Ultra long-dated bonds: the wood for the trees

In the last few months several European countries have issued ultra long-dated bonds; i.e. with maturities superior to 30 years. Since the beginning of 2016, France, Belgium and Spain have sold bonds at 50 years while Ireland and Belgium have issued bonds at 100 years.

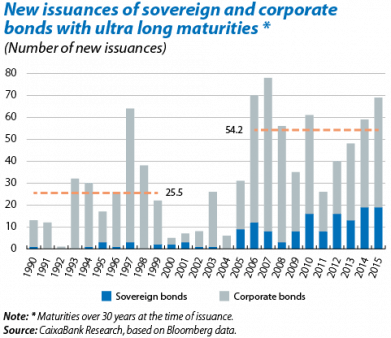

Issuing ultra long-dated bonds is nothing new in the bond market nor is it reserved just for sovereign debt: at the beginning of the 1990s large US firms such as Disney and CocaCola issued debt at 100 years and, more recently, Petrobras and the French EDF joined the club of one hundred-year bond issuers. However, since the middle of the 2000s there has been a significant increase in issuances of this kind of bond, whose annual average total has gone from almost 25 in the 1990s to more than 54 between 2006 and 2015.

From the issuer's point of view, placing very long- term securities has an obvious advantage: it lowers refinancing risk as it reduces the proportion of short-term debt. Moreover, within the current context of all-time low interest rates and rock bottom term premiums (reflected in the flat interest rate curve), ultralong financing represents a relatively modest extra cost for issuers. For example, the 50-year bonds issued by Spain last May, totalling 3 billion euros, resulted in a cost (IRR) of 3.4% annually, only 51 bps more than the 30-year financing cost.

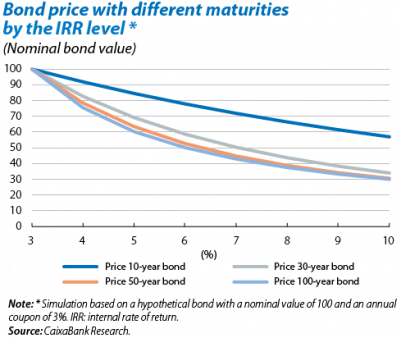

From an investor's point of view, buying a bond whose maturity exceeds life expectancy in the most advanced countries may seem strange at first glance. But 50 or 100-year debt provides higher yields than 30-year bonds without significantly increasing interest rate risk; i.e. the risk entailed in a variation in the IRR on the price of the bond. This is because a change in interest rate has less impact on the price of bonds whose maturity is over 30 years (see the second graph). At a similar level of uncertainty and interest rate risk, ultra long debt provides more attractive returns than 30-year debt.

The recent and relatively high demand for these bonds is also due to temporary factors. In a context of very low interest rates, lengthening the maturity of an investment is one of the strategies to achieve higher yields. For some investors, such as insurers and pension funds, this strategy is preferable to investing in debt with a lower credit rating, for regulatory reasons. The positioning of investors who anticipate a possible enlargement of eligible bonds in the ECB's asset purchase programme is also helping, albeit probably marginally, to push up the demand for bonds with maturities in excess of 30 years.

Issuing ultralong bonds forms part of a more general trend towards longer debt maturities. According to the Bloomberg index for euro area sovereign bonds, the weighted average maturity for bonds from the countries of the monetary union went from six and a half years in 2010 to more than nine at present. And the same pattern can also be seen in other segments of the bond market, such as corporate debt or debt issued in US dollars. Persistently rock bottom interest rates should continue to support these trends, which might even intensify with the ECB starting to buy corporate bonds at the beginning of June.