An end of the year with more questions than answers in the international economy

On the one hand, the macroeconomic outlook for developed economies will continue to be restrained by tighter monetary conditions, coupled with the impact of less expansionary fiscal policies. In this regard, we have cut the euro area’s growth outlook for 2023 and 2024 to 0.5% and 0.7% (–0.3 pps in both cases), in contrast to the increased optimism for the US economy, where we now expect growth of 2.0% for 2023 and of 0.8% for 2024 (both +0.3 pps). In emerging economies, the main reduction in the growth forecasts affects China (–0.5 pps, to 5.2% in 2023; and –0.3 pps, to 4.6% in 2024), which contrasts with the better performance of other large emerging economies, such as Brazil, Russia, India, South Africa or Indonesia. Overall, the outlook for the coming quarters is marked by a slowdown in growth, while inflation is expected to moderate. All this will take place in an environment marked by risks, which include uncertainty regarding the effects of monetary policy and the persistence of inflation, latent financial vulnerabilities in several countries and concerns over the recent «protectionist shift» that could affect global trade flows. In the same vein, the OECD has revised global growth

for 2023 up by 0.3 pps, to 3.0%, and has cut the forecast for 2024 by 0.2 pps, to 2.7%.

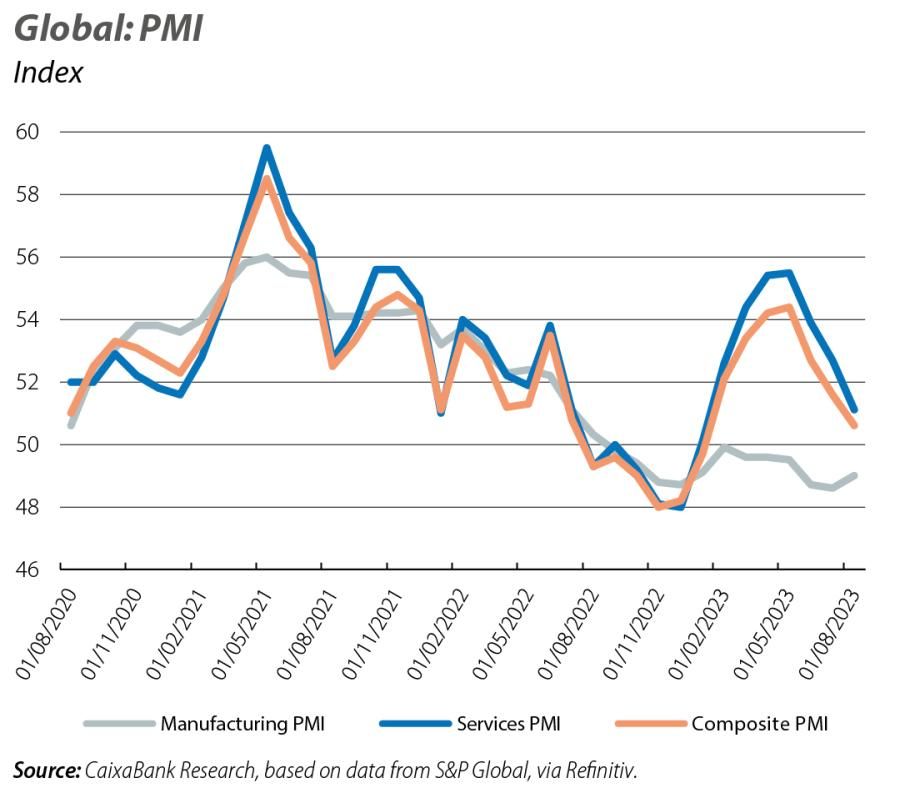

This is reflected in the global composite Purchasing Managers’ Index (PMI), which stands at 50.6 points in August, its lowest level since January (49.7 points), driven mainly by the loss of steam in the services sector which has registered three consecutive months of sharp declines, dropping from 55.5 points in May to 51.1 in August. On the one hand, some large emerging economies (such as Brazil, Russia, India and China) have recently seen improvements on the manufacturing side. However, the euro area continues to show particularly visible and persistent weakness. Indeed, despite the improvement in the euro area composite PMI in September, it still remains in contractionary territory (up 0.5 points to 47.2), weighed down by the fragility of the manufacturing sector (–0.1 points, to 43.4) and the lack of momentum in services (+0.8 points, to 48.7). The difficulties in Europe’s manufacturing sector are also reflected in the PMI of its two largest economies: in France, it fell in September to a low point since the outbreak of the pandemic (–1.8 points, to 44.2) and in Germany, despite the recovery, it remains well within contractionary territory (+0.5 points, to 39.6).

