Can inequality cause a financial crisis?

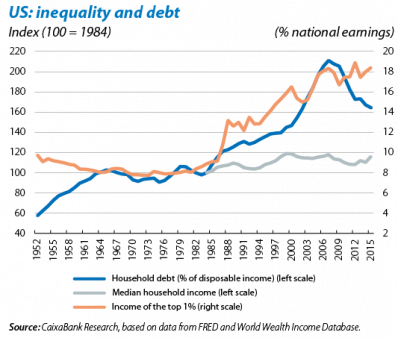

Far from a sensationalist headline, this question is the focus of much political and academic discussion. The figures for the US speak for themselves (see the first graph). Between 1984 and 2007, the income share corresponding to the top 1% of earners went from 8.9% to 18.3% and, at the same time, the total debt of households soared from 58.3% of earnings to 123.1%, while the median household income had only risen by 17.9% (an average annual growth of 0.7% compared with 1.8% GDP growth per household). The subsequent developments in the US economy are well known: the biggest financial and economic crisis since the Great Depression of the 1930s. Journalists and filmmakers have interpreted these events at length, developing a narrative that links economics, politics and inequality. However, there’s still a lot of discussion going on in the wings: the idea of a relationship between inequality and debt is appealing but what do we really know about this apart from its correlations?

According to classical economic theory, if inequality increases because of a permanent change in the income of one part of society, then this new situation should encourage less consumption and less debt on the part of those individuals whose income has decreased. Given that the higher inequality observed in the US is due to permanent factors1 but the level of debt has risen in spite of this, leading economists such as Nobel prize-winners Stiglitz and Krugman, the former Chief Economist of the IMF and former Chairman of the Federal Reserve of India, Raghuram Rajan, and the prolific Daron Acemoglu from the Massachusetts Institute of Technology propose that politics and social status are key factors in encouraging debt. There are a host of examples to illustrate the role played by politics, such as the repeal of the Glass-Steagall Act (which separated commercial banking from investment banking to limit risk-taking), the reduction in capital requirements for Fannie Mae and Freddie Mac (two major sources of financing to buy housing) and the extension of mortgages insured by the Federal Housing Administration to help people take out larger mortgages with lower down payments. However, while Acemoglu2 has claimed that the increase in inequality and debt are due to financial deregulation without there being a cause/effect relationship between inequality and debt, Rajan3 proposes that inequality generates social pressure on politicians to promote, through regulatory changes, an increase in indebtedness beyond the level warranted by a household’s solvency. In line with Rajan’s view, Mian and Sufi (2009) show that there was abnormally high growth in subprime mortgage lending in poorer areas of the US.4 Moreover, this political factor would be complemented by the role played by social status: when inequality increases, individuals want to take out loans to be able to buy the goods and services their neighbours can afford. Along this line, Bertrand and Morse (2016)5 observe that, between 1980 and 2008, in those US regions where the earnings of higher income households increased, there was also a drop in the saving rate of the rest of households.6

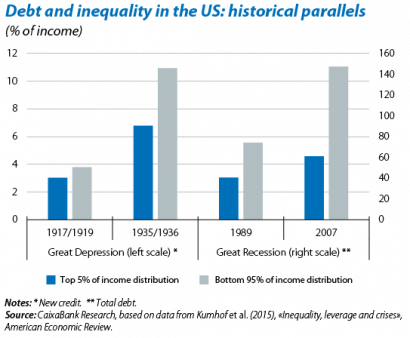

One of the reasons for the appeal of a cause/effect relationship between inequality, debt and the financial crisis is that a similar correlation had already been observed before the Great Depression of the 1930s: in the years leading up to the Depression there was also an increase in the income share of the highest income segment of the population and an increase in household debt. Moreover, as shown by the second graph, in both episodes most of this debt was concentrated among the lowest income households. However, in a recent study for the US, Coibion et al. (2016)7 conclude that households with fewer resources take out less debt in more unequal regions than in those with less inequality. According to this study the reason is that, in regions with greater inequality, customers with fewer resources have to compete for loans with more solvent customers (from the higher end of the income distribution) and, because of this, they are offered worse conditions (fewer loans granted and at higher interest rates). Although this study does not refute the existence of a causal relationship between an increase in inequality and debt,8 it does question the conventional narrative. Rajan’s thesis may be supported by palpable examples of regulatory changes and findings such as those by Bertrand and Morse (2016) and Mian and Sufi (2009) but the study by Coibion et al. (2016) suggests that greater inequality is not necessarily associated with an increase in credit taken out by the most disadvantaged segments of society. In short, the debate continues.

