A better 2023 and a worse 2024 for the international economy?

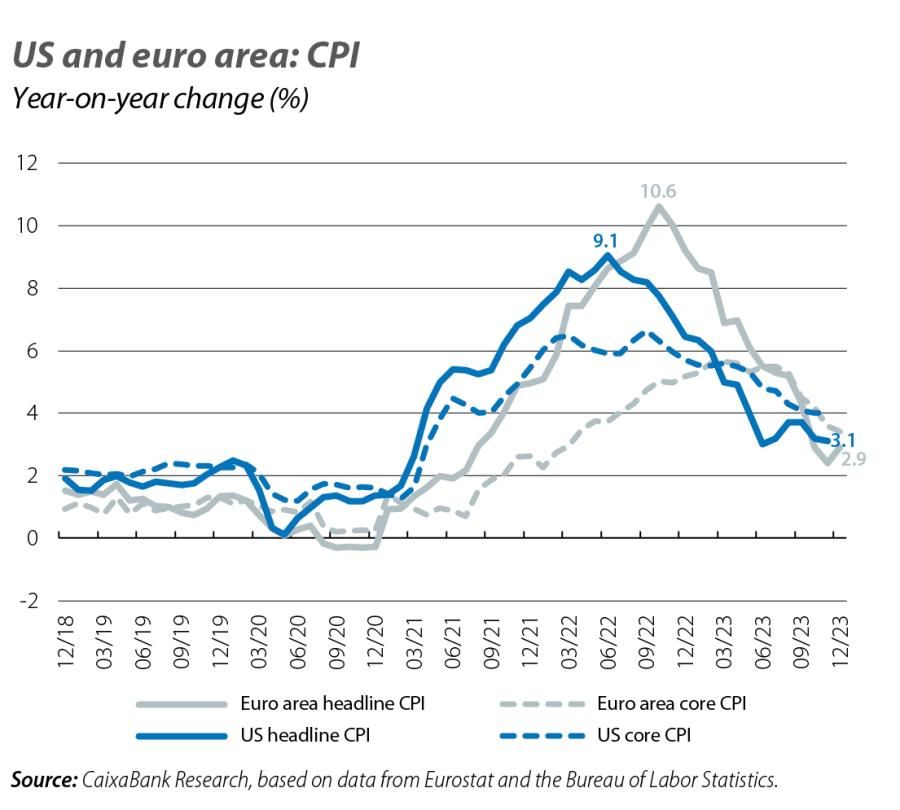

And now, normalisation? After a 2023 with disparate growth between the major economies, the data for Q4 reflect a widespread cooling among the biggest economies and suggest we will see a landing of the global economy in the coming months. On the other hand, in recent months disinflation has come as a positive surprise. Whereas headline inflation at the end of 2022 stood at 9.2% in the euro area and at 6.4% in the US, the situation at the end of 2023 is very different. In the euro area, headline inflation stood at 2.9% in December, helped by base effects in energy, but with the core components also experiencing a slowdown. In the US in November, headline inflation stood at 3.2%. The coming months will be key to unveiling how easy the final path to the 2% inflation target, and how difficult the famous landing of advanced economies, will be. In anticipation of these questions, in recent months the markets read the economic activity and inflation data for Q4 2023 as a sign of a soft landing, leading investors to bring forward their expected timing for the first rate cuts by the Fed and the ECB to the spring.