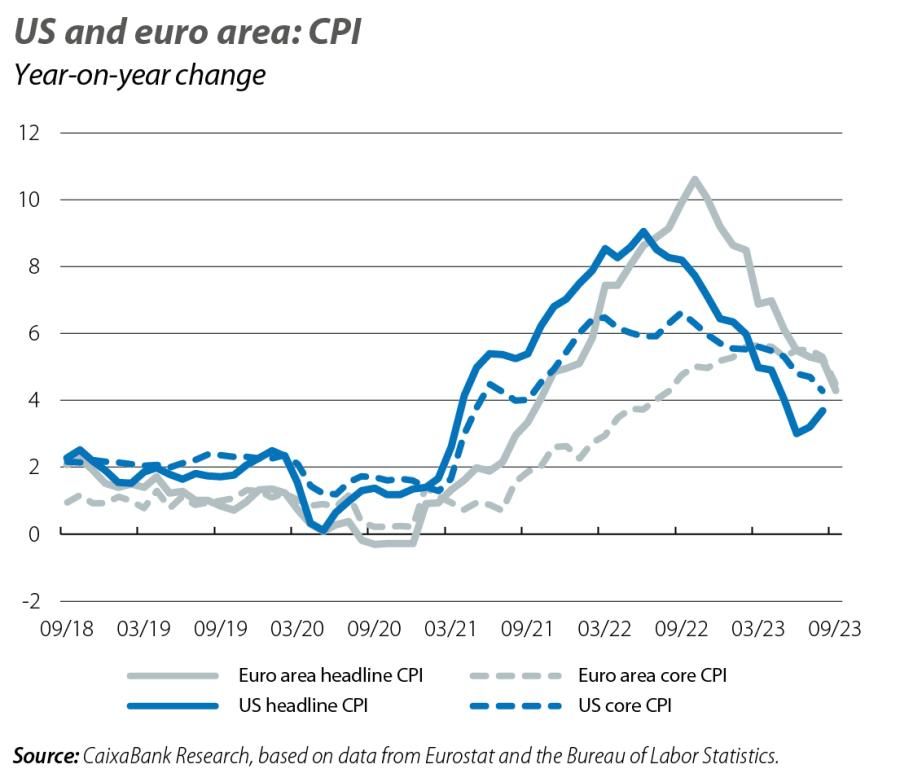

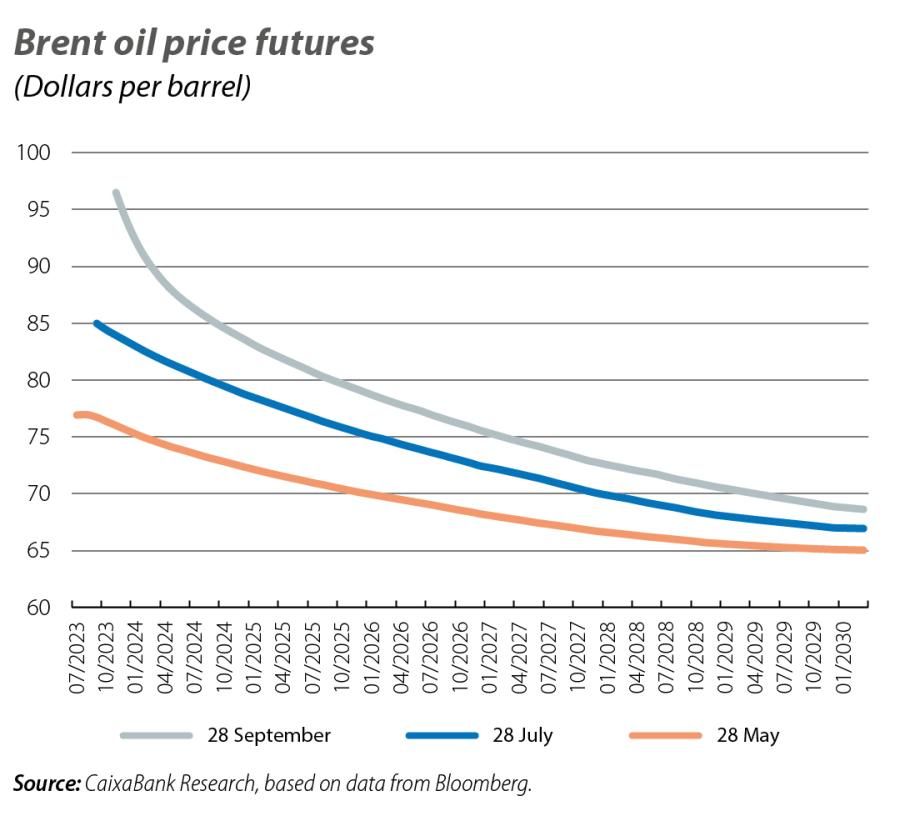

In August, headline inflation climbed to 3.7% (+0.5 pps) in the US, pushed up by fuel prices, while in the euro area, where the data for September is already available, it fell to 4.3%. On the other hand, the rate of decline in core inflation (which excludes energy and food) on both sides of the Atlantic, which stood at 4.3% in the US and at 4.5% in the euro area, will not provide any respite for the central banks. In addition to the risks of persistent inflation and the intensification of second-round effects, there are fears regarding the effects of the increase in the oil price. Since the end of May, Brent oil has risen by 30%, to around 95 dollars a barrel. The recent tightening of this market, which is explained by a pronounced deterioration in supply conditions and by the global demand for crude oil proving more resistant to the macroeconomic conditions than expected, is also reflected in the medium-term outlook for prices being well above those of prior to the summer.

