want to accept large numbers of refugees and might block decisions in the EU over the coming months. Immigration is also a conflictive issue in the debate regarding whether the UK should remain in the EU. The possibility of a Brexit is fuelling uncertainty, pushing down the value of the pound sterling over the last few weeks. The economic consequences of a Brexit are difficult to evaluate as the exact relationship the UK would have with other EU member states is not clear, nor how long it would take to establish such a relationship. However the costs during the transition period could be significant for the British economy.