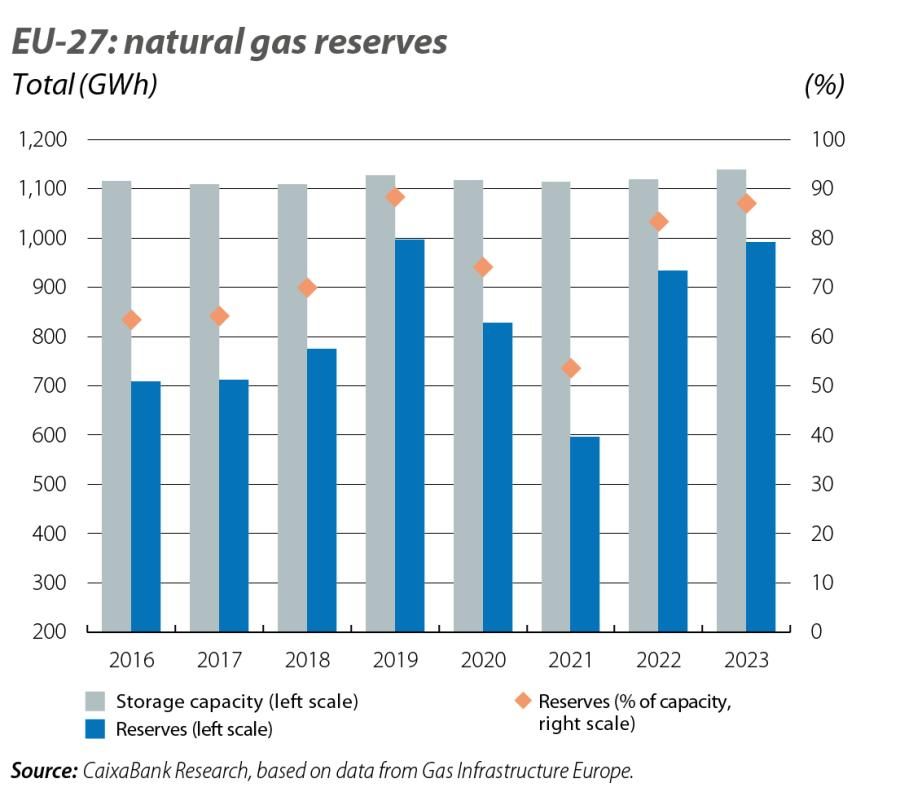

A year ago, the energy crisis was considered one of the main determining factors for the economic scenario and, at that time, futures contracts were indicating that gas prices would persistently be at or above €100/MWh. However, prices moderated to €40-50/MWh relatively quickly, so despite initially anticipating that euro area GDP growth in 2023 would be around 0.2%, this figure is likely to be comfortably exceeded. However, risks such as the persistent weakness of European industry and the materialisation of the impact of interest rate hikes have extended into 2024, a year in which we expect the euro area to grow by 0.7% (versus the 1.6% forecast of a year ago). On another battle front, the EU has managed to reach an agreement on the new fiscal rules. The 27 Member States concluded a political agreement at the European Council for the reform of fiscal rules just before the Christmas break, and it now needs to be negotiated with the European Parliament. The new rules maintain the formal limits of 3% and 60% of GDP for deficits and public debt, but allow fiscal adjustment paths to be «tailored» for each country, with four-year plans that can be expanded to a maximum of seven years. The new fiscal framework, which will not be binding until the 2025 budgets, foresees a transition period lasting until 2027 (intended for countries that have fiscal deficits above 3.0% and which would automatically enter the excessive deficit procedure) with interest on debt being temporarily excluded from the calculation.