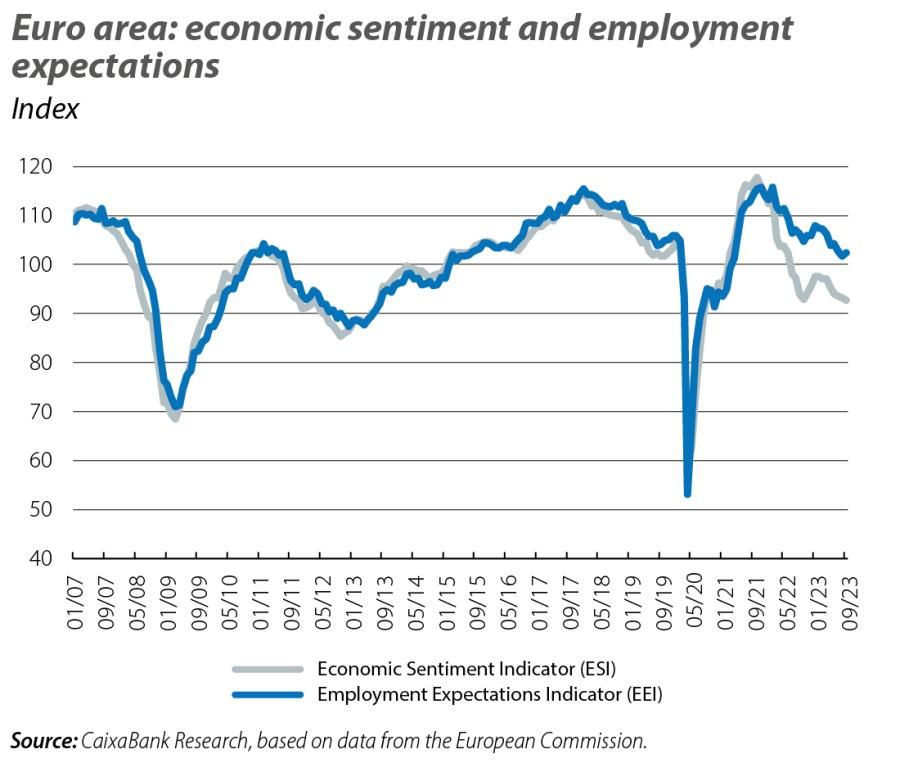

The European Commission’s Economic Sentiment Index (ESI) for the EU fell to 92.8 points (compared to an all-time average of 100 points), marking a new low since August 2020 and underscoring the economic weakness of the European economy as a whole. However, the Employment Expectations Index (EEI) has remained significantly above the ESI, specifically around 10 points higher in the last year (compared to practically no difference in the pre-pandemic period). Of course, in recent months it has followed a similar declining trend to that of the ESI, and stood at 102.4 points in September. On the other hand, the economy will continue to depend upon the fiscal stance, as Member States will have to begin normalising their fiscal policies ahead of the reinstatement of the European fiscal rules in 2024. Indeed, even if negotiations between Member States continue, the new European fiscal framework is expected to maintain the existing fiscal targets (such as the deficit target of 3.0%), even if greater control is offered at a national level on how nominal targets are to be met, for example, by drawing up multi-year plans.