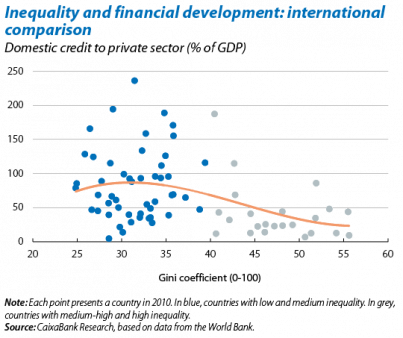

Apart from the US, other advanced economies have also seen a considerable rise in household debt, albeit with a more moderate increase in inequality. In fact, Bordo and Meissner (2012)9 compare 14 advanced economies between 1920 and 2008 and find no significant association between inequality and growth in credit. This finding is also reflected in the third graph, where we can see that, in advanced economies and at moderate levels of inequality, there is no clear relationship with the level of credit. However, when we look at countries with higher levels of inequality it is difficult to find any well-developed financial systems.

In fact, if we take a long-term perspective we can see that, historically, economic growth has gone hand in hand with the spread of political rights, the emergence and consolidation of a middle class and the development of financial markets. Put into historical perspective, access to credit acts as an engine for growth, particularly benefitting those with lower incomes who own fewer resources to finance their projects. However, in order for the financial system to function efficiently, there must be solid institutions that guarantee ownership rights and the fulfilment of contracts. In developing economies, those companies with good political connections tend to enjoy better access to credit and lower interest rates (mainly through state-owned banks). The development of an advanced rule of law, which is associated with lower inequality, therefore has the potential to minimise the role played by political connections and distribute credit more efficiently. It comes as no surprise that the Bank of England was set up just after the English parliament managed to restrict the powers of the monarchy in the Glorious Revolution of 1688, nor that the Industrial Revolution started in England 100 years later.

In summary, inequality, politics, financial development and economic performance are hugely important factors that have resonated throughout history. The Great Depression in the 1930s and the Great Recession of 2007-2009 are unique events in recent history whose severity has awarded them a special place in our social imaginary, revealing the power but also the complexity of such economic relationships.

Adrià Morron Salmeron

Macroeconomics Unit, Strategic Planning and Research Department, CaixaBank

1. Of note are technological changes and the impact of globalisation. Social mobility is crucial insofar as it reduces the permanent nature of inequality.

2. See Acemoglu, A. (2011), «Thoughts on Inequality and the Financial Crisis», presentation at the congress of the American Economic Association.

3. Rajan, R. (2010), «Fault Lines», Princeton University Press.

4. Mian, A. and Sufi, A. (2009), «The Consequences of Mortgage Credit Expansion: Evidence from the US Mortgage Default Crisis», Quarterly Journal of Economics.

5. Bertrand, M. and Morse, A. (2016), «Trickle-Down Consumption», Review of Economics and Statistics.

6. This «contagion» is not due either to a larger increase in real estate prices or a larger increase in the consumer price index for the region.

7. Coibion et al. (2016), «Does Greater Inequality Lead to More Household Borrowing? New Evidence from Household Data», Federal Reserve. Bank of San Francisco Working Paper.

8. Insofar as it is not studying the response of households to an increase in inequality in the region where they live but rather comparing the behaviour of households with similar income levels in regions with different levels of inequality.

9. Bordo, M. and Meissner, C. (2012), «Does Inequality Lead to a Financial Crisis?», NBER Working Papers.