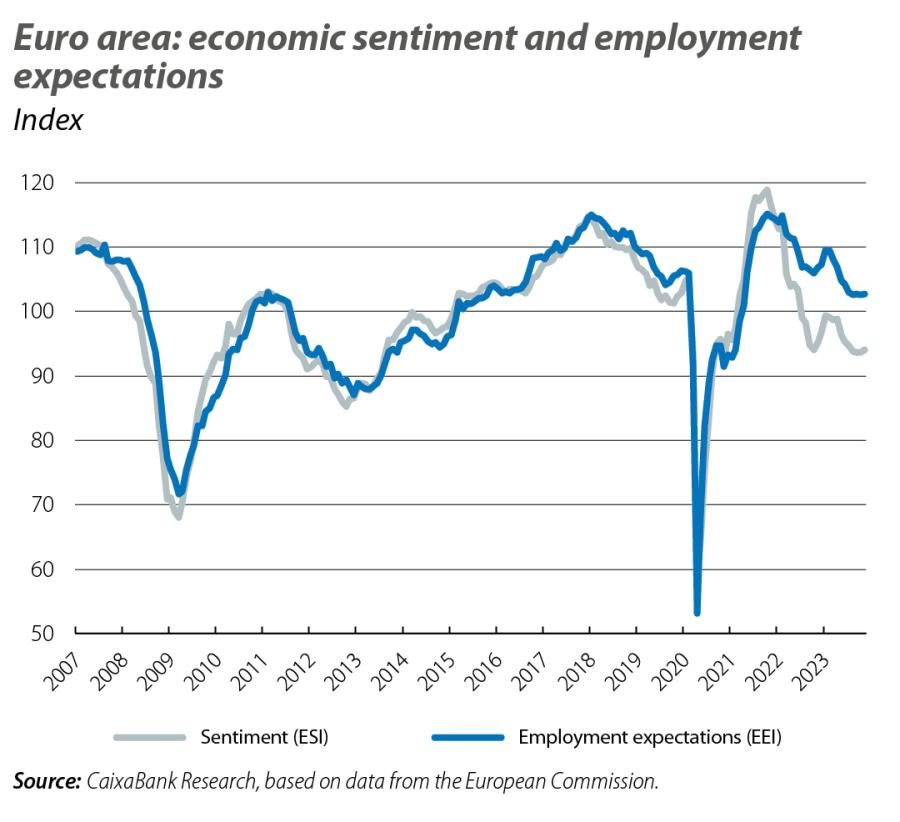

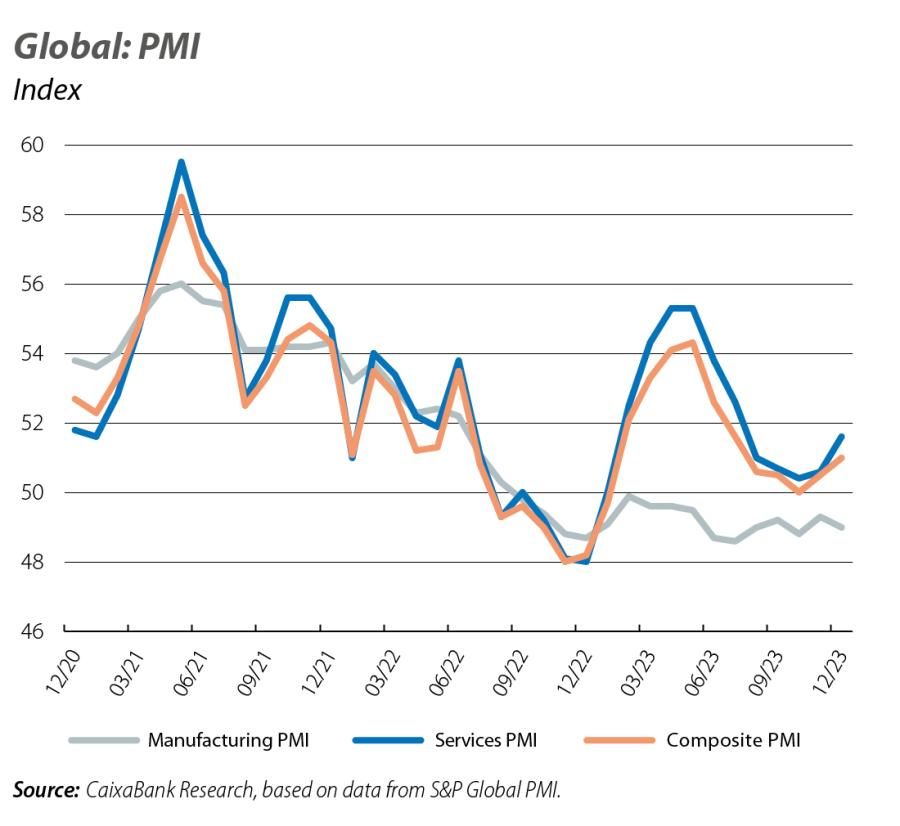

In Europe, December’s PMIs remained in contractionary territory (below the 50-point threshold) for the seventh consecutive month, reflecting the persistent weakness in European industry and the gradual depletion of the cyclical boost in the services sector. On the other hand, the labour market remains solid with unemployment rates at rock bottom, although some leading indicators, such as the employment expectations indicator, hint at a gradual cooling of the labour market over the coming months. In the US, there is a slowdown in economic activity compared to Q3, although GDP growth remains buoyant at around 0.6% quarter-on-quarter, according to the Atlanta and New York Feds’ nowcasting models. The labour market, meanwhile, showed mixed dynamics in December (with 216,000 jobs created, a strong figure that is higher than expected, although most of the jobs were created in less cyclical sectors, such as education and health and general government).