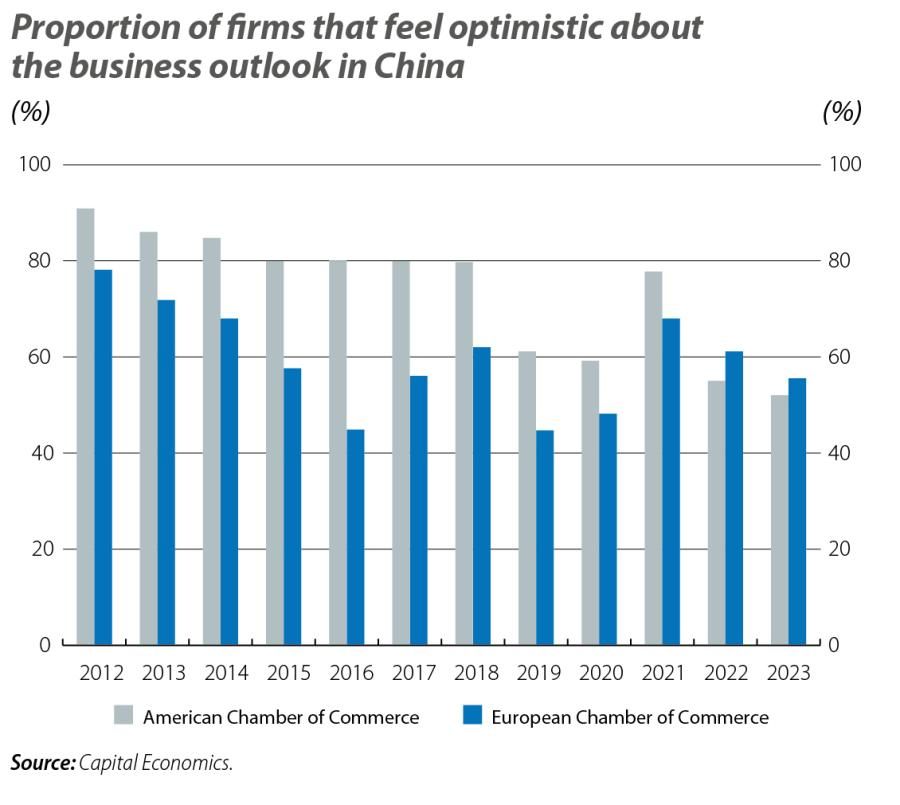

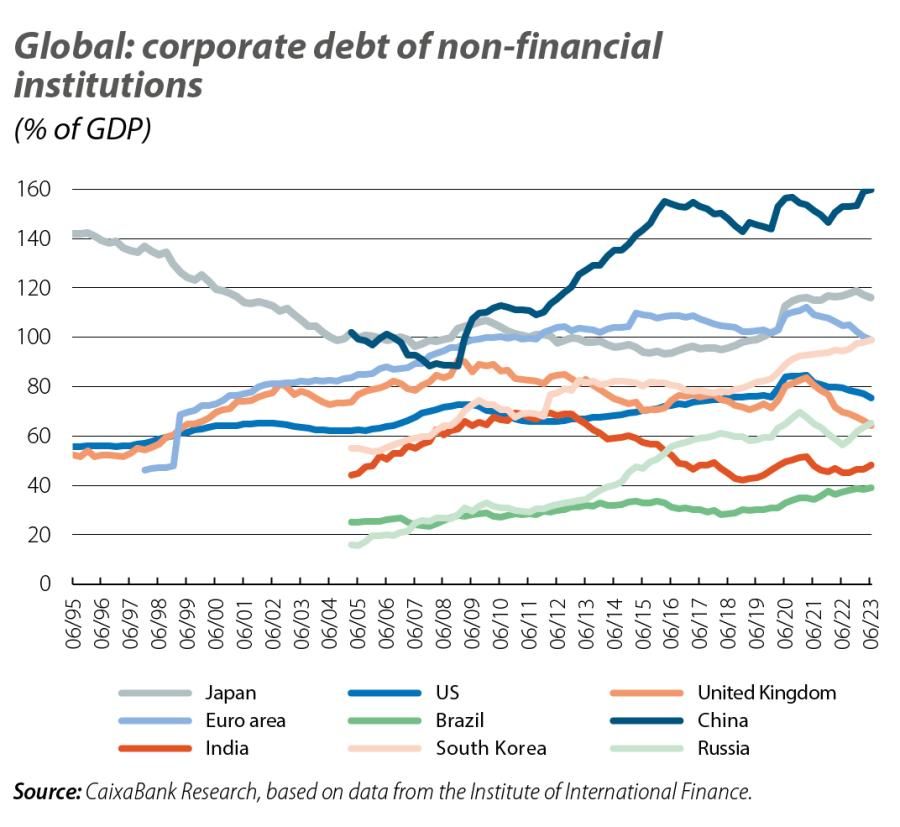

Emerging from the pandemic is proving particularly tortuous for the Asian giant, which is having to deal with both structural challenges and the «economic scars» left by the pandemic. On the one hand, the level of non-financial corporate debt has reached a new high, standing at 160% of GDP, especially concentrated in sectors such as real estate and in local government financing vehicles (LGFVs). On the other hand, the «stellar» performance of Chinese exports during the pandemic is now being reversed, while geo-economic tensions accumulate and domestic consumption fails to pick up despite the savings accumulated by many households. Nevertheless, it is not all bad news. The figures for August were better than expected, with a particularly strong performance in the growth of industrial production (+4.5% vs. 3.7% in July) and retail sales (+4.6% vs. 2.5% in July). In part, this improvement is due, on the one hand, to the intervention of the Chinese authorities through a loosening of monetary policy and through the «fiscal machine» being put into gear. On the other hand, the recent relaxation of regulations in the real estate sphere ought to help sustain the sector over the coming months. Still, in the medium term the lack of investor and consumer confidence in China will continue to put the country’s economic outlook under pressure.