At the same time as we expect a slowdown among advanced economies in 2024, there is another driver of the global economy which appears to be losing steam. In the post-financial crisis period and up until the pandemic, China had partially offset the rather subdued performance of advanced economies (which grew by an average of 1.0% in the period 2008-2020, compared to 7.5% in China). However, a mix of internal and external factors make a scenario in which the Asian giant’s growth remains above 5% unlikely. Some of these factors were highlighted during 2023, with the reduction in exports and a domestic confidence crisis, aggravated by a prolonged decline in the real estate sector. In addition, in recent months, the problems of overcapacity in China’s manufacturing sector are becoming apparent. The latest business confidence data are a good witness to these trends. On the one hand, the official composite PMI fell to 50.3 points in December, marking its lowest level in the year and substantially below its all-time average. By components, the services PMI remained at 49.3 points (its lowest level since the reopening), while the construction PMI rose to 56.9 points, well below the pre-pandemic average, signalling a lukewarm recovery in the sector. The manufacturing PMI fell from 49.4 to 49.0 points, amid signs of a cooling in foreign demand and falling production prices.

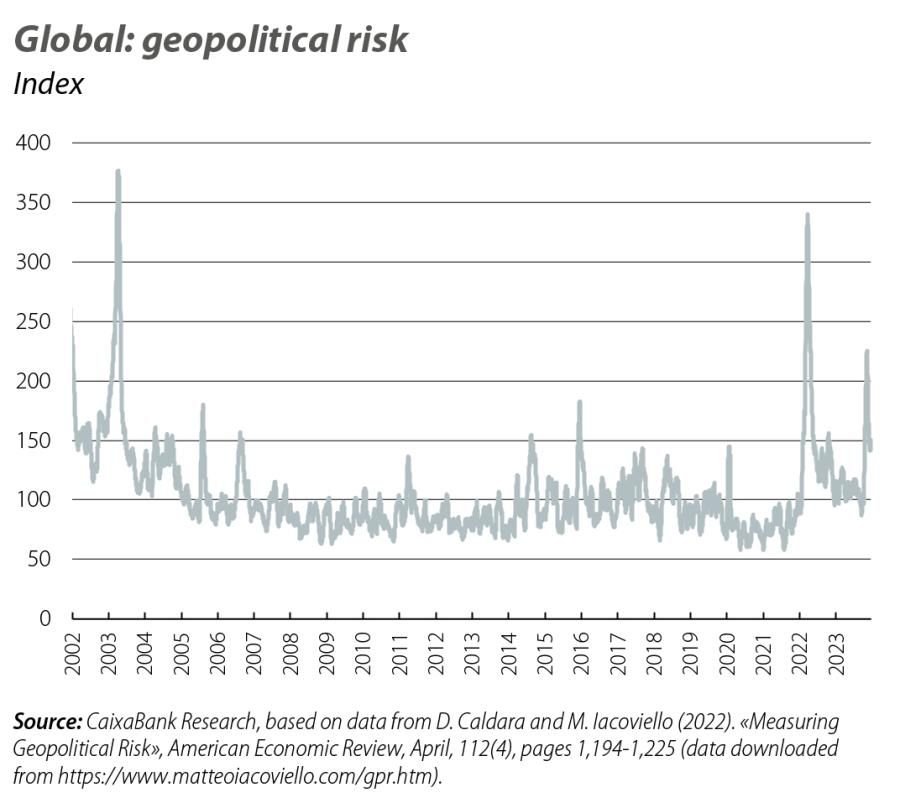

A series of simultaneous crises remain active at the turn of the year, and in addition to the war in Ukraine there has recently been a revival of the Israeli-Palestinian conflict and the war in Sudan, making 2023 one of the years with the most active conflicts since World War II. In the midst of this increased conflict and defence spending, and with the role of multilateral institutions degrading, in 2024 over half of the world’s population will be called to the polls for national elections. Moreover, many of these elections have the potential to affect, in turn, the current global geopolitical balance. In addition to elections in countries such as Taiwan, India and the United Kingdom, all eyes are on the US presidential elections. In Spain, «polarisation» was named word of the year in 2023. The Collins English Dictionary and The Economist have preferred expressions related to artificial intelligence. Both themes will continue to mark world affairs this year.